- BTC broke above $118K, but volume’s still way below historic rally levels.

- NUPL for long-term holders shows growing profits—but not yet euphoria.

- Rally could continue… if more liquidity shows up. If not? Might fizzle.

So, Bitcoin just smashed through a new all-time high, cruising past $118,000. You’d think the whole market would be on fire, right? Well, not exactly. According to Glassnode, even with that big breakout, actual trading volume is still kinda underwhelming. Like, surprisingly low.

BTC Volume Still Looks Sleepy

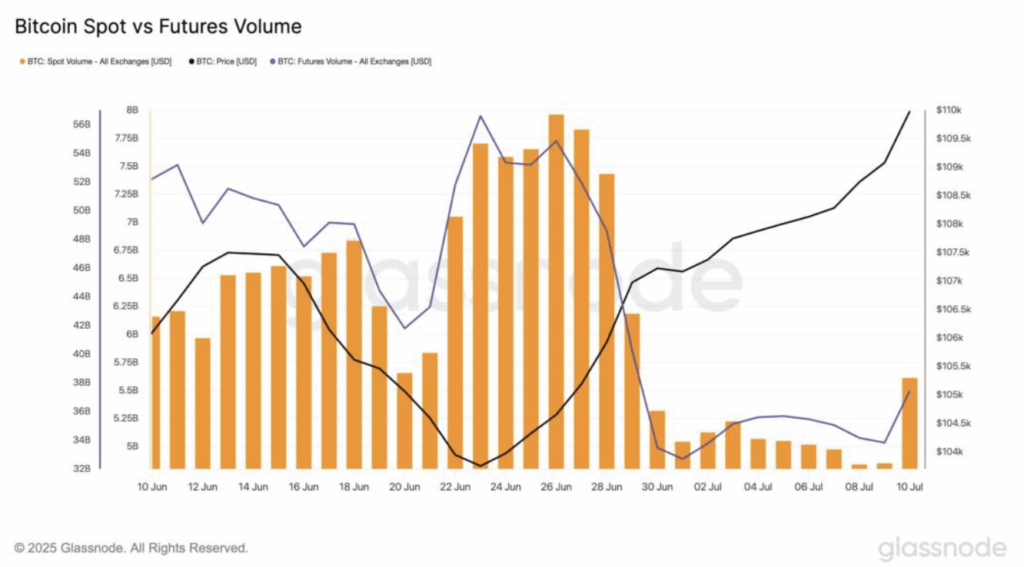

A few weeks back, Glassnode flagged that BTC-related volume had dropped to yearly lows—classic pre-summer slowdown vibes. Fast forward to today, even after Bitcoin’s surge, the latest data still shows weak engagement overall.

Spot and futures volumes (basically all the action from people buying and selling) did get a bump after BTC’s price took off—but the numbers are nowhere near the kind of explosive levels we usually see during these runs.

Yeah, there’s movement. But it’s still pretty…thin.

“BTC hit an ATH despite thin liquidity – worth paying attention to,” Glassnode noted on X. Translation? This rally might be skating on ice that’s a bit thinner than it looks. If volume doesn’t pick up soon, the whole thing might lose steam before it really gets going.

Long-Term Holders Still Not Euphoric

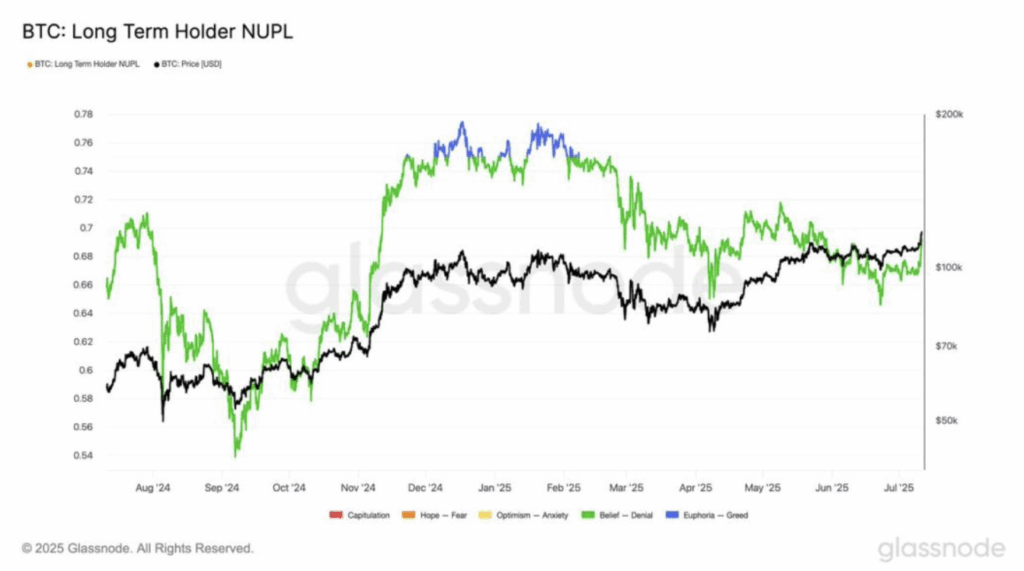

Now here’s the weird part: even the long-term holders—those diamond-handed types who’ve been holding for over 155 days—aren’t acting overly euphoric. That’s coming from the Net Unrealized Profit/Loss (NUPL) chart. It shows how much unrealized gain or pain these holders are sitting on.

At the moment, LTH NUPL is at 0.69. That’s solid, but not crazy. For reference, anything over 0.75 is typically where the market starts getting into FOMO-fueled euphoria territory.

Last cycle? We were in that euphoric zone for 228 days. This cycle? Just about 30 so far. So yeah, it’s still looking… cautious. Maybe even mature. Or maybe we’re just early.

Is This a Calm Before the Next Storm?

At the time of writing, BTC is chilling around $118,000, up a nice 9% over the last seven days. Price is flying, sure—but without the wild volume or euphoria you’d expect.

So now comes the big question: is this the start of a slow and steady melt-up? Or just a quiet peak before things cool off again?

Keep an eye on volume. If more traders pile in, this could still go parabolic. But if interest stays lukewarm, the price might be writing checks the market’s not ready to cash.