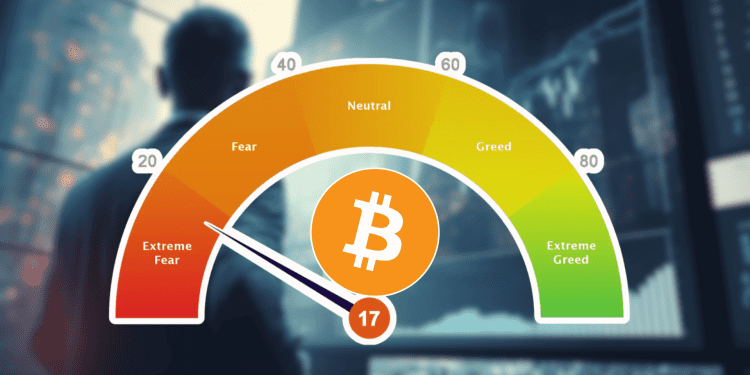

• The Bitcoin Fear and Greed Index has dropped to near “extreme fear” levels, scoring 26 out of 100

• Historically, such low fear levels often precede price rebounds, potentially presenting a buying opportunity for investors

• The Fear and Greed Index analyzes factors like volatility, momentum, social media trends, and Bitcoin’s market dominance to gauge market sentiment

The latest data from Bitcoin Magazine Pro‘s Fear and Greed Index reveals that Bitcoin sentiment has reached near “extreme fear” levels. With a score of 26 out of 100, the index indicates the crypto market may be undervalued and oversold.

Introducing the Fear and Greed Index

The Fear and Greed Index is a tool for gauging Bitcoin market sentiment. It analyzes factors like volatility, momentum, social media trends, and Bitcoin’s dominance. The index ranges from 0 to 100, with lower scores signaling fear and higher scores indicating greed.

Understanding Bitcoin’s Current Sentiment

Bitcoin’s current index score of 26 reflects heightened anxiety in the market. This comes amidst a 25% Bitcoin price drop this past week. However, historically, periods of extreme fear often foreshadow price rebounds. As such, this could signal an opportune moment for strategic investments.

Leveraging the Fear and Greed Index

The consistent tracking of fear and greed levels provides valuable insights into the volatile crypto market. The index has proven a reliable indicator, with excessive fear typically marking undervalued conditions and extreme greed overvaluation. As such, it allows savvy investors to time entries and exits more effectively.

Looking Ahead at Bitcoin’s Ever-Evolving Market

As the crypto space continues to mature, tools like the Fear and Greed Index remain essential to understanding sentiment-driven price movements. This empowers investors to navigate the market’s choppy waters and make informed investment decisions.