- White House crypto czar David Sacks dismissed concerns about Trump’s crypto involvement, calling it “irrelevant” to policy decisions.

- The Strategic Bitcoin Reserve will focus only on Bitcoin, while other cryptocurrencies remain part of a sellable asset stockpile.

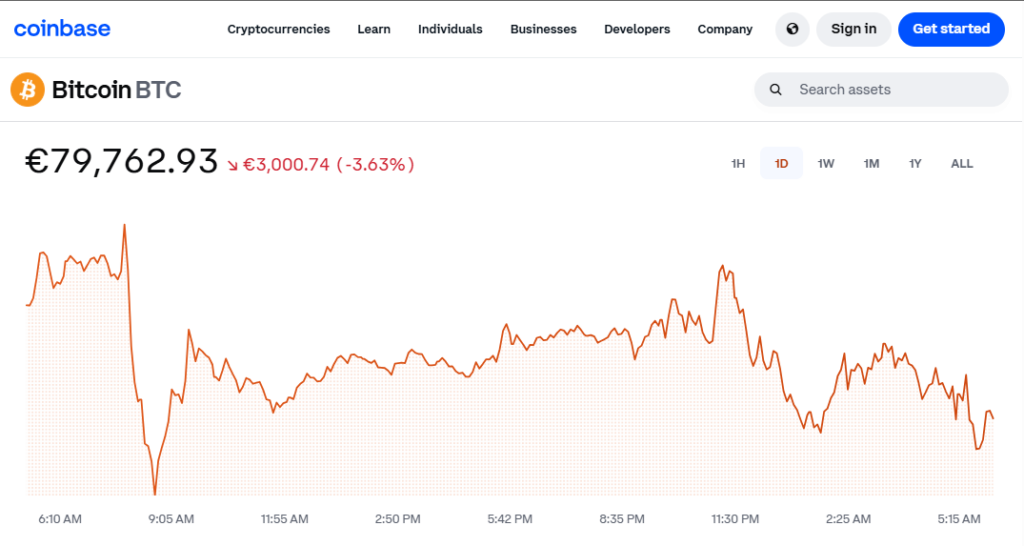

- Investors were disappointed by the lack of immediate Bitcoin purchases, leading to a market dip instead of a rally.

White House crypto czar David Sacks pushed back against concerns on Friday regarding President Donald Trump’s potential conflicts of interest in the crypto space, dismissing them as “irrelevant” to policy decisions.

Trump’s Crypto Ventures: A Non-Issue?

“I don’t think it’s had any impact,” Sacks said when asked whether Trump’s personal crypto projects, including his controversial TRUMP meme coin, have influenced regulatory decisions. “I think it’s kind of irrelevant to what we’re doing here.”

Sacks also shrugged off concerns about Trump’s personal investments in Bitcoin and other digital assets, saying, “Those are facts not in evidence.”

Trump’s Crypto Ties Run Deep

Before returning to the White House, Trump’s brand was involved in multiple crypto projects, including:

- An Ethereum-based DeFi platform, World Liberty Financial

- The Solana meme coin, TRUMP

- Several NFT collections, which reportedly generated millions in revenue

While the exact amount of Trump’s personal earnings from these ventures remains unknown, on-chain data suggests that associated companies have reaped billions in value—including $200 million from the WLFI token sale alone.

A Strategic Bitcoin Reserve—But No Altcoins

The White House confirmed last week that Trump’s newly announced Strategic Bitcoin Reserve will focus exclusively on Bitcoin, reinforcing the administration’s view that BTC is in a “league of its own.”

“Bitcoin is special in our view,” a senior White House official said. “It’s the most secure. It’s the most decentralized. It doesn’t have an issuer. So it deserves special treatment.”

Meanwhile, other cryptocurrencies—including XRP, Solana, and Cardano—will remain part of the U.S. Digital Asset Stockpile, which the Treasury has the discretion to sell at any time.

Market Reaction to Bitcoin Reserve Announcement

Despite the announcement of the Strategic Bitcoin Reserve, crypto markets saw a dip instead of a rally. Bitcoin fell 2% to around $87,000, briefly dropping 5% after the news broke. Other major cryptocurrencies, including Ether, XRP, Solana, and Cardano, also struggled to gain momentum.

“Although the price has partially recovered, the lack of new demand and uncertainty about future government actions are preventing a significant rally,” said Rachel Lin, CEO of decentralized exchange SynFutures.

Investors had hoped for a more aggressive Bitcoin accumulation plan but were left disappointed by the lack of immediate buying commitments. While the executive order allows for “budget-neutral strategies” to acquire more BTC, no concrete steps have been outlined yet.

“This is not the aggressive Bitcoin reserve some were pressing for,” TD Cowen’s Jaret Seiberg said. “Instead, the government is simply keeping crypto rather than immediately turning it into cash. Though limited, this is positive for crypto by signifying White House support for digital assets.”

SEC Shifts Tone on Meme Coins

Ever since Trump’s return to office, crypto regulations have shifted in ways that seem to benefit his own projects. Just days after the TRUMP meme coin launched, SEC Crypto Task Force head Hester Peirce suggested the token wouldn’t fall under SEC jurisdiction. Weeks later, the SEC issued a statement clarifying that meme coins, in general, should not be classified as securities.

The Road Ahead for Crypto Policy

Treasury Secretary Scott Bessent emphasized that the U.S. must stop selling Bitcoin before considering any accumulation strategy. Speaking on CNBC’s “Squawk Box”, Bessent stated, “The first step is to stop selling, and then we’re going to put a plan in place from there.”

With the first White House Crypto Summit on the horizon, investors and analysts are waiting to see if a clearer Bitcoin accumulation plan emerges. Meanwhile, broader economic concerns—including tariff wars and inflation fears—continue to weigh on the crypto market, making it uncertain whether Bitcoin can break past $90,000 in the near term.