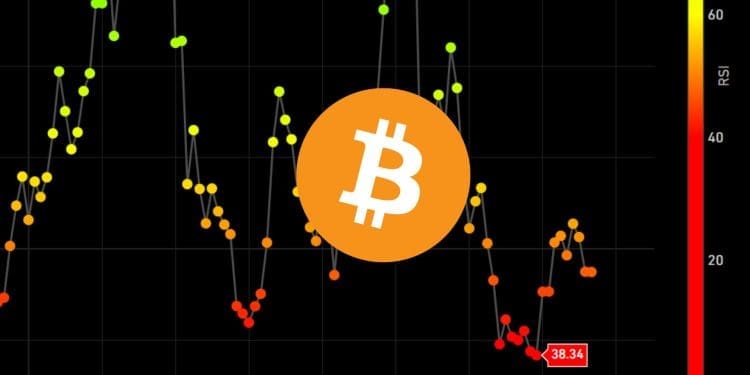

- Bitcoin is still overbought despite the recent price correction, according to JP Morgan. The bank believes the sell-off may continue after the upcoming halving event.

- Inflows into Bitcoin spot ETFs have slowed recently, while outflows have surged. This challenges the notion that ETF flow will be characterized by sustained one-way inflow.

- JP Morgan expects profit-taking to continue after the halving, given that Bitcoin remains overbought amid the ongoing correction.

JP Morgan recently stated in a report that Bitcoin is still overbought, despite the ongoing price correction this week. The bank believes the sell-off may continue after the upcoming halving event.

Bitcoin Inflows Slow as Outflows Surge

Throughout the past week, a number of digital assets have seen their prices decrease. Bitcoin has led the way, with the asset down over 4% in the last seven days.

Spot Bitcoin ETF inflows have faced a slowing pace recently. Moreover, outflows from these investment vehicles have increased significantly over the same period.

“There remains considerable optimism in the market over the prospect for prices rising significantly by year-end,” JP Morgan said in its report. “However, the decline in inflows and surge in outflows challenges the notion that the spot Bitcoin ETF flow picture is going to be characterized as sustained one-way inflow.”

Profit-Taking Expected to Continue

The bank believes profit-taking is likely to continue after the halving, given that Bitcoin remains overbought amid the correction.

The Bitcoin halving is slated to take place next month, on April 20th according to current projections. How Bitcoin is positioned heading into the event will be an important factor in its post-halving performance.