- Bitcoin dropped below $86K, down 20% from its all-time high as market sentiment weakens.

- Bitcoin ETFs saw $2.7B in outflows over two weeks, with a record $1B pulled on Feb. 25.

- Uncertainty over Trump’s Bitcoin reserve plan and macroeconomic pressures are adding to investor fears.

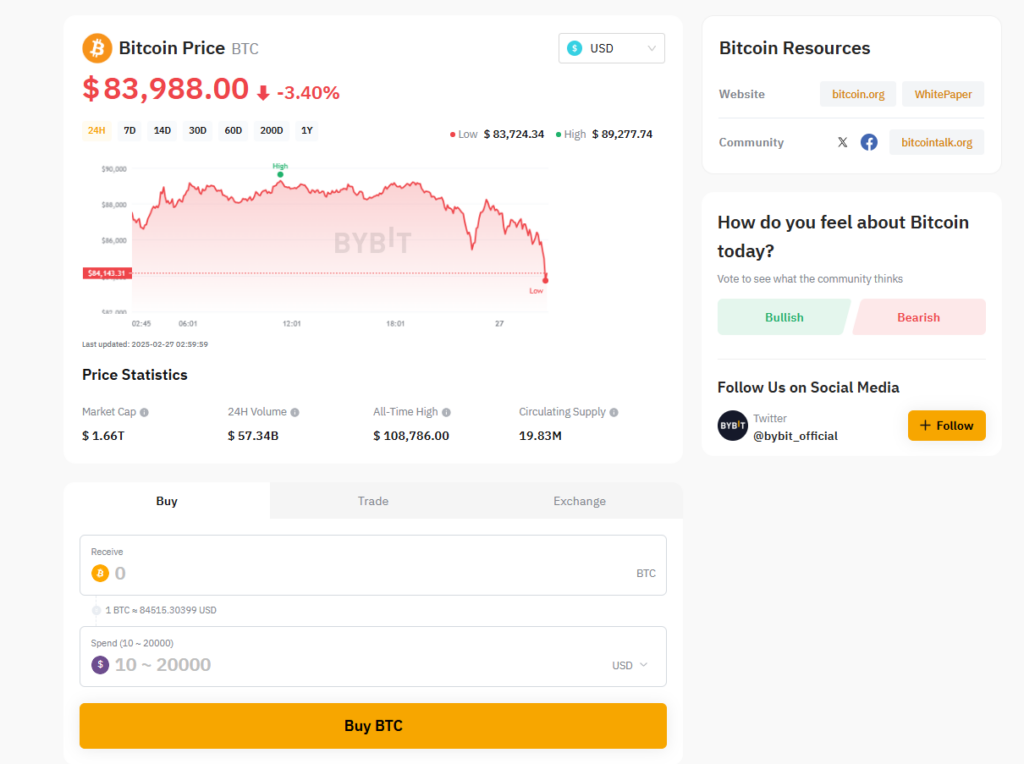

Bitcoin continues its downward slide, now hovering around $86,000, down nearly 10% in the past week and 20% off its all-time high from just a month ago. The Trump-fueled crypto rally that once sent BTC soaring past $100K? It might be losing steam.

Other major cryptos aren’t looking much better—Ethereum dipped 1% in 24 hours, while Solana took a steeper hit, falling over 4%.

Why the Drop? Bybit Hack, Meme Coin Scandals & Market Jitters

Bitcoin has been stuck in a choppy range for weeks, searching for a catalyst. But now? It’s found one—just not the kind bulls wanted.

- Bybit, a Dubai-based exchange, was hacked on Feb. 21, with North Korea’s Lazarus Group allegedly stealing $1.4 billion in crypto assets.

- The Argentina memecoin scandal resurfaced doubts in the crypto space, after President Javier Milei’s LIBRA token collapsed, leaving investors rattled.

- Market sentiment is shifting—fears of further downside are creeping in.

Combine hacks, scandals, and weak momentum, and you get a cocktail of uncertainty weighing down the market.

Bitcoin ETFs Bleeding Out—$2.7B Pulled in Two Weeks

Just weeks ago, Bitcoin ETFs were the hottest financial product on the market. Now? Investors are bailing.

- U.S. Bitcoin ETFs have seen $2.7 billion in outflows in just two weeks—with over $1 billion pulled on Feb. 25 alone.

- This sustained sell-off is dragging Bitcoin lower, as institutional demand slows.

- Confidence isn’t what it used to be—and ETF outflows are a glaring signal of that.

Without fresh demand, Bitcoin’s price is feeling the weight of all that selling pressure.

Bitcoin Reserve? Still No Word from the Trump Administration

Crypto investors were waiting for a big move—a U.S. Bitcoin reserve under Trump’s leadership. But so far? Radio silence.

While some state governments are pushing forward, the federal government remains indecisive, and that uncertainty isn’t helping market sentiment.

Macroeconomic Pressures—BTC Starting to Act Like a Stock?

Bitcoin is no longer just a niche asset—it’s reacting to global events like never before.

- Inflation reports and economic data are influencing prices, much like in traditional markets.

- Trump’s latest round of tariffs has shaken investor confidence, adding another layer of volatility.

- As Bitcoin becomes more mainstream, it’s moving more like the stock market—and that comes with new risks.

For now? Bitcoin bulls are looking for a lifeline, while bears are eyeing lower levels. Where BTC heads next depends on whether the market can shake off this uncertainty—or if the pain continues.