- Bitcoin slid to $92,123, erasing all 2025 gains and falling 13% in a week.

- More than $335M in BTC liquidations hit the market, with total crypto liquidations topping $725M.

- BTC is nearing the key $92K support zone, with prediction markets heavily favoring a move toward $85K.

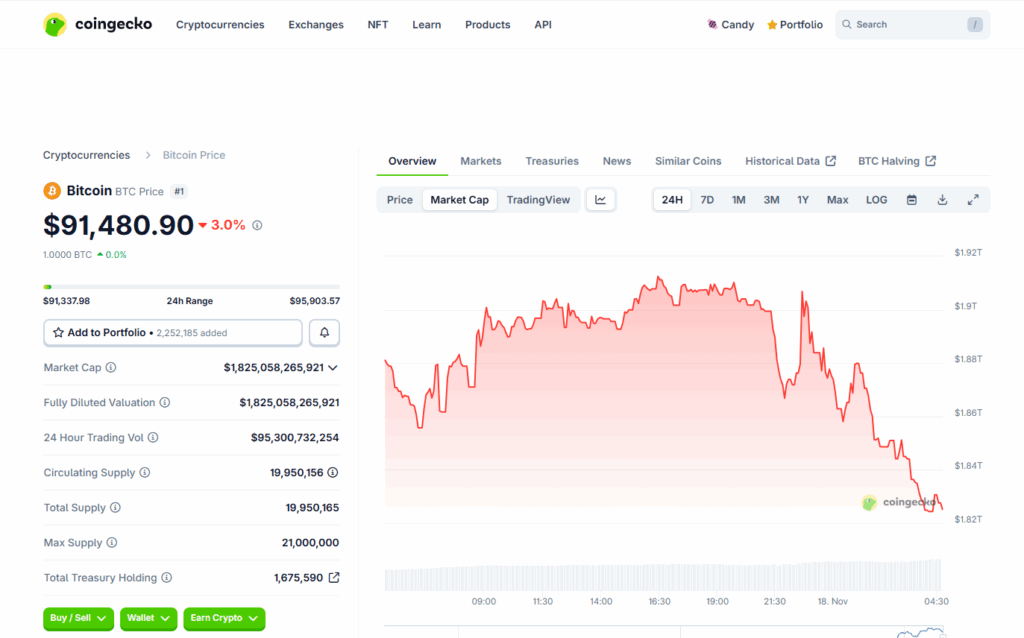

Bitcoin has officially erased all of its 2025 gains, dipping below $93,000 on Monday for the first time in nearly seven months. The benchmark cryptocurrency fell to $92,123 after sliding 2.3% over the past day and more than 13% during the last week, according to CoinGecko. The sell-off has been fierce, with trading volume doubling to $114 billion in just 24 hours and triggering a wave of liquidations across the entire crypto market.

Massive Liquidations and a Break Below Key Technical Levels

Roughly $335 million in Bitcoin derivatives were liquidated in the last day, contributing to $725 million in total market liquidations. According to QCP Capital analysts, the break below the 50-week moving average — along with a weekly close under $100,000 for the first time since May — has cemented a far more cautious tone across digital assets. In a market where narratives can shape price action, the revival of “end of the four-year cycle” discussions has amplified bearish sentiment.

Historically, Bitcoin undergoes a major correction about 12 to 18 months after each halving. With the April 2024 halving now behind us, BTC has entered that window — and the price action is lining up with past cycles. Many analysts previously suggested the four-year cycle was finished, but the recent downturn is shifting the tone: maybe it wasn’t over at all, just delayed.

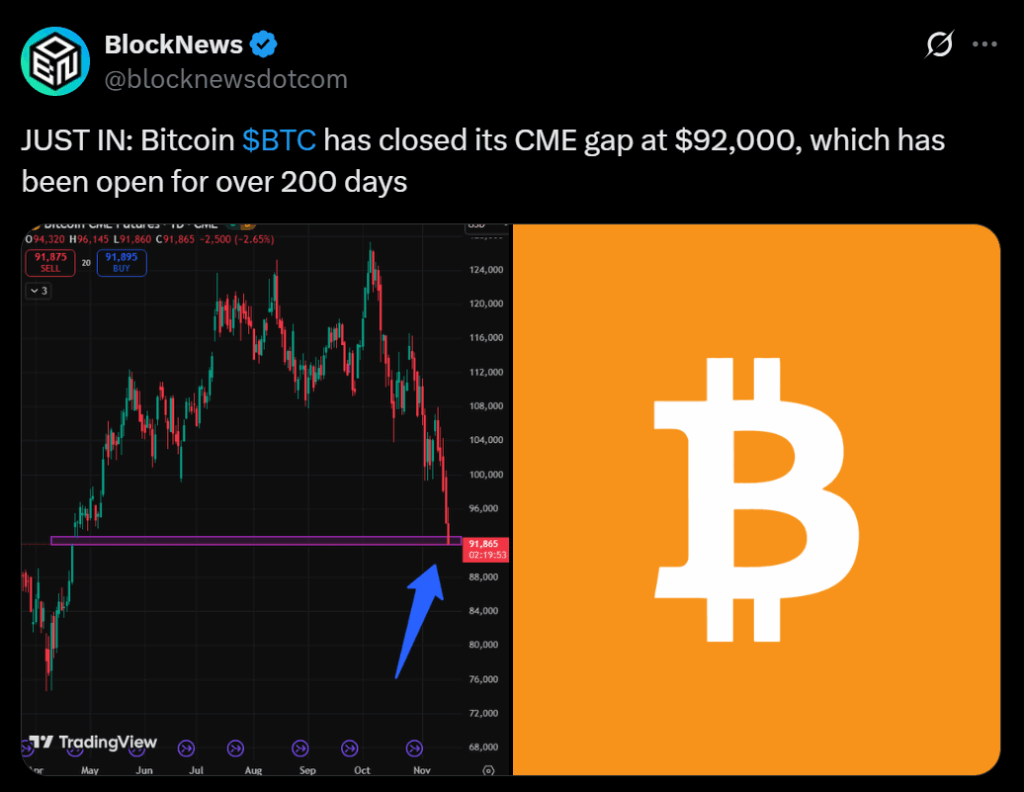

BTC Hovers Near Critical $92K Support

QCP flagged the $92,000 region as a key support level. This zone acted as a lower boundary during late 2023 and early 2024, and Bitcoin is now dangerously close to testing it again. The level also lines up with an unfilled CME gap, which could prompt a short-term bounce if tapped. But even if a rebound forms, QCP warns that overhead resistance remains dense — meaning any recovery could be capped.

Rising macro uncertainty isn’t helping either. The U.S. government shutdown finally ended after a record 43 days, but the broader economic picture still feels cloudy. Liquidity has been slow to return to crypto, and risk appetite remains weak.

Prediction Markets Turn Bearish: Traders Expect $85K Before $115K

On Myriad — the prediction platform owned by Decrypt’s parent company, Dastan — traders are pricing in a steep downside. Users now believe there is a 63% chance BTC will reach $85,000 before it can climb back to $115,000, a dramatic shift that jumped 30% in just one day.