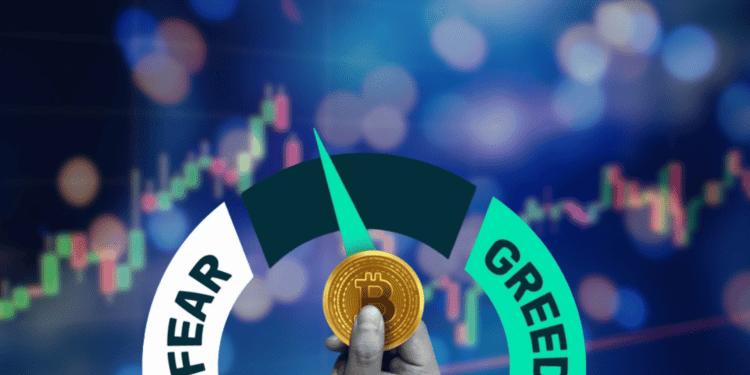

• Bitcoin Price (BTC) Crash to $53K Pushes Fear & Greed Index to Lowest Since Early 2023

• The widely-followed sentiment metric hit extreme greed levels earlier in March near the local top of the crypto market

• It is now pushing its limits in the opposite direction

The widely-followed sentiment metric hit extreme greed levels earlier in March near the local top of the crypto market, but now is pushing its limits in the opposite direction.

Price Drop

Bitcoin prices crashed below $53,000 on Wednesday, taking the largest cryptocurrency down about 55% from its record high of $69,000 hit in November 2021.

The sharp sell-off comes amid a wider retreat from riskier assets like tech stocks as the Federal Reserve embarks on an aggressive series of interest rate hikes to combat high inflation.

Fear & Greed Index

The Crypto Fear & Greed Index, which measures market sentiment, dropped to 10 on Wednesday – its lowest level since February 2021.

The index was showing a reading of 79, signaling extreme greed, in early March when bitcoin hit its recent peak of around $48,000.

Historical Context

The Fear & Greed index has only posted lower readings during severe crypto bear markets like in 2018-2019 and early 2020.

A reading of 10 indicates investors are very fearful, which often presents a buying opportunity for contrarian investors before a recovery. However, prices can still fall further despite the fearful sentiment.

Market Reaction

The crypto market faces a critical moment, with bitcoin struggling to maintain support around $50,000.

If selling pressure continues, bitcoin could test lower support levels around $40,000 which could spark another wave of fear selling.

Outlook

With the Fear & Greed index flashing a fearful reading, many analysts say crypto markets are oversold and poised for at least a short-term bounce. However, macroeconomic headwinds could continue to put pressure on bitcoin prices.

Conclusion

The latest plunge in the Crypto Fear & Greed Index reflects nervousness in the market as bitcoin falls further from its all-time high. While the index is signaling an oversold condition, bitcoin remains vulnerable to more downside until macroeconomic uncertainty passes.