- Bitcoin hit a record high of $93,483 amid strong demand and CPI data.

- Analysts foresee $100,000 soon, with some projecting potential highs of $200,000.

- Rising PPI data and Fed rate cut predictions may continue to support Bitcoin prices.

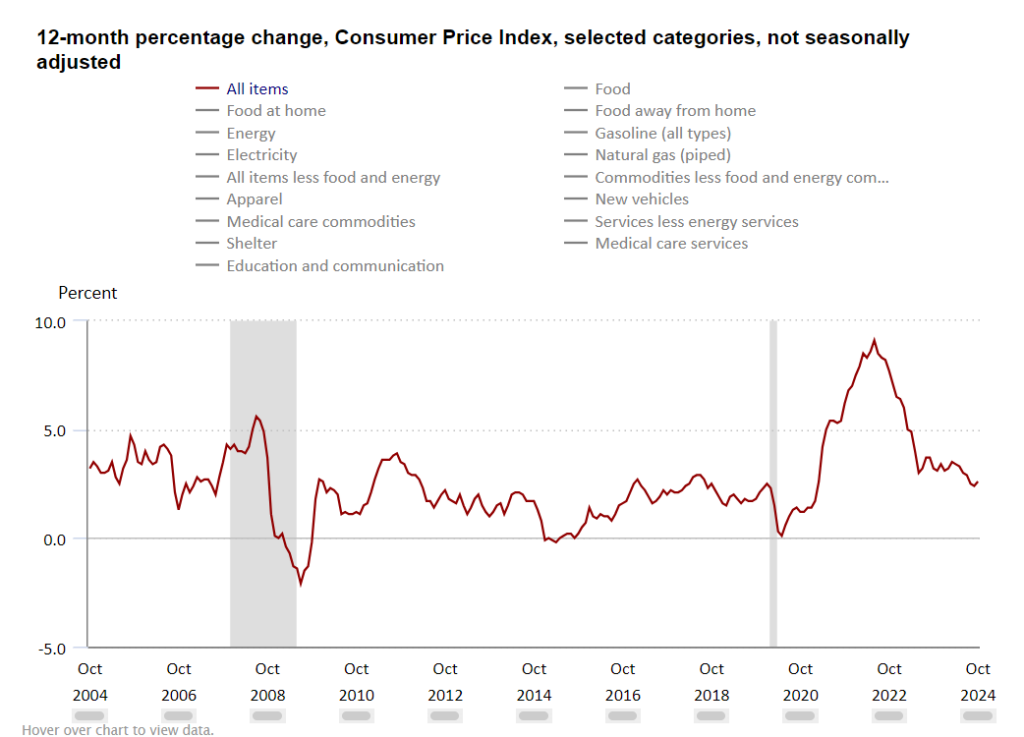

Bitcoin continued its rally on Nov. 14, reaching near $90,000 after setting a new all-time high of $93,483 on Bitstamp the day before. This surge followed the release of U.S. Consumer Price Index (CPI) data for October, which reported a 2.6% increase, aligning with expectations. Despite ongoing inflation, Bitcoin managed to hold its ground, briefly pushing above the $90,000 level.

Analysts see further gains, bolstered by market bets on an additional interest rate cut by the Federal Reserve in December. CME Group’s FedWatch Tool showed over 80% odds of a December cut, supporting optimism for the cryptocurrency. Quinn Thompson, founder of Lekker Capital, suggested Bitcoin could cross the $100,000 mark in the coming week, calling the CPI release “nothingburger” in terms of impact on Bitcoin’s rally.

Source: BLS

Further Upside Expected

Onchain indicators suggest more room for growth. On Nov. 13, CryptoQuant’s contributor Onchained noted that the platform’s Top/Bottom Index showed similarities to earlier bull phases, indicating possible room for Bitcoin to reach between $180,000 and $200,000. The index currently sits at 0.27, far from the typical peak range of 0 to 0.09, suggesting the rally may still have momentum.

Skew, a market analyst, marked $95,000 as a “key supply zone” based on current liquidity levels. Low volume in the Asian session suggested potential moves in the European and U.S. sessions, which could further drive Bitcoin prices.

Market Projections and Investor Optimism

Many crypto market watchers share similar bullish outlooks. Bitget Research’s Ryan Lee noted Bitcoin’s consistent gains during November, often its best month historically. Some analysts expect Bitcoin’s price to hit $100,000, spurred by a favorable macro environment and positive inflation data.

The latest predictions underscore the potential impact of upcoming Producer Price Index (PPI) data and any new policy moves from the Federal Reserve.