- BTC dominance drops to 60.83% as capital rotates into altcoins, not out of the market.

- Bitcoin faces heavy whale selling, but Ethereum and Solana show strong network activity and DeFi growth.

- Total altcoin market cap holds at $1.44T; key support levels suggest the market isn’t in panic mode.

Bitcoin’s been on a rollercoaster—sliding under $116K, whales dumping, and exchange inflows spiking. But here’s the twist: altcoins aren’t collapsing with it. Instead, the total altcoin market cap is still holding firm above $1.44 trillion, showing some quiet strength despite BTC’s shaky legs.

Bitcoin Dominance Slips as Capital Rotates

Data from CoinGlass shows BTC dominance falling to 60.83% on July 25, down from 62.1% earlier this week. Ethereum’s sitting steady with an 11.66% share, while Solana claims 2.54%. The “Other Coins” category? That’s up to 17.87%, its highest in weeks. This isn’t a market-wide selloff—it’s capital rotation.

The 4-hour RSI heatmap backs this up. Bitcoin’s RSI is stuck below 40, looking weak, while ETH, BNB, and TRX hover near neutral territory. Traders are clearly keeping their altcoin exposure despite Bitcoin’s tumble. It’s not panic; it’s reshuffling.

Total2 and Market Caps Still Strong

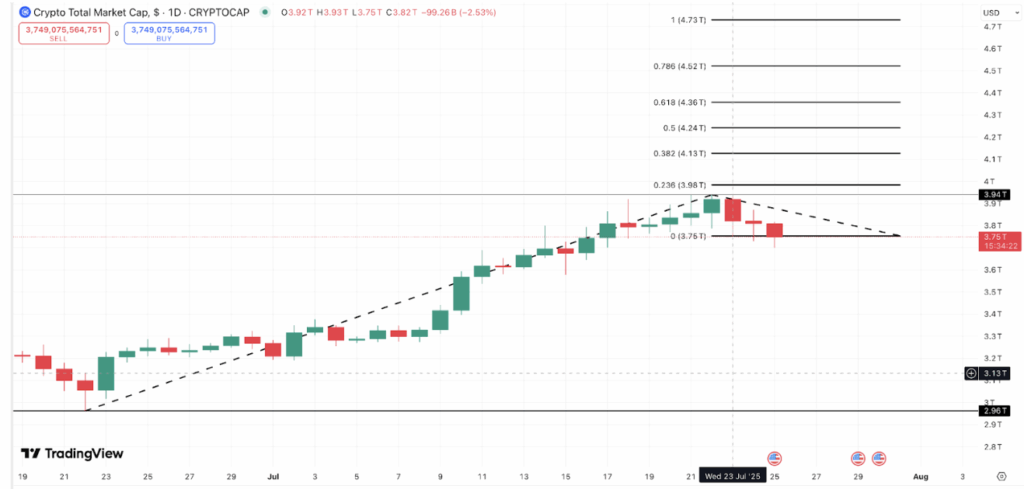

Even with today’s dip, Total2—the altcoin market cap excluding BTC—is steady around $1.44 trillion. It’s barely down from a $1.46 trillion high. Meanwhile, the overall crypto market cap stands at $3.82 trillion, just below the 0.236 Fibonacci retracement at $3.98 trillion. Unless we see a sharp drop under $3.75 trillion, the correction looks mild.

Put simply, altcoins aren’t diving. They’re cooling off, but the key supports are holding. Traders seem to be cycling out of Bitcoin but sticking with strong alt projects.

Whales Are Targeting BTC, Not Altcoins

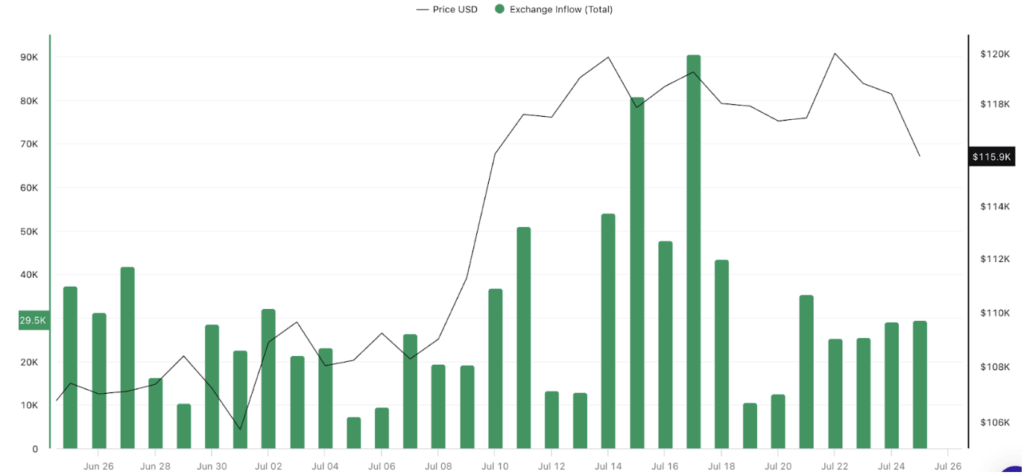

Bitcoin exchange inflows have surged, topping 80,000 BTC between July 14–17, with peaks near 90,000. On July 24, inflows were still high at around 30,000 BTC. Unsurprisingly, BTC’s price slid from $120K to $115K during this time.

But the altcoin story is different. Ethereum’s active addresses are up 8.37% in the last week and 32.23% over the month. Solana wallets dipped 9.59% in a day but are still up 15.53% monthly. Tron’s up 21.32% month-on-month.

DeFi TVL data confirms the shift: Ethereum’s TVL sits at $80.99 billion, Solana’s at $9.73 billion (up 15.53% over 30 days), while Bitcoin lags at $6.72 billion. This isn’t a total market exodus—it’s targeted BTC selling, likely from ETFs or big institutional players.

Key Levels to Watch

As long as Total2 stays above $1.44 trillion and the full market cap holds above $3.75 trillion, altcoins remain resilient. Bitcoin might be dealing with heavy sell pressure, but the broader market still has plenty of life left.