- Bitcoin leads the recovery with 62% of total crypto inflows and improving sentiment.

- On-chain data shows a strong accumulation phase forming as short sellers get trapped.

- A break above major supply clusters could ignite a push toward the $100K zone.

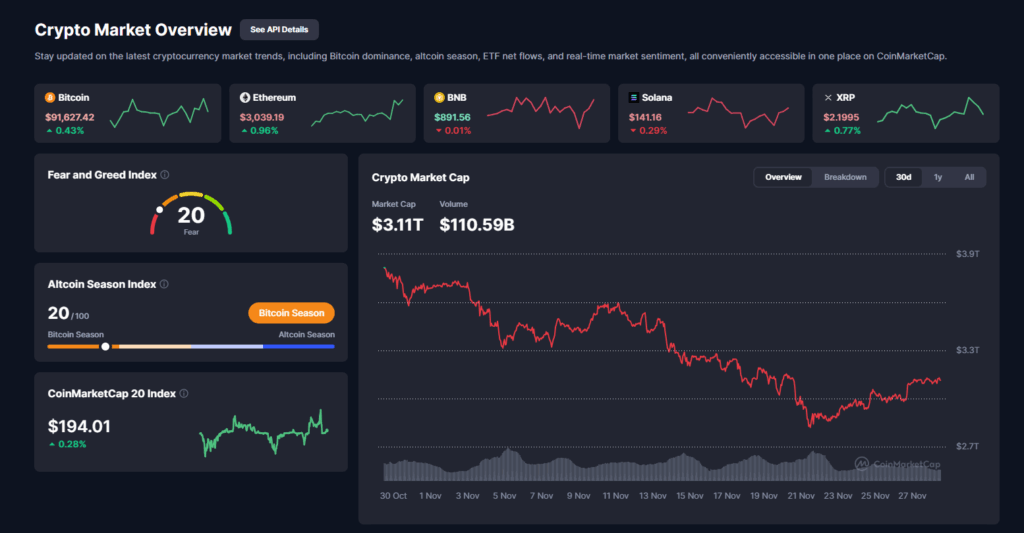

The final week of November is shaping up as a rare moment of calm after three brutal red weekly candles that erased roughly $970 billion from the total crypto market cap. This week alone, the market has climbed over 5%, pulling in $160 billion in fresh inflows and setting up what may become the first green close of the month.

Bitcoin is driving the entire move, accounting for 62% of all inflows, while the Altcoin Season Index has plunged to mid-July levels. With flows consolidating heavily into BTC, the Bitcoin price prediction trends remain firmly bullish heading into December.

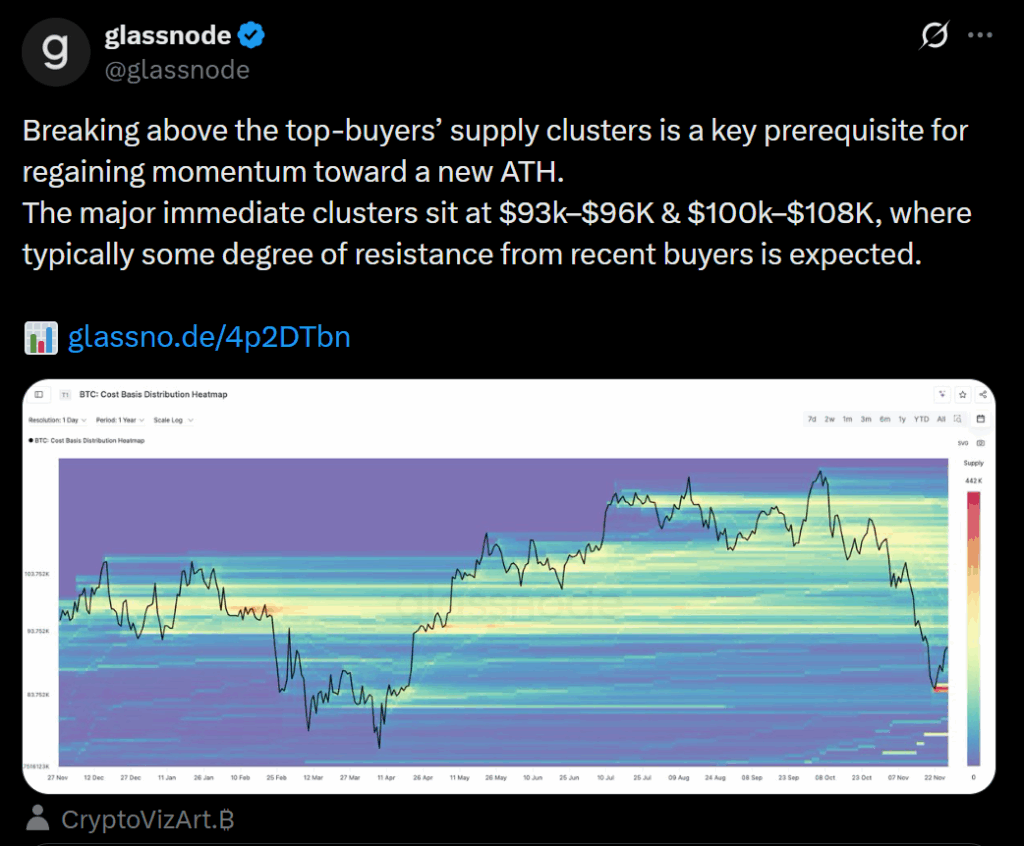

Key Resistance Still Holds

Even with the bounce, the market isn’t in full bull-run mode just yet. Glassnode data highlights four major supply clusters—price zones where long-term holders previously bought and may look to break even. These clusters often act as resistance because older wallets tend to distribute during stress relief rallies.

Despite this, sentiment is quietly improving. The Fear and Greed Index jumped eight points this week, moving from extreme fear into a calmer “moderate fear” zone. On-chain metrics are also rebounding, suggesting risk conditions are easing and investors are entering a new accumulation phase. The setup resembles a potential bear trap, creating the energy needed for BTC to press higher.

Short Sellers Get Squeezed

The shift in momentum has triggered a powerful reaction in derivatives. CoinGlass shows that this week produced $1.13 billion in liquidations, with 61.3% coming from short positions—the first time this month shorts dominated long liquidations.

This signals a very different market tone compared to the three prior weeks, which saw consistent long flushes. Traders had heavily shorted the market during peak fear, and those positions are now getting trapped as BTC rotates back into strength.

With sentiment flipping and shorts under pressure, Bitcoin has begun reclaiming levels that previously acted as resistance.

Can Bitcoin Really Push Toward $100K?

Many analysts believe the setup for a six-figure move is now strengthening. BTC’s capitulation metrics are recovering, with Net Realized Profit/Loss turning green and realized losses easing across the network. Combined with higher inflows and improving on-chain behavior, these signals imply that supply is quietly being absorbed.

From a technical standpoint, this trend often precedes a major resistance breakout. If BTC can push past the overhead supply clusters, the pathway to a $100K Bitcoin price prediction opens up quickly.

With shorts squeezed, sentiment normalizing, and accumulation returning, the market appears to be setting its sights on higher levels—assuming macro conditions stay supportive.