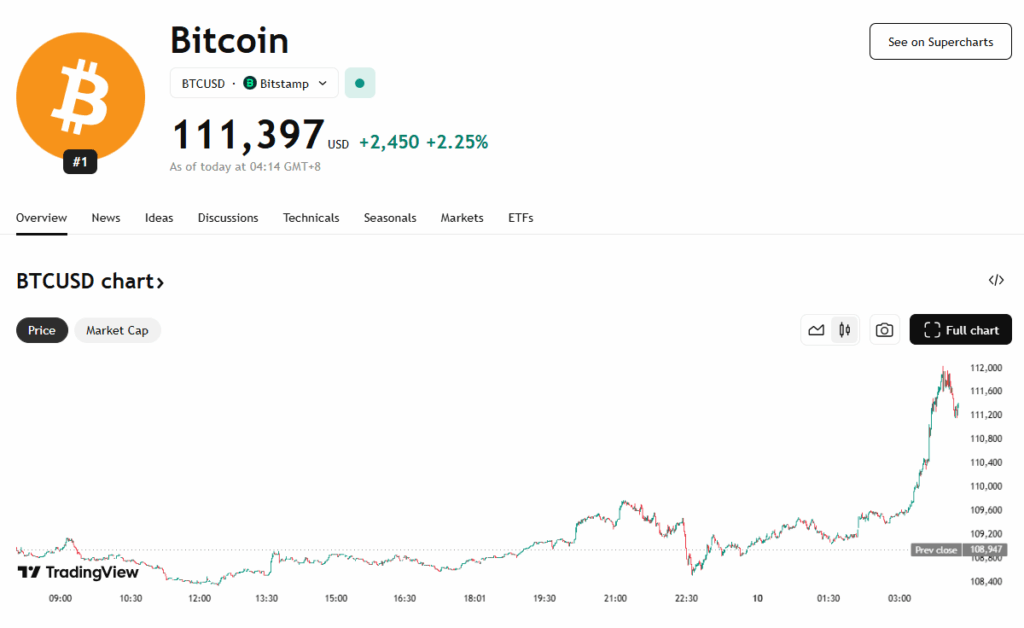

- Bitcoin surged to $111,400, approaching its all-time high of $112,000, amid a broader crypto rally led by Ethereum’s 6% rise to $2,760.

- Analysts highlight low volatility and quiet accumulation as strong bullish signals, suggesting a major move may be imminent.

- Ethereum’s breakout is attributed to rising institutional interest in its role in settlement infrastructure and asset tokenization, with Bitwise calling ETH a top play in the trend.

Bitcoin surged to $111,400 on Wednesday afternoon, marking its highest level since May and bringing it within striking distance of its all-time high of $112,000. The move broke weeks of tight rangebound trading and injected renewed energy into the broader crypto market. Ethereum also saw a strong breakout, jumping 6% to $2,760, its highest price in nearly a month.

The latest rally unfolded during U.S. market hours and coincided with a lift in crypto-related equities. Notably, MicroStrategy (MSTR) rose 4.4%, approaching its 2025 highs, while Coinbase (COIN) advanced 5%, and bitcoin miners like MARA Holdings and Riot Platforms (RIOT) gained about 6% each.

Quiet Before the Surge?

The rally has caught attention not just for its price movement, but for its quiet, low-volatility buildup. Charlie Morris, CIO at ByteTree, noted in a report that Bitcoin’s 90-day and 360-day volatility has been steadily declining, a technical signal that often precedes sharp upward moves.

“The setup for the next one is looking good,” Morris wrote. “As I keep on saying, the quiet bulls are the best.” With volatility compressed and momentum building under the surface, Bitcoin appears poised for a potential breakout beyond its previous record.

Ethereum’s Surge and Institutional Confidence

Ethereum’s ETH also performed strongly, pushing through resistance and showing bullish technical strength. According to Joel Kruger from LMAX Group, ETH’s rise reflects increasing institutional interest, particularly from long-only asset managers betting on Ethereum’s future role in settlement infrastructure and tokenized asset ecosystems.

Analysts from Bitwise echoed that sentiment, describing ETH as one of the “cleanest” plays to gain exposure to the fast-growing tokenization trend, which has become one of the most hyped narratives of 2025.

Macro and Market Outlook

Bitcoin’s sustained move above $110,000 could signal the start of a fresh bullish leg. For now, resistance around $112,000 — the May high — remains the final major barrier. Meanwhile, crypto equities are rallying in parallel, suggesting broader market confidence.

With both Bitcoin and Ethereum flirting with breakout territory, analysts are watching closely for confirmation in trading volume, continuation patterns, and potential ETF-driven flows that could amplify upside moves.