- Bitcoin price towered above $23,000 on Saturday, rising to $23,342 on Binance as BTC hit levels last seen in mid-August 2022.

- The price momentum pushed investors to wonder if a new bull market was here or if it was a typical bull trap before a price decline.

- At the time of writing, Bitcoin was trading at $22,945, up 1% in the last 24 hours.

The year 2023 started with a stark rally across the crypto market, with Bitcoin rallying 27% in the last quarter of the month, making it the most significant monthly gain for the king of crypto since October 2021. The remarkable price momentum has pushed investors to ask whether this is the beginning of a new bull market or a typical bull trap before the prices head lower.

Bitcoin (BTC) price soared to highs above $23,000 on Saturday, January 21, rising to $23,342 on Binance as the cost of the flagship crypto hit levels lasts seen in mid-August 2022. At the time of writing, BTC was trading at 22,945, about 1% up in the past 24 hours after shedding some of the weekend gains. However, the price of the largest cryptocurrency by market cap was still 8% up in the last seven days, 32.8% up in the previous two weeks, and 36% up in the last 30 days.

BTC Rally Comes Amid A Bullish Outlook: Santiment

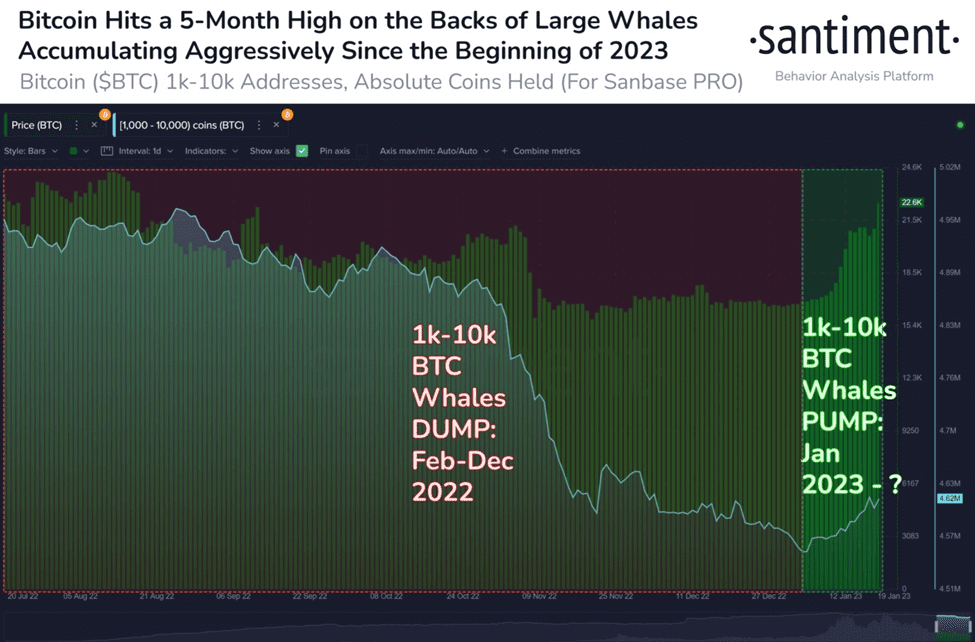

On-chain data platform Santiment highlighted that Bitcoin’s tower above $23k has come amid a bullish outlook from large BTC investors. According to the platform, whale addresses with 1,000 to 10,000 BTC have accumulated more than 64,638 Bitcoin tokens in the past two weeks, worth more than $1.46 billion.

Looking into the profitability of BTC holders, data shows that 50% are losing money. This comes as the percentage of addresses earning or losing money has historically pointed to peaks and bottoms. At the same time, long-term Bitcoin holders historically take advantage of bear markets to buy Bitcoin. With on-chain metrics suggesting that the base may be behind us, the macro landscape still creates uncertainty for the path ahead.

