- Retail Bitcoin traders are selling off holdings, while whales and institutions are accumulating, signaling potential long-term bullish momentum.

- Options data suggests short-term volatility may normalize, reinforcing the idea that the worst of the recent flash crash is over.

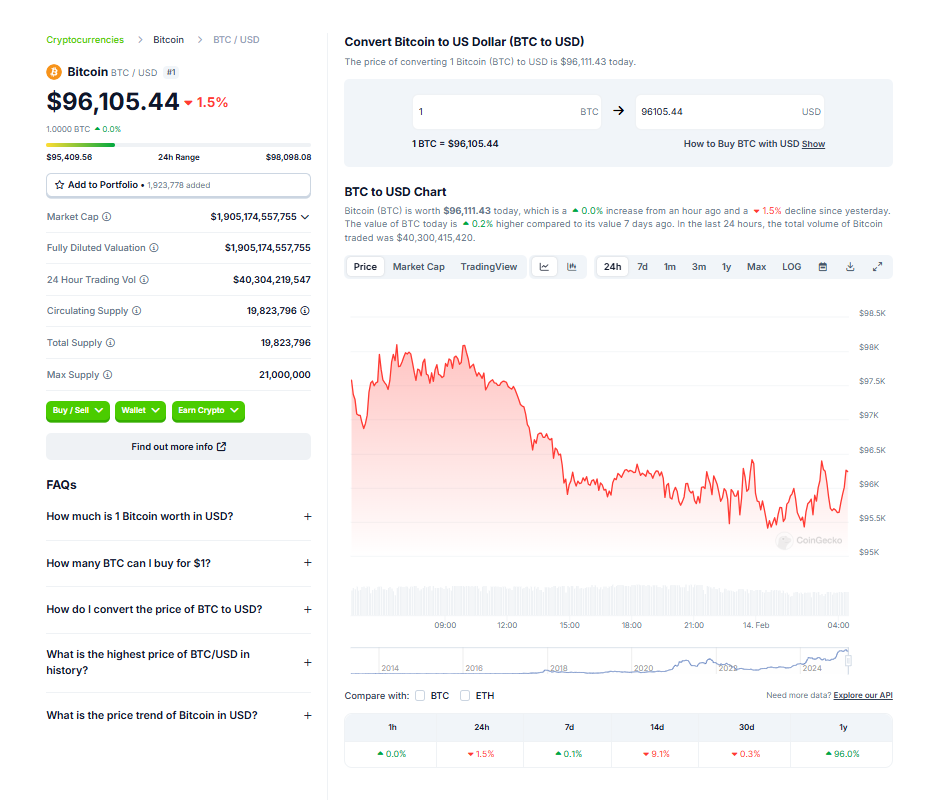

- Bitcoin hovers around $96K, with key support at $93,572 and resistance at $103,278, as momentum indicators show waning bearish pressure.

Bitcoin is stuck below $100K, and retail traders are getting nervous. Many small wallet holders are offloading their BTC, fearing a deeper correction. But here’s the twist—whales and institutions are buying the dip.

According to Santiment, Bitcoin’s network has seen 277,240 fewer non-empty wallets over the past three weeks, the lowest count since December 10. Historically, when retail exits and whales accumulate, it’s often a bullish sign for long-term price action.

Volatility Could Settle—New Highs Still in Play?

Despite recent price swings, some analysts believe the worst of the “flash crash” is behind us.

- Realized volatility jumped from the mid-40s to mid-50s, per Imran Lakha of Options Insight.

- Options data suggests a short-term correction, but also confirms a bullish continuation ahead.

- Bitcoin funding rates remain low, and open interest has dropped, indicating less leverage in the market—typically a setup for stronger price action.

Bitcoin Near Key Support & Resistance Levels

BTC is currently trading around $96,000, hovering just 15% below its all-time high of $109,588.

- Support: $93,572, aligning with the 50-day EMA.

- Resistance: $103,278, the upper boundary of the Fair Value Gap (FVG).

Momentum indicators like MACD show waning negative momentum, meaning Bitcoin could be gearing up for another breakout.

With whales accumulating and volatility cooling, a return to all-time highs might not be far off.