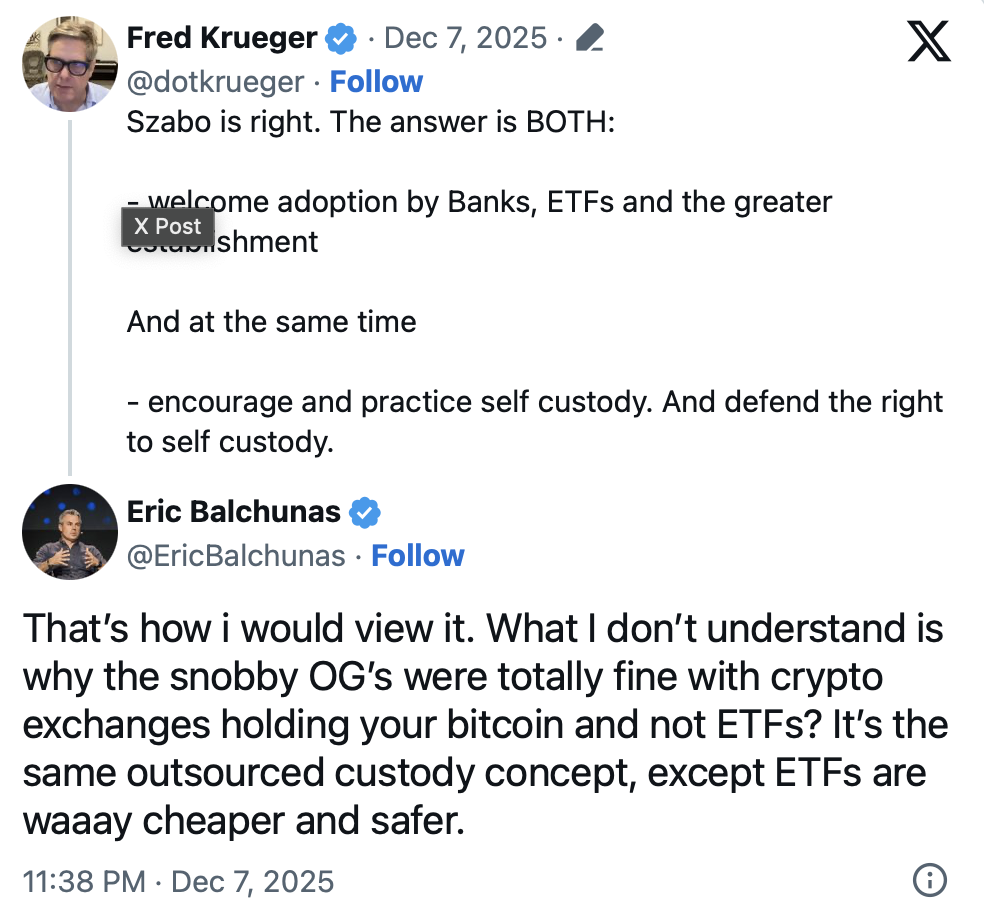

- Investor Fred Krueger backed Nick Szabo’s “both paths” approach, arguing Bitcoin should welcome banks and ETFs while fiercely defending the right to self-custody, attempting to bridge purists and institutionalists.

- The debate escalated as Bloomberg’s Eric Balchunas defended ETFs as cheaper and safer, while critics like Sam Wouters warned that ETFs lock users out of withdrawal freedom, turning Bitcoin into “a bird in a cage.”

- At its core, the clash is no longer just about products, but about Bitcoin’s identity: whether it remains a tool of sovereignty and exit, or evolves into a mass-market asset largely controlled through traditional financial rails.

A surprisingly fierce debate has erupted right in the center of Bitcoin’s ideological universe, with long-time industry veterans clashing over what the future of custody, sovereignty, and ETF-driven adoption should actually look like. The argument isn’t just technical — it’s philosophical, emotional, and honestly, it’s getting sharper by the day.

The latest spark came from investor Fred Krueger, who jumped in to support Nick Szabo’s push for a dual-path strategy.

Bitcoin’s Self-Custody Debate Heats Up as ETFs Take the Spotlight

Krueger encouraged followers to embrace traditional rails — banks, ETFs, and institutional wrappers — but also fight hard to preserve Bitcoin’s original promise of personal control.

“Szabo is right,” Krueger said. “The answer is BOTH: welcome adoption by Banks, ETFs, and the greater establishment… and at the same time, encourage and practice self-custody. And defend the right to self-custody.”

His position attempts to bridge the now-widening gap between Bitcoin “purists,” who believe sovereignty is the entire point, and ETF defenders who argue that large-scale adoption requires familiar, regulated infrastructure.

This all traces back to a debate sparked on Nov. 30, when Bram Kanstein argued that gold was such an efficient form of money that it was eventually replaced by paper claims — credit instruments that came from nothing but trust.

Szabo responded with a quick history lesson: gold was centralized in vaults because it wasn’t theft-resistant, and merchants preferred practicality over purity. That’s how gold morphed into paper receipts, and then into wire-based settlement systems.

Bitcoin fixes much of this — speed, verification, open access — but not everything. Szabo stressed that one key weakness still remains.

“Bitcoin is, without further work, still below the best trust-based methods in its theft resistance,” he warned.

This, in his view, is why Wall Street leans heavily toward third-party custody and ETFs.

ETFs vs. Self-Custody: A Sharp Philosophical Divide Emerges

That comment widened the rift.

Bloomberg’s Eric Balchunas questioned why “snobby OGs” happily trust exchanges with custody but oppose ETFs. In his view, both rely on third-party custody — but ETFs are “way cheaper and safer.”

Analyst Sam Wouters pushed back hard:

“You can withdraw from an exchange at any time. An ETF is a bird in a cage,” he said.

He argued that freedom to exit is the value proposition — even if most users don’t self-custody today. With ETFs, that option simply doesn’t exist.

Balchunas countered that ETFs expand adoption massively, push ownership into millions of hands, and help Bitcoin evolve into a more stable monetary asset.

But critics replied that Bitcoin wasn’t created to sit under corporate control. They worry that ETFs could eventually give institutions too much perceived influence over the protocol.

As the debate escalated, Balchunas insisted that self-custody is “a pain” and can be “very expensive” when done through apps and exchanges. But others quickly pointed out that many platforms offer no withdrawal fees, tight spreads, and no annual fees — unlike ETFs.

Balchunas later added:

“All I know is I got a ledger thing, then the app went out to source BTC, and it was 1.4% minimum to convert my $. Some were 2–3%. For an ETF person, that’s insanely expensive, worse than the 1970s.”

Still, many in the community argue that Bitcoin exists precisely because corporations and institutions cannot be trusted on their word alone.

A Defining Moment for Bitcoin’s Future

Bitcoin continues to live between two worlds — one built on sovereignty and self-possession, the other on scalability and mass-market convenience. What started as a disagreement about ETFs has now transformed into a much deeper ideological fault line.

This isn’t just a debate anymore.

It’s the beginning of Bitcoin’s next chapter — and whichever side gains momentum will shape how the world interacts with Bitcoin for decades to come.