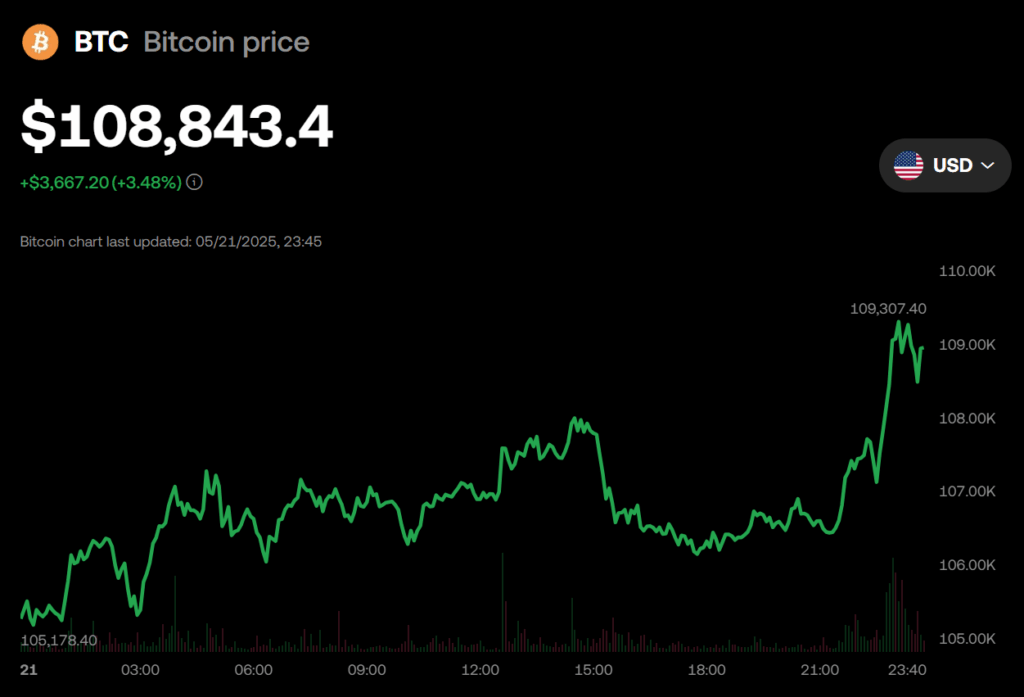

- Bitcoin hit a new all-time high of $109,458 on May 21, pushing toward a historic monthly close above $102,400.

- Technical indicators show mixed signals, with bullish short-term momentum but lingering bearish divergences on the weekly chart.

- Analysts are split between a continued parabolic rally and a potential top, making the next few weeks crucial for BTC’s 2025 outlook.

Bitcoin’s bull charge hit a fresh milestone on May 21, pushing to an all-time high of $109,458. This comes after a historic weekly close above $106K and positions BTC for its strongest May close ever—if it can hold above $102,400. Analysts say if this keeps up, we might be entering “price discovery” mode, with traders targeting the $130K range as the next possible resistance. At this rate, the parabolic vibes are back in play.

Warning Signs Brewing Beneath the Surface?

Despite the rally, some technical indicators are starting to flash caution. The weekly RSI has been showing bearish divergence since March, and MACD isn’t exactly bullish either. While those signals don’t guarantee a reversal, they suggest that momentum could be weakening even as prices push higher. So far, Bitcoin has barely dipped—could be a sign of strength or a setup for a surprise pullback.

Short-Term Charts Look More Bullish Than Bearish

On shorter timeframes, Bitcoin’s breakout from a rising channel looks strong. The move came right after bullish divergences showed up in both RSI and MACD, which typically precedes more upside. This supports the idea that BTC’s recent consolidation phase is behind it, and new highs might still be on deck—at least in the short run. Traders are watching closely to see if this strength holds.

The Bigger Picture: Which Elliott Wave Are We In?

Zooming out, there are two competing wave counts in play. Bulls believe we’re in wave three, the strongest leg of a five-wave rally. Bears, however, think this might be wave five—the final push before a major correction. The bear case struggles with symmetry issues in earlier corrections, but it’s still technically valid. The next few weeks could tip the scales one way or the other.

Outlook for the Rest of 2025

Whether BTC is gearing up for a massive breakout or an end-of-cycle top, one thing’s clear—these next few weeks are critical. Price action is teetering at historic levels, and whichever way it breaks could set the tone for the second half of 2025. For now, momentum is king. But if history’s taught us anything, it’s to expect the unexpected when Bitcoin is this hot.