- Bitcoin has $16B in short liquidations up to $107K, suggesting market makers could push prices higher.

- Analysts warn BTC might still drop to the $80K range, with support levels around $80,850 and $81,000.

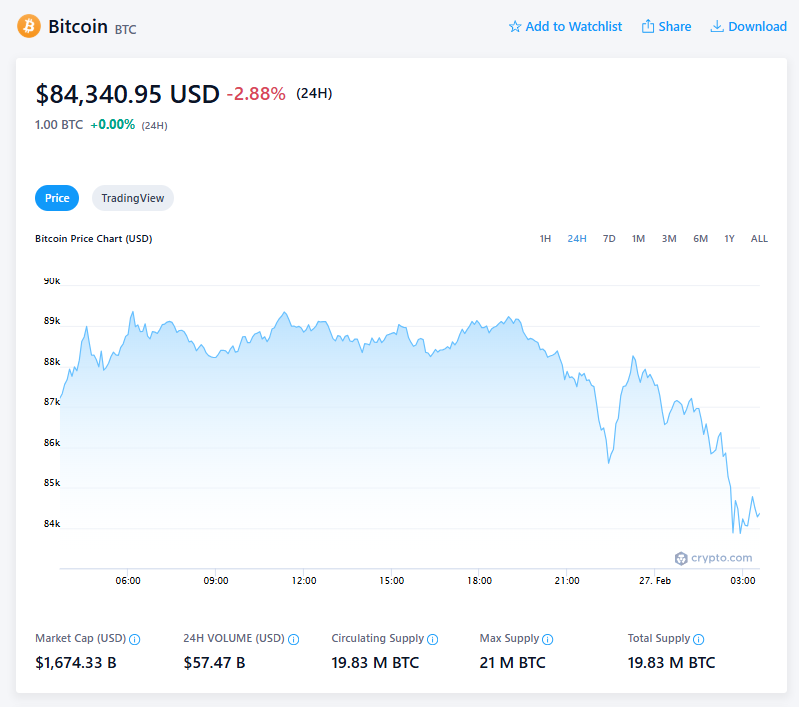

- Bitcoin is trading at $88,700, down 3% in 24 hours, as traders remain split on whether a rebound or further decline is next.

Bitcoin has been on a rollercoaster, dropping as low as $86,000 in recent days, leaving traders wondering: Is the bull run over, or is this just a dip before the next big move?

Crypto analyst Kevin Capital says the liquidation data suggests a rebound is coming—with a massive $16 billion in potential short liquidations up to $107,000, compared to just $1.5 billion in long liquidations down to $77,000.

That’s a huge imbalance—and market makers tend to chase liquidity.

Bitcoin’s Liquidation Map Suggests Upside

Kevin Capital shared his analysis on X, highlighting that:

- Market makers prefer to move prices where they can trigger the most trades—which, in this case, leans bullish.

- With $16B in short liquidations sitting above BTC’s current price, there’s a strong incentive for a push upward.

- He advises patience, as the next few days will be key for Bitcoin’s direction.

Despite the recent pullback, long-term BTC holders remain confident—with Ali Martinez reporting that 20,400 BTC were accumulated during the latest sell-off.

But Could Bitcoin Still Drop to $80K First?

Not everyone is convinced we’ve hit the bottom. Ali Martinez and Titan of Crypto both warn that BTC could still dip into the low $80K range before any significant recovery.

- Martinez sees similarities to Bitcoin’s 2021 cycle, suggesting a consolidation phase before a leg down.

- His chart shows BTC could fall as low as $80,850 if the pattern holds.

- Titan of Crypto points to trendline weakness, noting that if BTC fails to reclaim support, $81K (Kijun level) could be next.

At the time of writing, Bitcoin is trading at $88,700, down 3% in the last 24 hours—leaving traders torn between bullish liquidity setups and bearish technical risks.

For now? The battle between bulls and bears rages on.