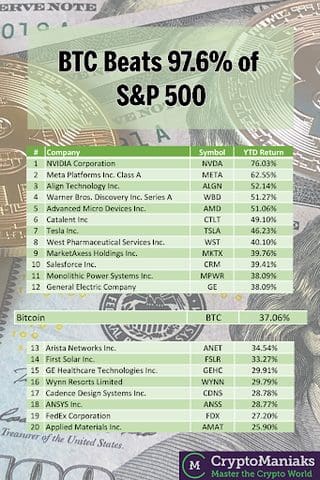

- Bitcoin’s performance surpasses that of 97.6% of the 500 top publicly traded companies in the U.S.

- The BTC has risen by 37.06% since March 10.

- A daily candlestick close above $28,500 could see Bitcoin rise to tag $32,000.

With the ongoing turmoil in the U.S. banking sector, investors are increasingly wary about keeping their money in banks. Many of these investors are looking for alternative ways to keep their money safe to regain control of their finances. For most of them, this means investing in cryptocurrencies.

As such, the crypto market has been hitting up, with Bitcoin towering above $27,000. The big crypto reached as high as $28,937 just moments following the U.S. Federal Reserve’s decision to increase interest rates by 25 basis points. Many analysts had favored the Bitcoin price to reach $30,000. Even though BTC did not make the said trip to $30K, it trades 69% above the January 31 opening.

According to Cryptomaniaks, a leading crypto education platform, the price of Bitcoin has risen by 37.06% from $20,376.32 to $27,929.17 since March 10.

To put this into context, only 12 companies in the S&P 500 have seen returns of more than 35% since the year began.

This means that the performance of the largest cryptocurrency by market capitalization surpasses the 27.2% year-to-date (YTD) returns recorded by FedEx, the 19.3% YTD returns by Apple, and Amazon’s 17.8% YTD returns. Bitcoins have also outperformed more than 97% of the top 500 publicly traded companies in the United States.

Bitcoin Holds Above $27,000 – Where Is It Headed Next?

BTC started the year in the green, recording a series of higher highs and higher lows before being rejected by the $25,500 supplier congestion zone on February 20. This was followed by a 22% correction that saw the price seek solace from the 200-day Simple Moving Average (SMA), which sat at $10,705 on March 10.

After that, the banking crisis saw an inflow of funds into crypto assets, which saw the pioneer cryptocurrency surge more than 49% to a high of $28,937, as shown on the daily chart below.

After Jerome Powell’s speech failed to propel the Bitcoin price to $30,000, as many expected, the asset has since been oscillating around the $28,000 level. At the time of writing, Bitcoin was hovering around $28,037, 0.7% up on the day.

The king crypto appeared bullish, as validated by the upward-facing moving averages and the northward movement of the Moving Average Convergence Divergence (MACD) indicator above the neutral line. Moreover, the Relative Strength Index (RSI) was moving within the positive region. The price strength at 66 suggested that the bulls controlled the Bitcoin price and were focused on pushing it higher.

Therefore, a daily candlestick close above the immediate resistance at $28,500 would see BTC rise to confront opposition from the $28,500 and $32,000 supply areas. Bitcoin was rejected from this region in June 2022, plummeting approximately 40% toward the $17,500 support line.

Overcoming this barrier would confirm a bullish breakout for the flagship cryptocurrency bringing new yearly highs into the picture.

BTC/USD Daily Chart

On the downside, the RSI painted near overbought conditions for the Bitcoin price. Bears may take control of the cost as buying exhaustion kicks in, forcing a correction. The first line of defense is found at the support recently established at $27,200.

Additional support areas could emerge from the $25,000 psychological level or the $24,000 primary support level, embraced by the 50-day Simple Moving Average (SMA). In highly bearish cases, BTC may drop below $22,000 to revisit the 100-day and 200-day SMAs at $21,500 and $20,100, respectively.