- Standard Chartered’s Geoffrey Kendrick now suggests his $120K Bitcoin target for Q2 2025 might be “too low.”

- Institutional inflows into U.S. Bitcoin ETFs hit $5.3 billion in three weeks, signaling growing interest from big players.

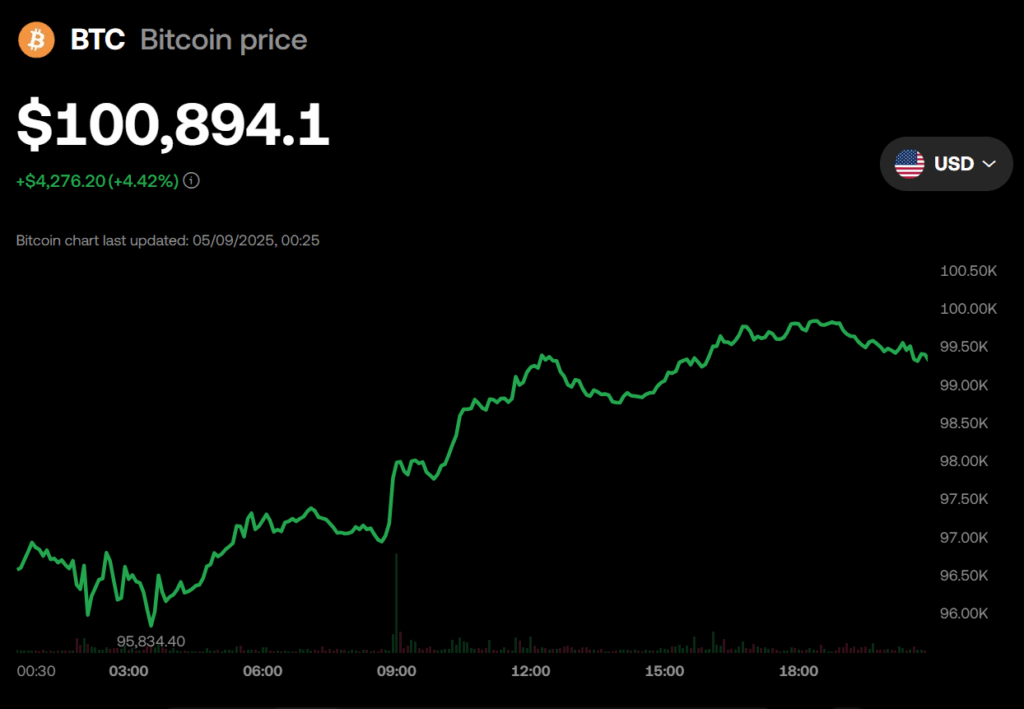

- Bitcoin surged 4.5% to $100,511.22, driven by Fed rate stability and increasing institutional accumulation.

Standard Chartered’s Geoffrey Kendrick, the analyst who pegged Bitcoin at $120,000 by Q2 2025, is now saying he might’ve undershot it. “Apologies, but my $120k Q2 target may be too low,” Kendrick joked in a note to clients on Thursday.

Last month, Kendrick projected Bitcoin would hit a fresh all-time high of $120,000, driven by a shift away from U.S. assets and heavy accumulation by big players. Now, with BTC surging past $100,000, Kendrick says the $120k target “looks very achievable,” hinting that the real ceiling might be higher.

Institutional Money Floods In

Bitcoin’s breakout isn’t just about retail hype. According to Kendrick, institutional flows are pouring in. Spot Bitcoin ETFs in the U.S. have seen $5.3 billion in inflows over the last three weeks, with major players like MicroStrategy ramping up their BTC stash.

Other examples? Abu Dhabi’s sovereign wealth fund is holding BlackRock’s IBIT Bitcoin ETF, and even the Swiss National Bank has been buying up MicroStrategy shares — a company that’s basically a proxy for Bitcoin at this point.

Bitcoin Hits $100K — What’s Next?

Bitcoin climbed 4.5% Thursday to $100,511.22, as per Coin Metrics data, fueled by the Fed’s decision to keep interest rates steady. Kendrick, who’s maintained a bullish stance on Bitcoin for years, says it’s now all about the flows. “The dominant story for Bitcoin has changed again,” he said. “It’s now all about flows. And flows are coming in many forms.”