- Bitcoin dropped 5% in October, marking its first red month since 2018, but historically gains 42% on average in November.

- The Fed’s rate cuts and easing U.S.–China tensions could boost BTC’s recovery potential.

- Ongoing government shutdowns and ETF approval delays may still weigh on Bitcoin’s short-term momentum.

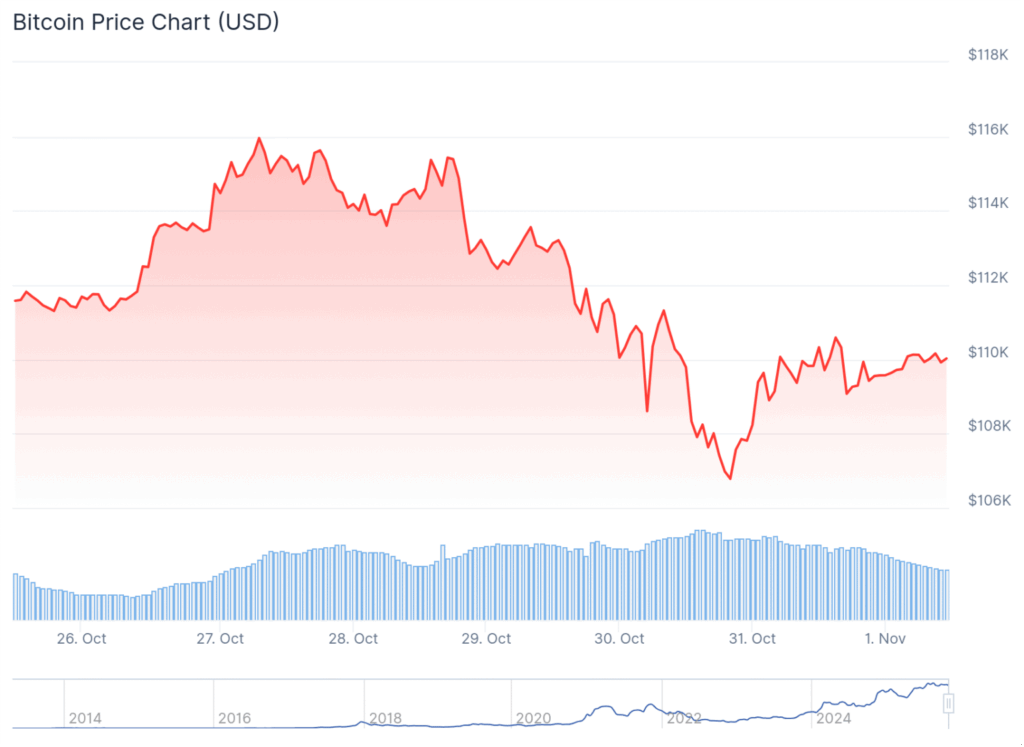

For the first time since 2018, Bitcoin closed October in the red, dropping nearly 5% and snapping its seven-year winning streak. The fall followed President Trump’s shock announcement of 100% tariffs on Chinese imports, triggering $19 billion in crypto liquidations within a single day. Still, BTC remains up over 16% year-to-date — and history suggests brighter days may be ahead as November begins.

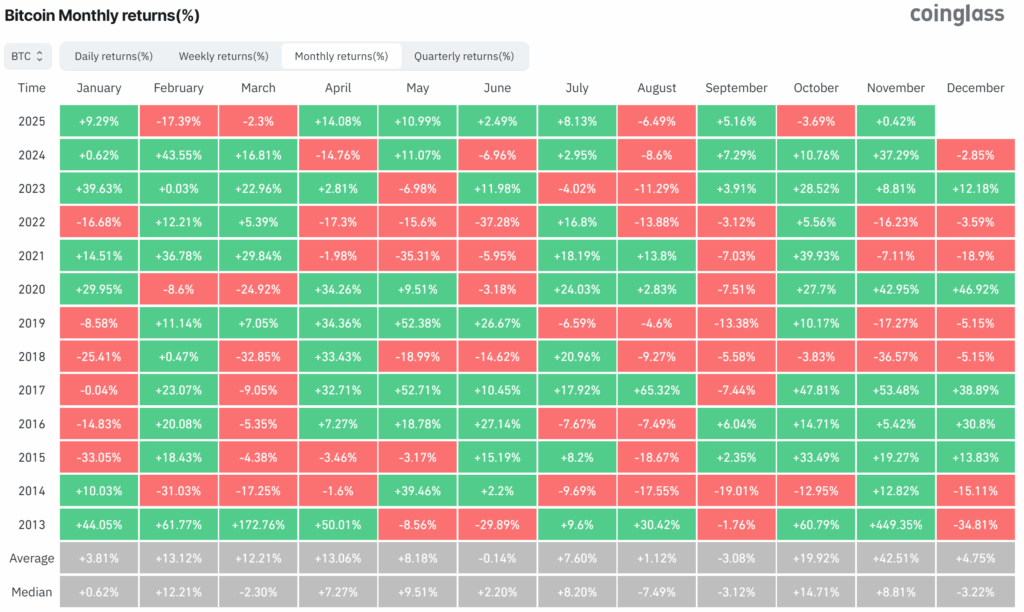

History Favors the Bulls

According to Coinglass data, November has historically been Bitcoin’s strongest month, averaging a 42.51% gain since 2013. If that trend holds, BTC could climb above $160,000 before month-end. However, 10x Research’s Markus Thielen cautions that seasonal patterns alone aren’t enough. “They matter, but only when supported by broader factors,” he said, hinting that macro conditions may determine whether this rally sticks.

Trade Tensions, Fed Cuts, and ETF Delays

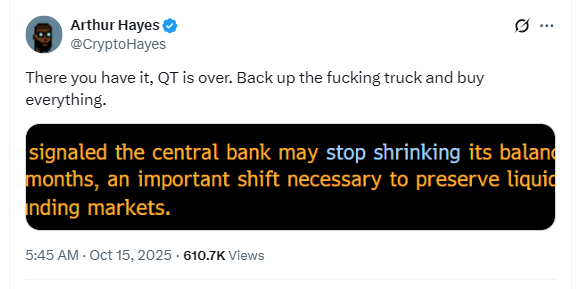

The ongoing U.S.–China trade drama keeps shaking global markets. Trump recently met President Xi in South Korea, signaling real progress on a deal that includes tariff cuts and renewed soybean imports. Meanwhile, the Federal Reserve cut interest rates by 0.25% and officially ended its quantitative tightening program on December 1 — both moves that could inject new liquidity into markets and potentially boost Bitcoin’s outlook.

Even Arthur Hayes, the BitMEX co-founder, couldn’t hold back his excitement. He wrote on X:

What to Watch This Month

If history repeats itself, Bitcoin could be heading for a major rebound through November. Lower interest rates, easing trade tensions, and strong seasonal patterns all set the stage for a potential rally. But with regulatory delays and lingering volatility, traders will be watching closely to see if BTC can turn its “Red October” into a “Golden November.”\