- Bitwise strategist Jeff Park predicts Bitcoin could hit $92,000 if Trump wins the presidency.

- Trump’s pro-crypto campaign promises have fueled bullish sentiment among crypto analysts and investors.

- Some experts caution that long-term effects of Trump’s policies could hurt Bitcoin despite initial gains.

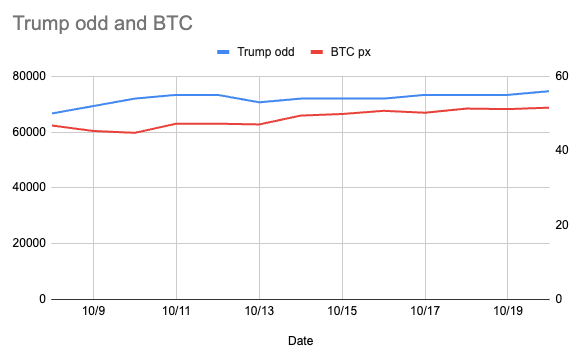

A prominent crypto analyst has predicted that Bitcoin could skyrocket to $92,000 if Donald Trump secures a win in the upcoming U.S. presidential election. Jeff Park, head of alpha strategies at Bitwise, made the projection on October 22, linking Bitcoin’s price movement to Trump’s chances of victory, as reflected on decentralized betting platform Polymarket. By using probability analysis, Park foresees a major surge in Bitcoin’s price following a potential Trump win.

Source: Jeff Park on X

Bitcoin’s Price Tied to Trump’s Crypto Stance

Park’s bullish prediction is not an isolated case. Bitcoin millionaire Erik Finman has similarly suggested that Trump’s policies could push Bitcoin as high as $100,000. Trump’s 2024 campaign has heavily leaned into pro-crypto rhetoric, with promises to fire SEC Chair Gary Gensler and transform the U.S. into a global hub for cryptocurrency. These pledges have boosted optimism within the crypto community, where many see a Trump victory as a catalyst for significant market growth.

However, not everyone shares this enthusiasm. Billionaire investor Mark Cuban has warned that while Bitcoin may see an initial spike following a Trump win, the long-term consequences could be less favorable. Cuban believes that some of Trump’s proposed economic policies, including import tariffs, could lead to inflation, ultimately weakening Bitcoin’s price in the future.

Mixed Reactions to Potential Crypto Growth

While Trump currently trails Vice President Kamala Harris by a small margin in national polls, his lead in betting markets is much larger, with an 18.8% advantage on Polymarket. Despite the divergent views on Trump’s potential impact on Bitcoin, it’s clear that his candidacy has sparked considerable interest within the cryptocurrency space, where political developments are increasingly influencing market dynamics.