- Bitcoin surged close to $77,000 following strong investor interest tied to Trump’s election victory and economic outlook.

- Spot Bitcoin ETFs recorded $1.38 billion in net inflows, boosting Bitcoin’s market value and demand.

- Analysts predict Bitcoin could outperform other assets amid tariff proposals and economic concerns in 2024.

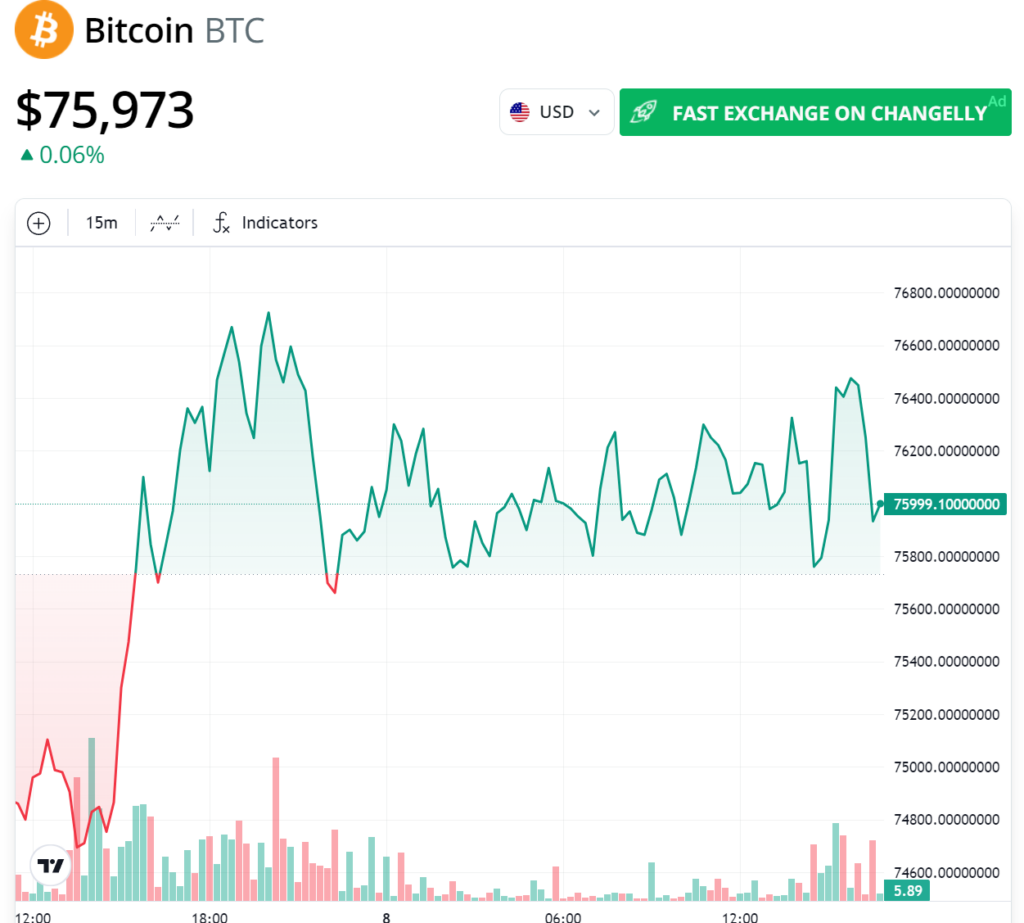

Bitcoin’s recent rise to nearly $77,000 has captured market attention, spurred by an influx of investor interest following Donald Trump’s presidential win. On Nov. 7, Bitcoin reached a record high of $76,999, according to Cointelegraph, just two days after Trump was confirmed as the election victor. The Republican win, paired with optimistic economic expectations, has led to significant inflows into Bitcoin-related products.

In a Nov. 8 report, trading firm QCP Capital observed a notable increase in Bitcoin investments, including net inflows exceeding $1.38 billion into spot Bitcoin ETFs. This trend aligns with past bull markets following Bitcoin halving events, suggesting potential for further growth. Analysts predict that Bitcoin may see continued gains, possibly surpassing $77,000, as interest from retail and institutional investors grows.

Source: Cointelegraph

Potential for Bitcoin to Outperform Other Assets

QCP Capital suggests that Bitcoin may outpace traditional assets like equities, partly due to Trump’s proposed tariff increases on Chinese imports, which could make Bitcoin an attractive alternative. This tariff hike, expected to reach 60%, represents a sharp increase from previous rates, adding to investor concerns over national debt and potential economic impacts. Analysts predict Bitcoin could continue to gain momentum as a lower-risk option compared to equities.

Record Inflows into Spot Bitcoin ETFs

Following Trump’s win, spot Bitcoin ETFs in the U.S. saw net inflows hitting $1.37 billion, marking an all-time high. This surge is expected to create a feedback loop, with rising ETF inflows potentially pushing Bitcoin prices higher. QCP Capital anticipates that the continued influx of retail capital and systematic fund investments could further stabilize Bitcoin’s upward trend, especially as market volatility decreases.