- BlackRock’s Bitcoin ETF hits record trading volume as Trump wins the 2024 presidential election.

- The ETF outperformed popular stocks like Berkshire, Netflix, and Visa in trading volume.

- Analysts forecast more bullish trends for Bitcoin, with potential new highs by inauguration.

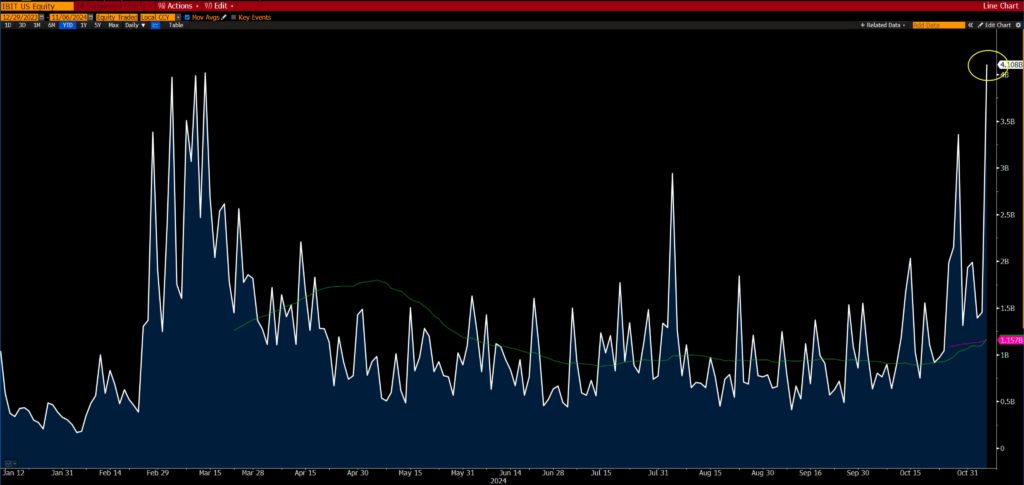

Bitcoin surged to a new all-time high following record trading volumes in BlackRock’s Bitcoin exchange-traded fund (ETF) as the 2024 U.S. presidential election concluded with Donald Trump’s victory. Bloomberg ETF analyst Eric Balchunas noted that the iShares Bitcoin Trust (IBIT) registered its highest-ever single-day volume on November 6, reaching over $4.1 billion in trades.

Record-Breaking ETF Performance

Balchunas shared that IBIT’s volume exceeded that of prominent stocks, including Berkshire Hathaway, Netflix, and Visa. This volume increase coincided with Bitcoin climbing to $76,500, setting a new record shortly after Trump’s win. Balchunas also highlighted that other Bitcoin ETFs had one of their most active days since their early trading surge in January, with trading volumes nearly doubling across the sector.

The momentum in Bitcoin ETFs unfolded alongside a broader rise in the cryptocurrency’s value. By the time of publication, Bitcoin’s price had slightly pulled back to $75,267, based on TradingView’s data. ETF Store president Nate Geraci observed that Bitcoin ETFs have become significant players in the market, comprising six of the top ten ETF launches of 2024.

Source: Eric Balchunas on X

Optimism for Bitcoin and Other Crypto Assets

Analysts view Trump’s crypto-friendly stance as potentially transformative for the cryptocurrency industry. Several financial experts believe that Trump’s pro-crypto policies could spur interest in assets beyond Bitcoin, benefiting the sector at large. Some analysts have pointed to new filings for altcoin ETFs that would include assets like Solana, XRP, and Litecoin, indicating that major asset managers are prepared for expanded crypto ETF offerings.

Balchunas, in a statement on October 25, characterized the rising trend of crypto ETF filings as strategic moves aligned with Trump’s victory. Pro-crypto policies from the incoming administration are expected to drive increased market activity for both Bitcoin and other digital assets.

Looking ahead, several analysts foresee a continued Bitcoin rally under Trump’s administration. Fadi Aboualfa, Copper.co’s head of research, suggested that Bitcoin could reach $100,000 by Trump’s inauguration on January 20, underscoring the market’s enthusiasm for Bitcoin’s future.