- Bitcoin crashed below $87,500, triggering over $250M in liquidations within one hour.

- Long BTC and ETH positions were hit hardest as cascading margin calls accelerated the drop.

- Market volatility remains high, increasing the risk of further liquidation-driven selloffs.

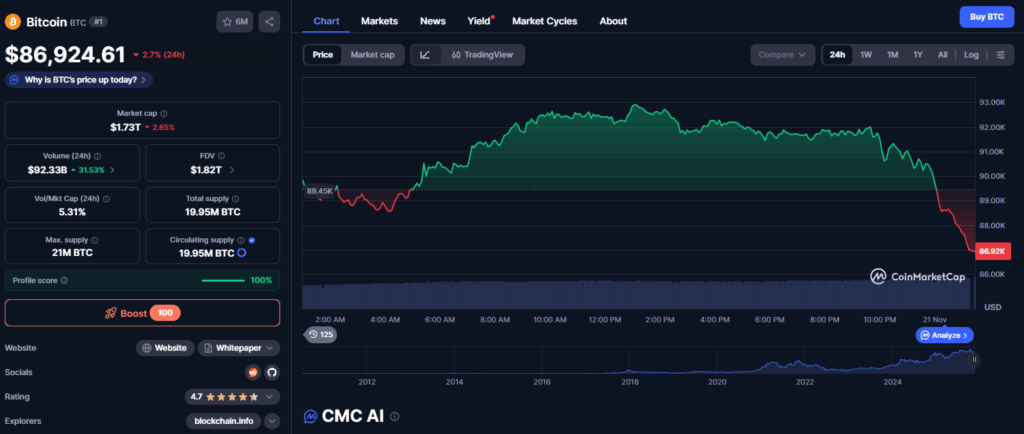

The cryptocurrency market was hit with another sharp liquidation event, wiping out more than $250 million in positions within a single hour as Bitcoin plunged below $87,500. The drop came shortly after BTC had climbed near $92,000, catching leveraged traders completely off guard and accelerating the selloff across major exchanges.

Bitcoin — still the market’s primary driver — saw the largest concentration of long liquidations, sending prices lower in a fast cascade. Ethereum followed the same pattern, contributing to the rapid unwind as volatility surged across both centralized and decentralized trading platforms.

Long Positions Face Heavy Losses

The bulk of the liquidations hit long positions, particularly on Bitcoin and Ethereum, as margin calls were triggered almost instantly during the steep drawdown. Exchanges reported intensified liquidation flows, with leveraged traders forced out of their positions as BTC and ETH fell through key support zones.

This marks the latest in a string of liquidation-driven declines throughout recent weeks. With volatility elevated and liquidity thinning, sudden drops continue to wipe out large chunks of leveraged open interest in minutes.

A Market Still on Edge

The timing and severity of the crash show how fragile the crypto market remains during the broader correction phase. Bitcoin’s quick move under $87,500 highlights the lack of strong buy-side support, while ongoing macro uncertainty and fading risk appetite have amplified every downside move.

Until traders reduce leverage and liquidity stabilizes, similar liquidation waves may continue to hit the market whenever Bitcoin experiences sharp intra-day volatility.