- Bitcoin ETFs saw $744M in net inflows, snapping a five-week outflow streak.

- Ethereum ETFs continued to bleed, with $102.9M in outflows for the fourth straight week.

- Despite ETF losses, BlackRock’s BUIDL fund boosted its ETH holdings to $1.15B, showing strong institutional interest.

After five straight weeks in the red, U.S. spot Bitcoin ETFs finally bounced back, clocking in a net inflow of $744.4 million for the week ending March 21—their biggest in eight weeks, according to data from SoSoValue.

Who’s Driving the Rally?

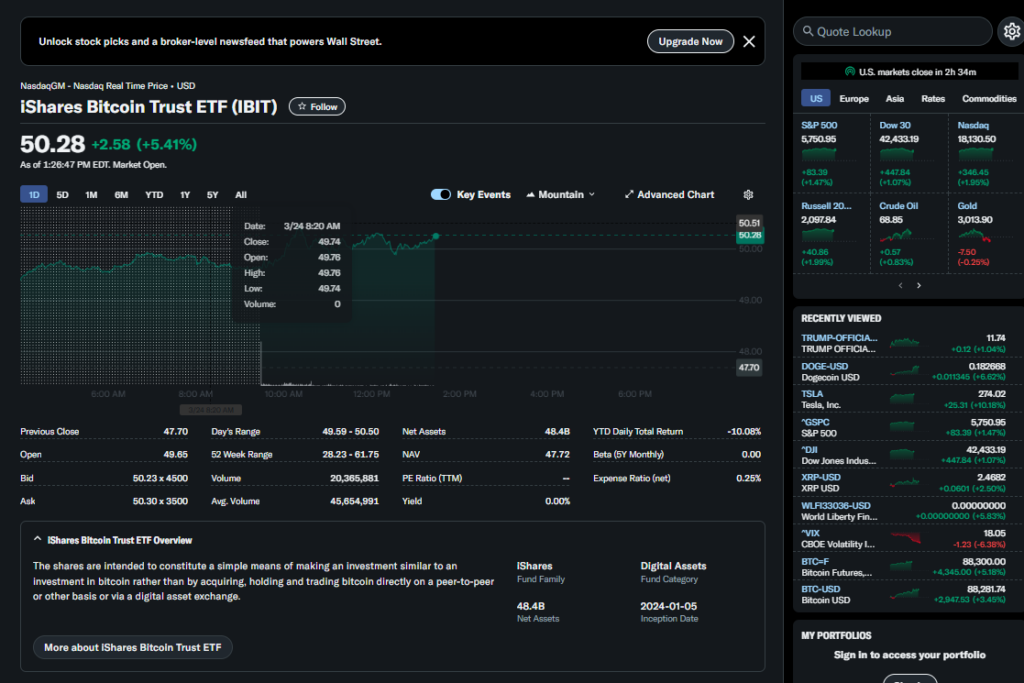

The bulk of the inflows came from the usual heavyweights: BlackRock’s iShares Bitcoin Trust (IBIT) led the charge with $537.5 million, while Fidelity’s FBTC followed behind with $136.5 million.

This comes after a rough patch for both crypto and global markets—thanks to trade war chatter and looming recession fears. But now? The tide might be turning.

Earlier this year, Bitcoin ETFs had their best runs yet—pulling in $1.96 billion the week ending Jan. 17 and $1.76 billion the week after. Those inflows helped push BTC to a record high of $109K on Jan. 20, which also happened to be President Trump’s inauguration day.

BTC Price Rebounds

After dipping into the $78K range during the correction, Bitcoin’s price is back up—hovering around $87,343 at the time of writing. So yeah, sentiment’s warming up again.

ETH Still in the Red

Ethereum? Not quite as lucky. ETH ETFs saw $102.9 million in outflows this week—the fourth week in a row of net losses. BlackRock’s ETHA took the biggest hit, dropping $74 million.

Still, ETH isn’t totally out of the game. It’s trading above $2,090, after briefly dipping below $2K for the first time in over a year.

Bright Spot for Ethereum

Even though ETF flows aren’t looking great, institutions are still quietly loading up. BlackRock’s BUIDL fund, focused on tokenized real-world assets, now holds $1.15 billion worth of ETH, up from $990 million just last week.

That’s a clear sign: big players still see Ethereum as the backbone of real-world asset tokenization.

Market Sentiment: Cautious Optimism

The Crypto Fear & Greed Index rose from 32% to 45% this week, hinting at a shift in investor mood. Still, not everyone’s convinced.

Singapore’s QCP Capital issued a warning: tariff escalations set for April 2 could slam risk assets again. So while the bulls are waking up, they’re still sleeping with one eye open.