- BlackRock’s Bitcoin ETF pulled in $531M in a day, boosting its net assets to nearly $59B.

- Most other BTC ETFs saw outflows, with Fidelity losing $58M and Grayscale continuing its $22B bleed.

- All nine Ethereum ETFs reported zero flows, reflecting stalled investor interest.

It’s been a rollercoaster for U.S. spot Bitcoin ETFs this week. Most funds posted outflows, but BlackRock? They just casually hauled in over half a billion dollars in a single day. Meanwhile, Ethereum ETFs? Zero movement. Not a dime in or out—just… crickets.

BlackRock dominates while rivals lose ground

According to SoSoValue data, Bitcoin ETFs pulled in a chunky $425.45 million in net inflows on May 5. It’s a solid start to the week, and follows a strong streak—$1.81 billion poured in during the last few days of April and first week of May. The week before that? A monster $3.06 billion.

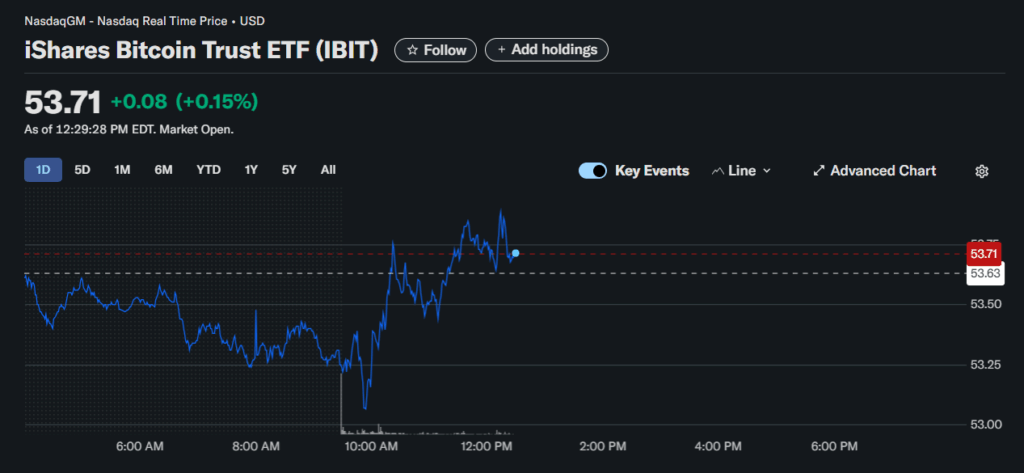

BlackRock’s iShares Bitcoin Trust (IBIT) did all the heavy lifting with $531.18 million in net inflows just that day. That brings its total to $44.21 billion in inflows, and it’s now sitting on $58.68 billion in net assets—by far the biggest BTC ETF out there.

Other funds? Not so lucky

Fidelity’s Wise Origin Bitcoin Fund (FBTC), the second-largest, lost $57.82 million on the day. It still has $11.6 billion in cumulative inflows and $18.74 billion in assets, but the drop stings.

Bitwise’s Bitcoin ETF (BITB) also slipped, with $22.66 million flowing out. It’s at $2.04 billion in net inflows overall, with $3.64 billion in net assets—putting it in fourth place by size.

And then there’s Grayscale’s Bitcoin Trust (GBTC)… still leaking. Another $16.37 million exited the fund, which has now racked up $22.76 billion in total outflows, dragging its net assets down to $17.94 billion.

ARKB, the ARK 21Shares Bitcoin ETF, didn’t fare great either—$6.14 million in exits. Its total net inflows sit at $2.64 billion, and it holds $4.53 billion in net assets.

Lastly, Franklin Templeton’s EZBC lost $2.74 million, nudging its total inflows to $259.73 million. It’s got about $490 million in net assets now, which puts it toward the bottom of the pack.

ETH funds just sat this one out

On the Ethereum side? Total silence. All nine ETH ETFs reported zero flows in or out—a pretty rare flatline across the board. ETH’s recent underperformance might be part of it, or maybe investors are just waiting for something… anything… to spark some movement.