- Bitcoin could rally up to 600% above the current price, according to Lark Davis, .

- The run up to $180,000 may occur during the markup phase following the next Bitcoin halving event.

- In the meantime, BTC is bearish and may make a drawdown to $15,000 before recovery.

Bitcoin (BTC) could soar 600% from the current price after halving, according to a renowned crypto investor and founder of Wealth Mastery Lark Davis. Davis said this in a recent post on X (formerly Twitter) noting that the accumulation before BTC halving events in the past have presented the best times to build positions.

According to Davis:

“The mark up phase post halving this time could see Bitcoin rally up to 5-600% above the current price if we assume a bull top at 150-180k.”

Davis explained that BTC’s acceleration to the projected 600% rally will occur during the markup phase that will come immediately after the next Bitcoin halving event. He also said that his predicted target derives from the assumption that the resulting peak from the current Bitcoin price is between $150,000 and $180,000.

“Bitcoin halving is when the reward for Bitcoin mining is cut in half. Halving takes place every four years. The halving policy was written into Bitcoin’s mining algorithm to counteract inflation by maintaining scarcity”

The next Bitcoin halving is expected to take place in April 2024, and the system will continue until roughly 2140 when all Bitcoin is mined. Halving decreases the number of BTC coins released into circulation creating a sense of scarcity. This, in turn, leads to an increase in Bitcoin price as demand increases.

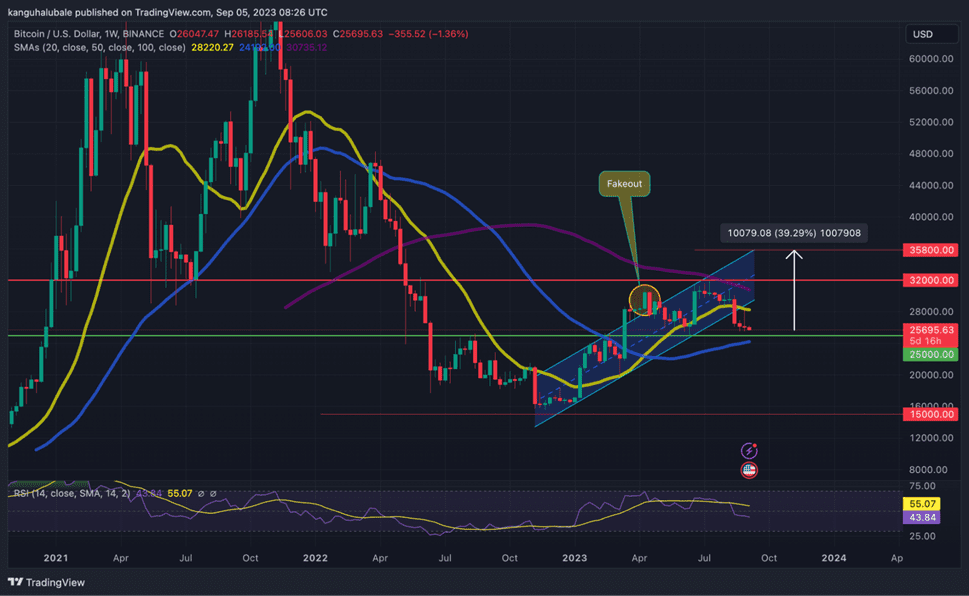

Davis used a weekly chart to further elaborate on his analysis. The chart showed the consistent cyclic behavior displayed by the Bitcoin price action over the previous halving events.

From his illustration, there are an average of 75 weekly bars in every accumulation period before the Bitcoin halving. Hence, Bitcoin is currently deep into accumulation, with several weeks to go.

It is worth noting that the extent of Bitcoin’s price movement based on Davis’ cyclic analysis reveals a diminishing trend. Both the bearish and bullish price movements reveal a diminishing return with every new cycle.

Therefore, the projected 600% post-halving rally is less than the previous bull run, which was 724%.

Bitcoin Price Analysis

In the meantime, Bitcoin is trading in a fourth straight bearish weekly session as shown in the chart below. The market sentiments remain bearish at the moment with the Relative Strength Index (RSI) moving within the negative region. The price strength at 43 suggested that there were more bears than bulls in the market.

As such, weekly candlestick close below the $25,000 demand zone would bring the support at $24,192, embraced by the 100-weekly Simple Moving Average (SMA) into the picture. Below this, a move to the $20,000 psychological level or the $15,000 demand zone would be the next logical move.

This could be where the downside is capped for BTC, allowing bulls to regroup and buy more BTC at a discount, before making another attempt at recovery.

BTC/USD Weekly Chart

On the upside, Bitcoin could turn up from the current level to confront resistance from $28,000 or the 50 SMA at $28,220. The next hurdle would be the lower boundary of the ascending parallel channel at $29,500.

Overcoming this barrier would propel BTc to revisit the equal highs around $32,000 or break above this stubborn supplier zone toward the technical target of the governing chart pattern at $35,800. This would bring the total gains to 40%.