- Bitcoin Open Interest (OI) reaches an all-time high, reflecting increased trading activity.

- Analysts remain optimistic about Bitcoin’s potential to reach new milestones in 2024.

- MVRV ratio suggests Bitcoin may still have room for growth before becoming overbought.

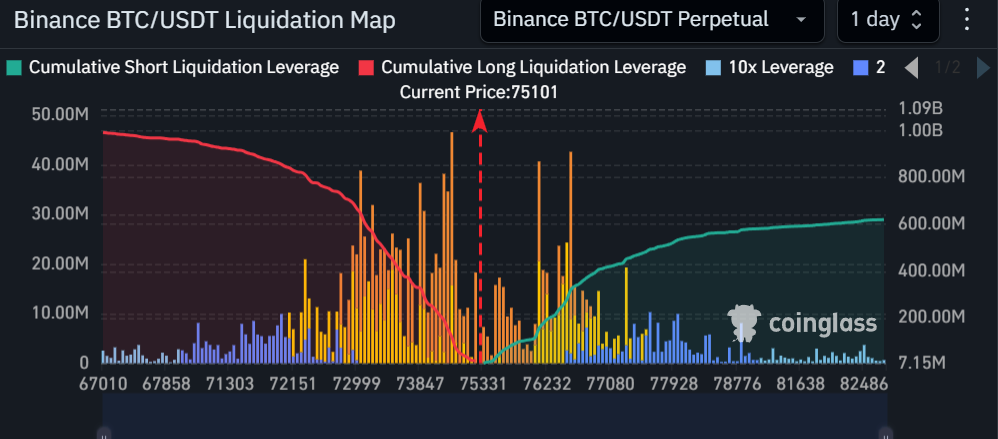

Bitcoin’s trading landscape witnessed a significant surge as Open Interest (OI) in Bitcoin derivatives reached unprecedented levels. This increase coincided with Bitcoin’s price rallying past $75,000, marking a new milestone and fueling optimism among market analysts who believe further gains are possible. According to CoinGlass, Bitcoin’s OI, which monitors outstanding Bitcoin contracts in options and futures, rose to $45.4 billion—a 13.3% increase since November 5. This follows Bitcoin’s earlier breakout past the previous high of $73,800 set in March.

Source: CoinGlass

Steady Increase in Open Interest Reflects Growing Trading Activity

Open Interest in Bitcoin continues to rise, indicating heightened trading momentum as more long and short positions are opened compared to contracts being closed. CoinGlass data showed OI climbing to $45.41 billion as of November 6, suggesting that traders anticipate Bitcoin’s value may not revisit its previous high of $73,679 soon. If Bitcoin’s price were to fall back to this level, an estimated $1.26 billion in short positions would face potential liquidation.

Bitcoin’s trading price was around $75,792 at the time of reporting, and several analysts observed that the price remains within a promising range for further upward movement. Veteran trader Peter Brandt commented in a recent X post that Bitcoin has entered a favorable phase of its bull market cycle, forecasting a possible peak between $130,000 and $150,000 by late next year.

Analyst Sentiment Indicates Room for Further Growth

The sustained increase in Bitcoin’s price and OI levels has stirred debate about whether the asset may be overvalued. However, several industry experts suggest that the current conditions indicate room for continued growth. Analyst Rajat Soni voiced optimism about Bitcoin’s trajectory, noting that its adoption phase is still early. He explained that Bitcoin’s rising value represents a shift as more people move away from fiat currency in favor of decentralized options.

CryptoQuant, a crypto analytics firm, added that Bitcoin’s recent all-time high does not imply that it has reached an overheated valuation. The firm pointed to Bitcoin’s Market Value to Realized Value (MVRV) ratio, which stands at 2.19, lower than its March peak of 2.87. MVRV is a tool traders use to gauge whether an asset might be overbought. Lower MVRV values generally indicate there may be room for additional price increases before reaching potentially unsustainable levels.

The optimistic outlook from experienced traders and market data suggests that Bitcoin may still have potential for further gains, even after reaching historic highs in recent days. As the cryptocurrency ecosystem continues to evolve, indicators like OI and MVRV will be closely monitored by traders for signs of further market opportunities.