- Bitcoin miners transferred over 25,000 BTC worth $2.2 billion as prices surged.

- Analysts suggest outflows may indicate profit-taking and preparation for the next cycle.

- Historic trends and new political developments may push Bitcoin toward $100,000 soon.

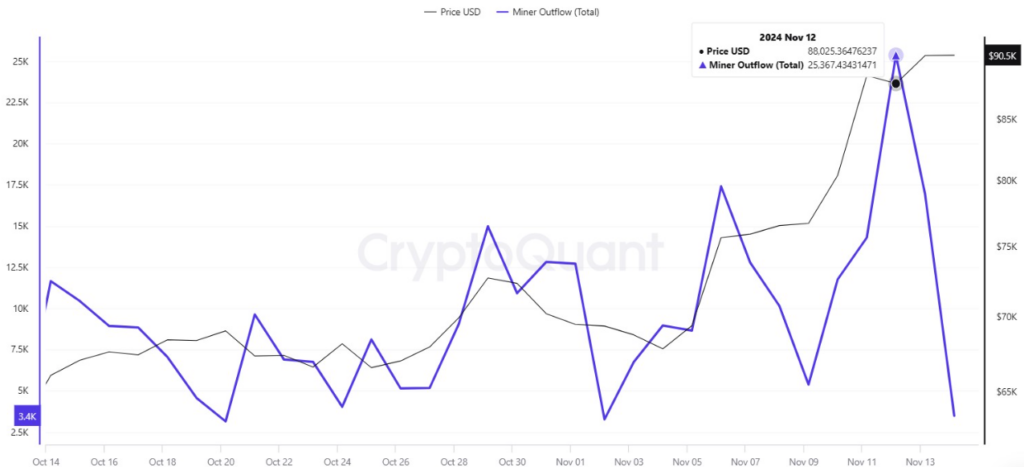

Bitcoin miners are actively shifting significant amounts of BTC out of their wallets as prices continue to hit new record highs, signaling potential profit-taking ahead of anticipated market changes. CryptoQuant data revealed that on Nov. 12, approximately 25,367 BTC, valued at around $2.2 billion, flowed out of mining pool wallets as Bitcoin’s price surged to $88,025.

Source: CryptoQuant

Preparing for a Potential Downtrend

Onchain analyst Avocado_onchain noted that miners often capitalize on profitable periods to secure gains before Bitcoin’s next halving event, which reduces mining rewards. Avocado explained that these outflows might reflect miner positioning for an eventual market correction, a common practice during peak price cycles. High mining participation, reflected in Bitcoin’s rising hashrate and difficulty levels, also suggests a strong base for continued price gains.

However, CryptoQuant cautioned that these transfers don’t always indicate selling. Miners may move funds for several reasons, including exchanges or other wallet management strategies.

Analysts See $100,000 Milestone Within Reach

According to Ryan Lee, chief analyst at Bitget Research, November historically yields strong returns for Bitcoin, supporting the possibility of prices exceeding $100,000 before month-end. Lee estimates that if Bitcoin grows by 14.7%, this target could be reached. Bitfinex analysts added that pro-crypto sentiment following Donald Trump’s recent presidential win may further accelerate adoption in the U.S., creating favorable conditions for Bitcoin’s potential price surge in the coming months.