A recent newsletter from IntoTheBlock, an on-chain data analytics firm, shows that macro correlations are back, such that after diverging in paths throughout the FTX collapse, crypto and stocks are now moving in tandem, with the newsletter attributing this relationship to the effect of the Fed’s actions on liquidity. With inflation easing, markets have widely pumped in anticipation of a potential Fed pivot. While there remains no confirmation from the Fed looking to loosen financial regulations, investors may be tailgating the decision. This is because they now understand how “printing money” causes appreciation in financial assets.

The report also points out that the “Fed’s balance sheet, Repo markets, and Treasury balances have a direct impact on the capital allocated to risk assets and their performance.”

“Bitcoin has surpassed $22.7k for the first time since August 18, 2022. The price rise has come as the large whale tier group of addresses holding 1,000 to 10,000 $BTC has collectively accumulated 64,638 ($1.46 billion) $BTC in the past 15 days.”

Bitcoin Price Analysis As BTC Targets New Range Highs

Bitcoin (BTC) started the year with the right foot forward, recording new gains by the day for the first 14 days before a select group of investors decided to book profits, particularly the ones who bought before the 2022 dip hit, giving room for bears to enter the market. The sell-off was short-lived as more bulls came into the market on January 19, leading to an increase in BTC price to the current levels.

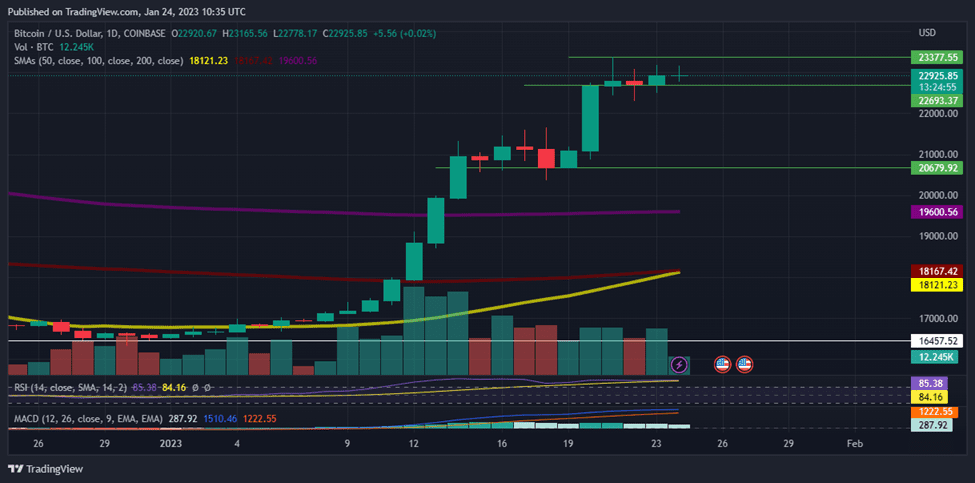

At the time of writing, Bitcoin was trading at $22,945 after bulls flipped the resistance at $22,693 into support over the weekend and were using it to fight the immediate resistance at $23,377. An increase in buying pressure could open the path for the BTC price to tag the resistance level and, in highly ambitious cases, record a new range high.

BTC/USD Daily Chart

The Moving Average Convergence Divergence (MACD) was moving upwards in the positive region, indicating that bulls controlled the market. Besides, the histograms were green, signifying bulls held the reins and had the momentum to push Bitcoin prices higher. The upward movement of the relative strength index (RSI) at 85 showed that there was still room for the upside.

The people’s crypto has strong downward support that validates the bullish thesis. If selling pressure increases, the support at $20,679 is the first place BTC bulls could stop for a breather as they prepare for a comeback.

Further down, the 200-day Simple Moving Average (SMA) at $19,600 and the 100-day and 50-day SMAs around the $18,100 zone also provide critical support. In extreme cases of selling pressure where BTC loses these levels, Bitcoin price could retest the $16,457 swing low.