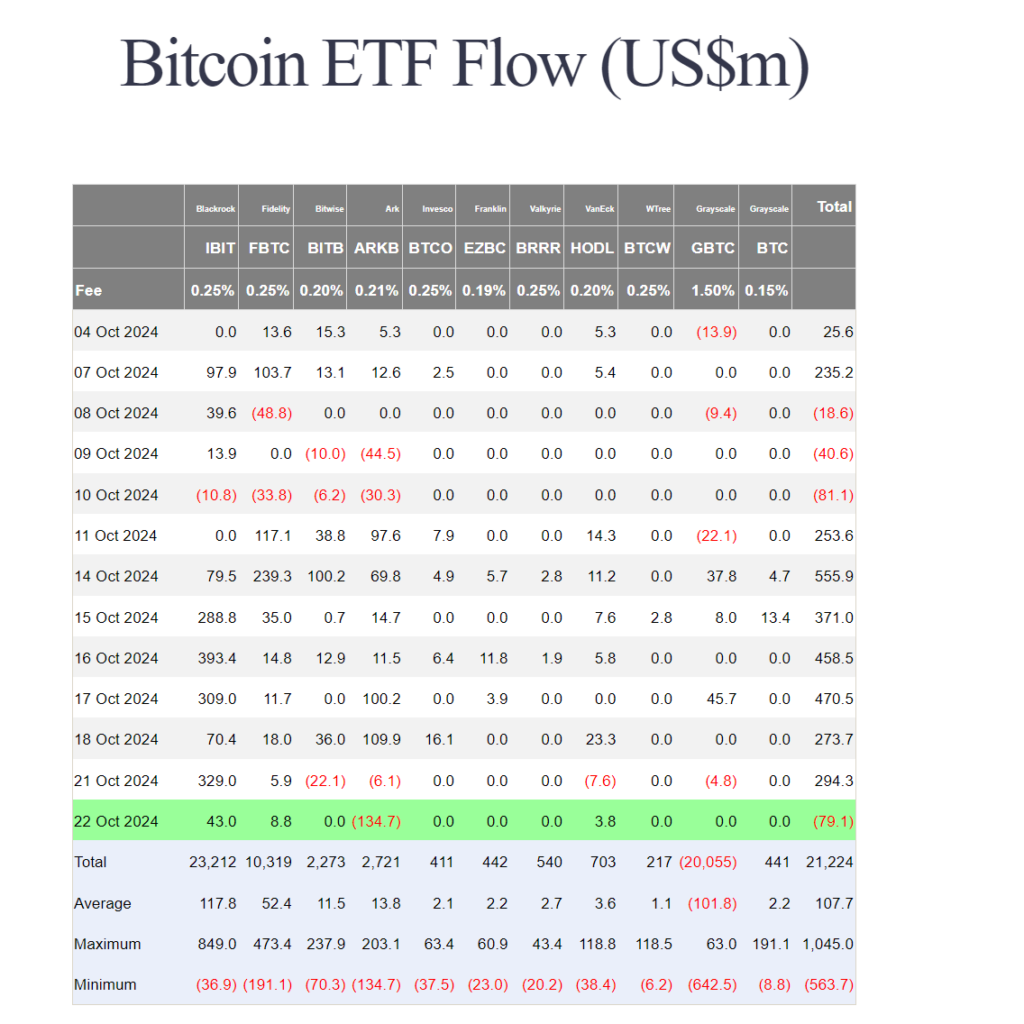

- US spot Bitcoin ETFs saw net outflows of $79.1 million on October 22, the first in two weeks.

- The ARK 21Shares Bitcoin ETF had $134 million in outflows, leading the daily downturn.

- Institutional Bitcoin ETF ownership now accounts for 20%, highlighting growing demand for exposure to BTC.

Institutional demand for Bitcoin has cooled as inflows into U.S. spot Bitcoin exchange-traded funds (ETFs) turned negative on October 22, marking the first day of net outflows in two weeks. According to data from investment firm Farside Investors, Bitcoin ETF inflows were down by $79.1 million, largely driven by outflows from the ARK 21Shares Bitcoin ETF, which saw $134 million withdrawn.

Source: WhalePanda on X

Bitcoin ETF Demand Softens

Despite Bitcoin trading near all-time highs, institutional demand appears to be slowing. On October 22, U.S. spot Bitcoin ETFs recorded net outflows, with the ARK 21Shares Bitcoin ETF leading the downturn. Other Bitcoin ETFs, such as BlackRock’s iShares Bitcoin ETF, managed to attract inflows, though these were considerably smaller compared to the previous day.

This decline in ETF activity follows a period of strong demand, with ETFs becoming increasingly popular among institutional investors. As of October 18, institutional ownership of Bitcoin ETFs reached about 20%, according to on-chain analytics platform CryptoQuant.

ETFs Remain a Major Story for Bitcoin Markets

Although institutional inflows have slowed, the overall impact of Bitcoin ETFs on the market remains significant. In recent months, ETFs have become key drivers of liquidity, allowing more investors to gain exposure to Bitcoin without directly owning the asset. U.S. ETFs crossed the $20 billion inflow milestone in October, with total assets under management now at $65 billion.

On-chain analytics firm Glassnode highlighted the importance of Bitcoin ETFs in recent research, calling them “one of the biggest stories in the market” for the third quarter of 2024.