- Bitcoin is consolidating around $110K, with a breakout above $116K needed to regain bullish momentum, while downside risk remains near $93K–$95K.

- Whale activity shows a shift toward Ethereum, ETF inflows have cooled, and futures demand is subdued, signaling weaker institutional appetite.

- September’s historical weakness could give way to a Q4 rebound if a Fed rate cut injects liquidity and triggers renewed demand.

Bitcoin is holding steady near the $110,000 mark after a turbulent stretch between $104K and $116K, leaving traders cautious as September unfolds. Historically, this month has carried a reputation for weakness, especially in post-halving years, often setting up a local bottom before a stronger Q4 rally. Analyst Benjamin Cowen highlighted that these seasonal patterns could again play out, with markets eyeing the September 17 FOMC meeting for a possible 25 bps rate cut that may provide much-needed liquidity.

Whale Influence and Shifting Sentiment

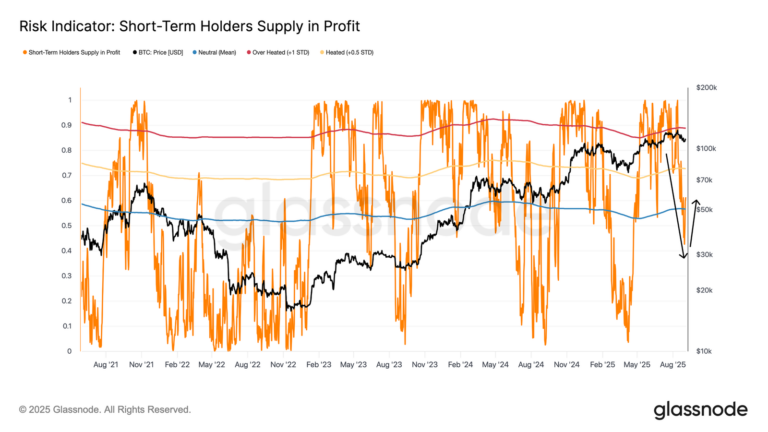

Over the past week, older Bitcoin whales have begun unloading portions of their holdings, redirecting capital into Ethereum, signaling a change in sentiment. Glassnode’s data shows BTC consolidating in its range as short-term holders face profit pressures, with over 75% of their supply needing a recovery above $114K–$116K to regain momentum. Without that move, the risk of a pullback toward the $93K–$95K support zone grows stronger, underscoring the fragile balance in play.

ETF Flows, Futures, and Liquidity Dynamics

Institutional appetite has cooled, with spot Bitcoin ETF inflows slipping into negative territory and futures demand showing lackluster participation. Instead, regional liquidity—particularly from Asia and the U.S.—has taken center stage in driving short-term price action. CryptoQuant data points out a recurring rhythm where Asia initiates momentum shifts, while the U.S. decides whether those trends stick. This dynamic suggests that ETF demand is no longer the sole fuel behind BTC’s movements.

September’s Historic Pattern Meets Macro Wildcards

September’s reputation for sell pressure looms large, but this year the macro backdrop could alter the script. A potential Fed rate cut, combined with the broader post-halving cycle, might set the stage for a late-year surge. If Bitcoin clears the $116K ceiling decisively, momentum could snap back quickly, pulling sidelined investors into the rally. If not, whales shifting into Ethereum and weakening ETF demand may spell more turbulence before stability returns.