• Bitcoin (BTC) reached an all-time high of $93,975 on Tuesday afternoon

• The price surge triggered $444 million in liquidations of BTC short positions in the derivatives market

• Experts attribute the rally to increasing institutional adoption and excitement around Blackrock’s bitcoin ETF

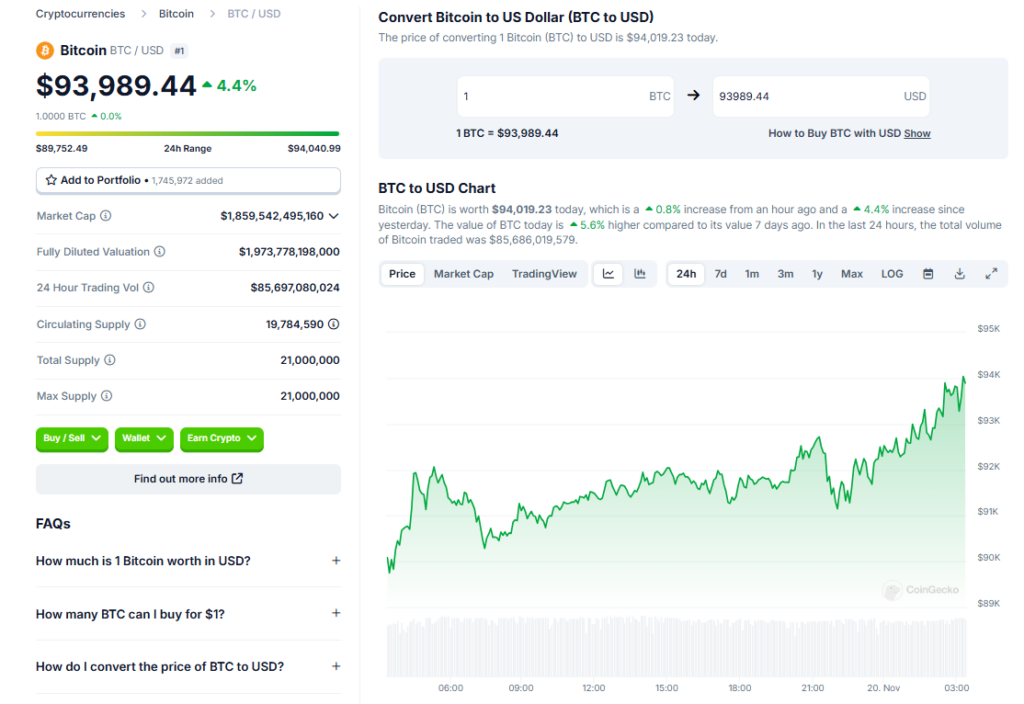

Bitcoin (BTC) shattered records on Tuesday, reaching an eye-popping $93,975 – a new all-time high. The top cryptocurrency gained 33% against the US dollar in the past day and climbed 75% this week. With a towering market cap of $1.86 trillion, bitcoin continues to command attention in the ever-evolving world of digital finance.

Bitcoin Rallies to $93,975, Liquidating $444M in Shorts

The day’s price leap coincided with bustling trading activity, with $8.479 billion in bitcoin exchanging hands in just 24 hours. The wild price swings also triggered a wave of liquidations in the derivatives market, wiping out $444 million in BTC short positions during the same timeframe.

Experts Weigh In on the Milestone

This milestone reinforces bitcoin’s role as a heavyweight in the financial arena, pulling in massive investments and sparking trader interest at breakneck speed. Experts attribute this latest price climb to increasing institutional buy-in as well as excitement around regulated trading options targeting Blackrock’s IBIT exchange-traded fund (ETF).

Bitcoin’s meteoric rise has reignited lively debates about its future as a hedge against economic uncertainty and its role as a digital store of value. Although questions about its scalability persist, the cryptocurrency continues to prove its staying power and creative adaptability, earning favor with both retail and institutional players.

Adding fuel to the buzz is speculation that the US might consider building a strategic bitcoin reserve. This landmark moment aligns with bitcoin’s social contract—offering confiscation resistance, censorship resistance, inflation resistance through its limited supply, and protection against counterfeiting.

As bitcoin’s journey unfolds, its adoption highlights a growing global pivot toward financial independence and cutting-edge monetary technologies. While the longevity of this momentum remains unknown, bitcoin’s latest triumph is a testament to its magnetic appeal and the doors it continues to open for innovation in the digital economy.

Conclusion

Bitcoin has once again reached new heights, surpassing $93,000 for the first time ever. This record comes amid ballooning institutional interest and debates over bitcoin’s future role in finance. Although uncertainties remain, bitcoin continues to push boundaries, sparking excitement and speculation around its potential. One thing is clear – this apex cryptocurrency shows no signs of slowing down.