- Bitcoin’s Fear & Greed Index dropped to 25, signaling ‘Extreme Fear’ as BTC fell below $90K.

- Historically, Bitcoin has rebounded from fear zones within two months, often hitting new all-time highs.

- Bitwise’s Jeff Park warns that fear-driven hesitation leads to missed opportunities, as Bitcoin tends to surge before investors regain confidence.

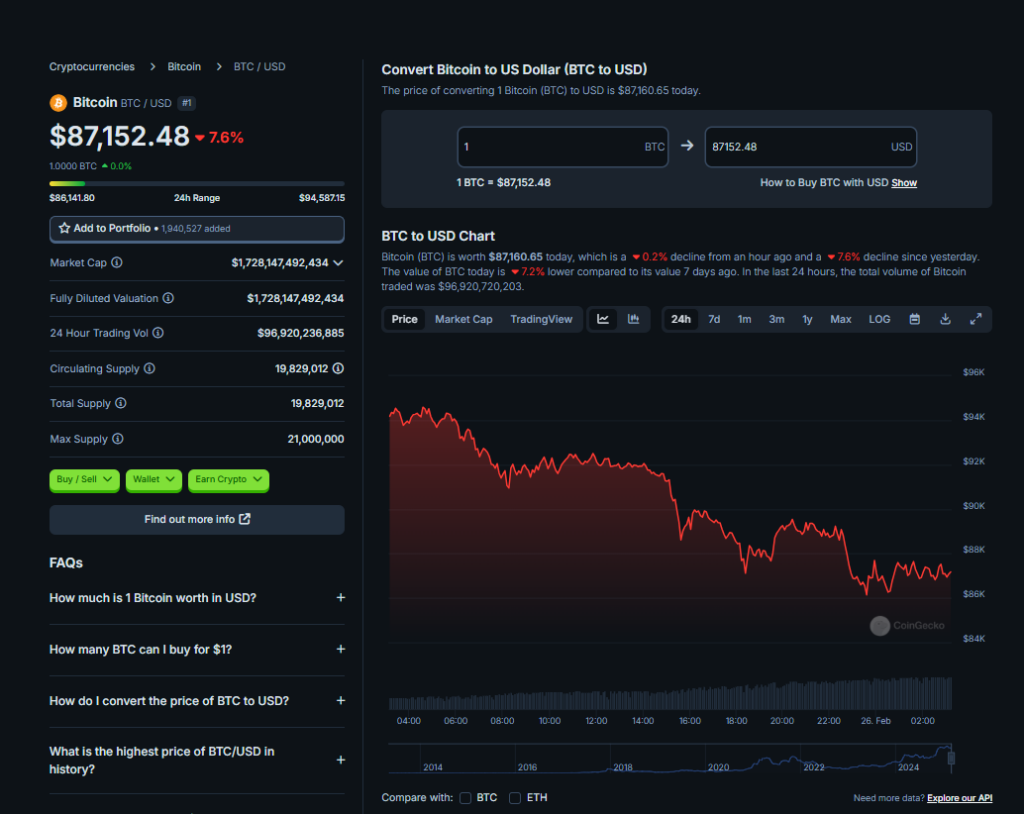

Bitcoin just slipped below $90K for the first time since August 2024, and with it, the Fear & Greed Index has plunged to 25, signaling ‘Extreme Fear’ in the market.

Funny thing? The last time Bitcoin was at this level, it skyrocketed 78% to $88K by November. Back then, investors were feeling greedy at these prices—now, they’re panicking.

Fear Turns to Greed… Then Back to Fear

The past 18 months have been a wild ride for Bitcoin, fueled by:

- BlackRock’s initial spot ETF filing, which ignited bullish momentum.

- The actual ETF launch, solidifying institutional support.

- Donald Trump’s 2024 election win, pushing Bitcoin past $100K.

Each time Bitcoin has entered the ‘Extreme Fear’ zone, it has historically bounced back within two months, often leading to new all-time highs. But then again, during the brutal 2022 bear market, it took over a year to recover.

Bitwise Exec Says It’s a Familiar Cycle

Jeff Park, Head of Alpha Strategies at Bitwise, isn’t fazed by the fear—he’s seen it all before:

“I’ve seen this movie too many times. People wish for lower prices, but when they get them, they lose faith. Then Bitcoin rips. By the time they’re ready to buy, it’s already at new all-time highs.”

So, is this just another setup for Bitcoin’s next rally? Or is the market in for a deeper correction before any bounce?

For now, history suggests that fear doesn’t last long—but timing it right? That’s the tricky part.