- Spot Bitcoin ETFs recorded six consecutive weeks of net inflows, reaching $8.95 billion since October 11.

- BlackRock’s iShares Bitcoin Trust leads with $29.3 billion in cumulative inflows, dominating the market.

- Ether ETFs also gained momentum, attracting $515 million in weekly inflows over the past three weeks.

For the week of November 11 to 15, spot Bitcoin exchange-traded funds (ETFs) saw net inflows totaling $1.67 billion. This marks the sixth consecutive week of positive activity for these funds, according to cryptocurrency tracking platform SoSoValue.

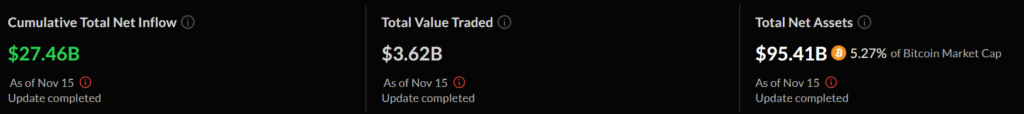

Since October 11, inflows into spot Bitcoin ETFs have steadily climbed, reaching a cumulative total of $8.95 billion. This activity has raised the total assets under management (AUM) for spot Bitcoin ETFs to $95.4 billion, equivalent to 5.27% of Bitcoin’s overall market value, which stands at $1.8 trillion.

Bitcoin ETFs Maintain Market Leadership

BlackRock’s iShares Bitcoin Trust continues to dominate the spot Bitcoin ETF market, leading with $29.3 billion in cumulative inflows since spot ETFs began trading in January. On the other hand, the Grayscale Bitcoin Trust ETF has experienced outflows amounting to $20.3 billion during the same period.

Ether ETFs have also seen growth alongside Bitcoin ETFs. Weekly inflows into spot Ether ETFs reached $515 million last week, marking three straight weeks of positive movement. Over the past three weeks, these funds have attracted $682 million in net inflows.

Source: SoSoValue

Growing Momentum for Digital Asset ETFs

The continued inflows into Bitcoin and Ether ETFs signal sustained investor interest in digital assets. This trend reflects confidence in these financial products as viable vehicles for accessing cryptocurrency markets, providing both institutional and retail investors with a regulated pathway for participation.