The crypto market downturn saw Bitcoin (BTC) drop to seek solace from the $18,000 support zone, levels last seen three months ago. The total cryptocurrency market capitalization dropped below $950 billion. It currently sits at $933 billion after climbing 3.23% in the past 24 hours. The Ethereum Merge did little to bolster investors as the now proof-of-stake token – ETH – fell below $1,300 on Monday.

The current market turmoil is being attributed to several macroeconomic events, including the higher-than-expected Consumer Price Index (CPI) data released on September 13 and a possible interest rate hike by the Fed, which is expected to be the biggest in four decades.

Most significant Interest Rate Hikes in 40 Years Expected

The Federal Open Market Committee (FOMC) meeting will take place on Wednesday, September 21. The crypto community is waiting for the FOMC’s decision on interest rates with bated breath. Analysts are looking at an 80% chance that the Fed will increase the rate by 75 basis points and a 20% chance that the increase will be by 100 basis points or 1%. Interest rates have not increased by 1% in the past 40 years.

For the period running from 1978 and 1981, the U.S. Federal Reserve raised rates by 1% seven times during then-Chairman Paul Volcker’s term. This was ascribed to soaring inflation.

According to the CME Group’s FEDWatch Tool, financial markets have now fully priced in a minimum 75 basis points increase for the Fed funds rate. However, it is not disregarding the possibility of a 100 basis points hike.

“A 100-point increase would be the Fed’s first such action since the early 1980s.”

Bitcoin Price Technical Outlook

At the press time, BTC had climbed back above $19,000, up 4.13% on the day. The big crypto was down 7.59% on weak daily volume, according to data from CoinMarketCap.

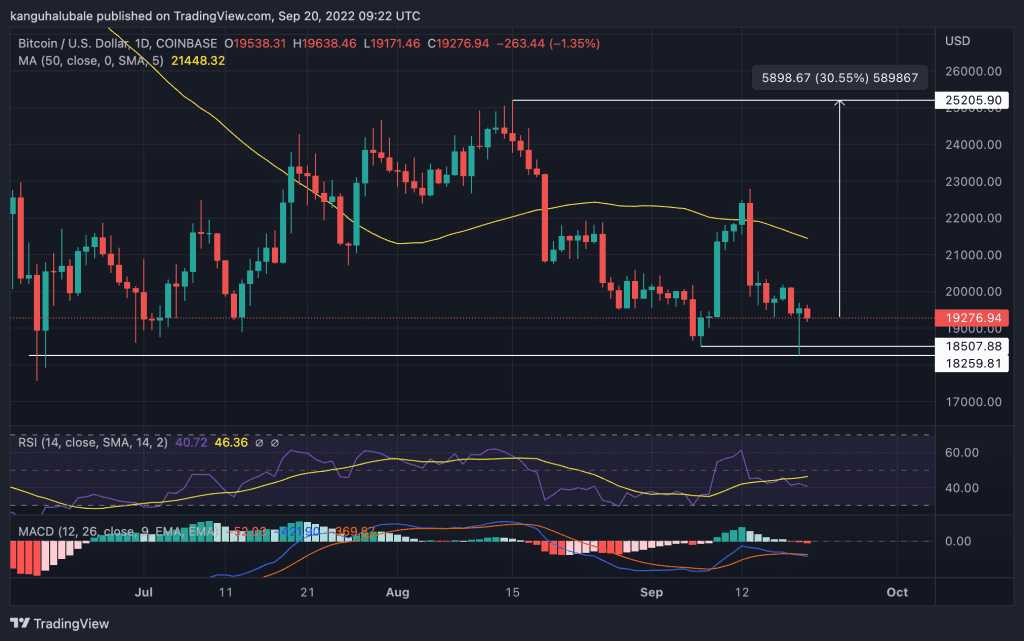

The 50-day simple moving average (SMA) faced downward, and the relative strength index (RSI) was positioned in the negative region, suggesting that the market favored the downside. The price strength at 40 indicated that the bears completely controlled BTC and were determined to push it lower.

Also adding credence to Bitcoin’s gloomy outlook was the downward movement of the Moving Average Convergence Divergence (MACD) indicator, implying that the market sentiment was negative. The 12-day EMA (blue line) had crossed below the 26-day EMA (orange line), as seen on the daily chart, suggesting that the price action favored the downside.

As such, sellers may attempt to pull the price back toward the $18,500 support line. Below that, the price may drop first toward the $18,259 swing low or the $18,00 psychological level shortly. Investors could expect Bitcoin bulls to regroup here before staging a comeback.

On the upside, increased buying from the current levels pushed Bitcoin to tag the $20,000 psychological level. Other roadblocks may arise from the 50-day SMA at $21,450 and the $23,000 resistance level. Above this, BTC may climb to reclaim the $25,000 support level or rise to tag the %25,205 range high. This would represent a 30% move from the current $19,276.

Note that the Bitcoin price needs to shatter the resistance at $25,000 to secure an uptrend.