- Bitcoin’s drop below $77K triggered major liquidations, dragging ADA down over 13% to around $0.55, with high trading volume showing active investor interest.

- If BTC falls to $70K, ADA could drop to $0.42–$0.46, while stabilization may keep it in the $0.50–$0.55 range.

- In a bullish scenario, ADA could rally to $0.60–$0.68, fueled by events like the 2025 Bitcoin Conference and ETF buzz.

Not the best start to the week.

Bitcoin slipped under $77,000, shedding over 8% — and along with it, more than $1.3 billion in crypto positions got liquidated. It’s been one of the most chaotic stretches we’ve seen since back in 2020. Meanwhile, Ethereum’s not holding up either, now trading below $1,500 — its lowest in almost two years.

And yep, Cardano (ADA) took a hit too. At the time of writing, it’s trading around $0.5548, which — let’s be honest — is miles away from its all-time high of $3.10 in 2021. It’s down 13% just today, although interestingly, trading volume has spiked 390%, suggesting that plenty of eyes are still locked in on it.

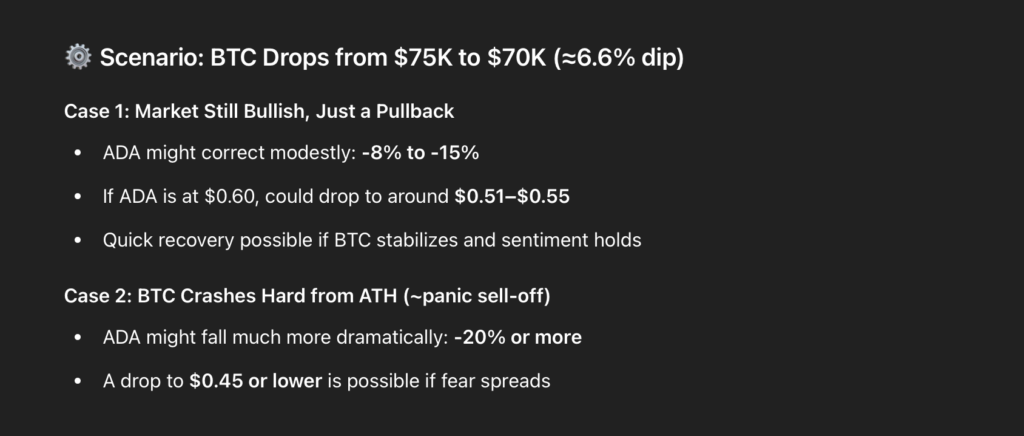

With Bitcoin flirting with further downside — maybe even dipping to $70K — we asked ChatGPT to lay out what that might mean for ADA. It gave us three possible paths: pessimistic, realistic, and optimistic.

Pessimistic: ADA Slides to $0.42–$0.46

If Bitcoin continues to slide and breaks down past $70K, it could set off a bigger sell-off for ADA. Especially if it loses that $0.50 support — that’s when things could get messy fast.

In this case, we’re looking at a potential 24% decline, taking ADA down to the $0.42–$0.46 range. Retail investors tend to panic when support levels crack, and right now, the overall mood is fragile. Add in the pressure from trade war fears and U.S. tariffs, and the whole market’s leaning cautious.

If Bitcoin stays weak, altcoins like ADA may not hold up much longer.

Realistic: ADA Holds the Line at $0.50–$0.55

If Bitcoin doesn’t completely collapse — say, it bounces at $70K or just slows its fall — ADA could hover close to where it is now.

There’s still some strength in the fundamentals. Grayscale holds over 22% ADA in its smart contract fund, and on LunarCrush, it’s the #4 most-mentioned asset among U.S. traders. That kind of visibility could help it hold up, at least short term.

Technically speaking, ADA is trading within a descending wedge on the 30-day chart — and that pattern often signals a reversal, if momentum flips back.

Optimistic: ADA Bounces to $0.60–$0.68

Now, best-case scenario? Bitcoin’s drop is just a quick dip before it rips back up. In that case, ADA could ride the bounce and rally toward $0.60, maybe even tap $0.68 if things get spicy.

There’s a few reasons to keep that door open:

- Cardano’s live demo is set to debut at the 2025 Bitcoin Conference

- A Cardano ETF proposal is floating around

- Big names like Alex Becker and Ash Crypto are talking it up as one of their top bets for this cycle

If market momentum returns and buyers start stacking ADA again, resistance at $0.65–$0.68 could be within reach.

Bottom line: A lot hinges on where Bitcoin heads next. If it tanks, ADA probably tanks too. If it holds steady, ADA might consolidate. If BTC rips higher, ADA could snap back harder than most expect.

Just… maybe don’t go all in on one scenario.