• It’s been a rough Thursday for the crypto market, with prices plummeting across the board

• Bitcoin, the poster child of cryptocurrencies, has dropped to $97,020 after hitting a record high above $108,000 just two days ago

• The crypto market downturn has affected other major cryptocurrencies as well

It’s been a rough Thursday for the crypto market, with prices plummeting across the board. Bitcoin, the poster child of cryptocurrencies, has dropped to $97,020—just two days after hitting a record high above $108,000. That’s a steep 7% loss for the day, and unfortunately, it doesn’t stop there.

While Bitcoin’s dip is grabbing headlines, it’s not the worst performer in the market today. Other major players are feeling the heat too, and it’s not pretty.

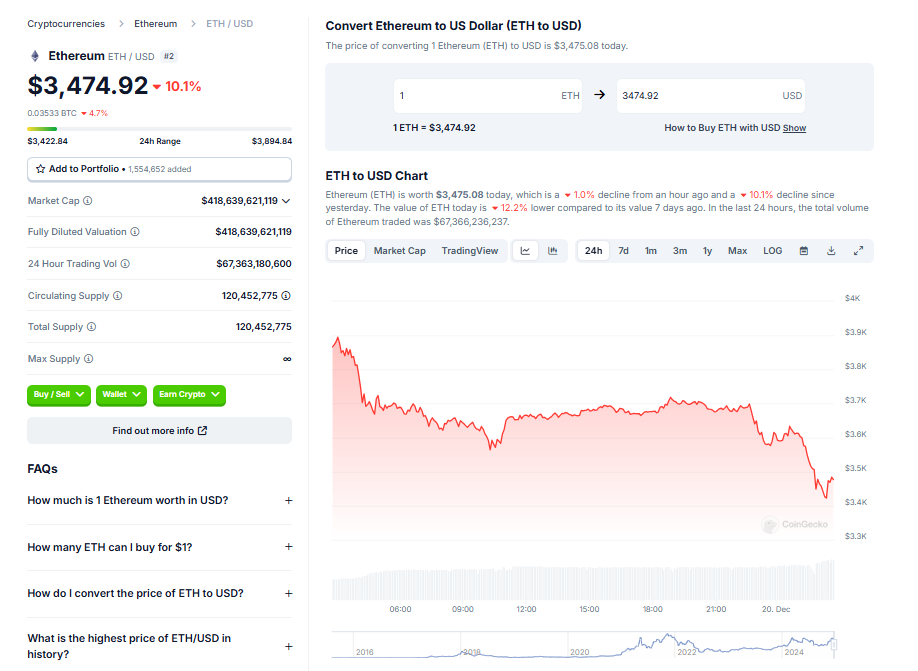

Ethereum and XRP Follow the Downward Spiral

Ethereum, the second-largest cryptocurrency by market cap, has taken an even harder hit. It’s currently trading at $3,422 after falling nearly 12% on the day. That’s a sharp drop for a coin that’s been riding high on optimism in recent weeks.

Meanwhile, XRP, Ripple’s star asset, isn’t faring much better. It’s down 11% and is now trading at $2.22. For XRP fans, it’s another tough pill to swallow after what looked like a promising rebound earlier in the week.

Meme Coins and Solana Aren’t Spared

And then there’s Dogecoin—the meme coin king that’s been a rollercoaster ride for months. Today, it’s plunged a whopping 20%, sitting at about $0.31. It’s a sobering reminder of just how volatile the meme coin market can be.

Solana, which has been a favorite among crypto traders, has also lost significant ground. The coin has slipped below the $200 mark, falling 12% to $191. For a blockchain often hailed as Ethereum’s biggest rival, this drop is bound to rattle some cages.

A $1.17 Billion Liquidation Frenzy

The broader market is painting a grim picture, with an overall 9% drop, according to CoinGecko. In the last 24 hours alone, a staggering $1.17 billion worth of long and short positions have been liquidated, as per CoinGlass data. Unsurprisingly, Bitcoin leads the liquidation wave, accounting for $241 million in losses.

For now, it’s a sea of red on the crypto charts. Whether this is just a temporary correction or the start of something bigger, only time will tell.