- Bitcoin ETFs recorded $400.7 million in net outflows as BTC dropped 2% to $88,200.

- Ethereum ETFs posted a $3.2 million outflow, ending a week-long streak of inflows.

- BlackRock’s Bitcoin and Ethereum ETFs saw positive inflows despite broader fund outflows.

For the first time since the U.S. presidential election on November 5, Bitcoin and Ethereum exchange-traded funds (ETFs) posted net outflows on November 14, signaling a pause in the recent surge of investor interest.

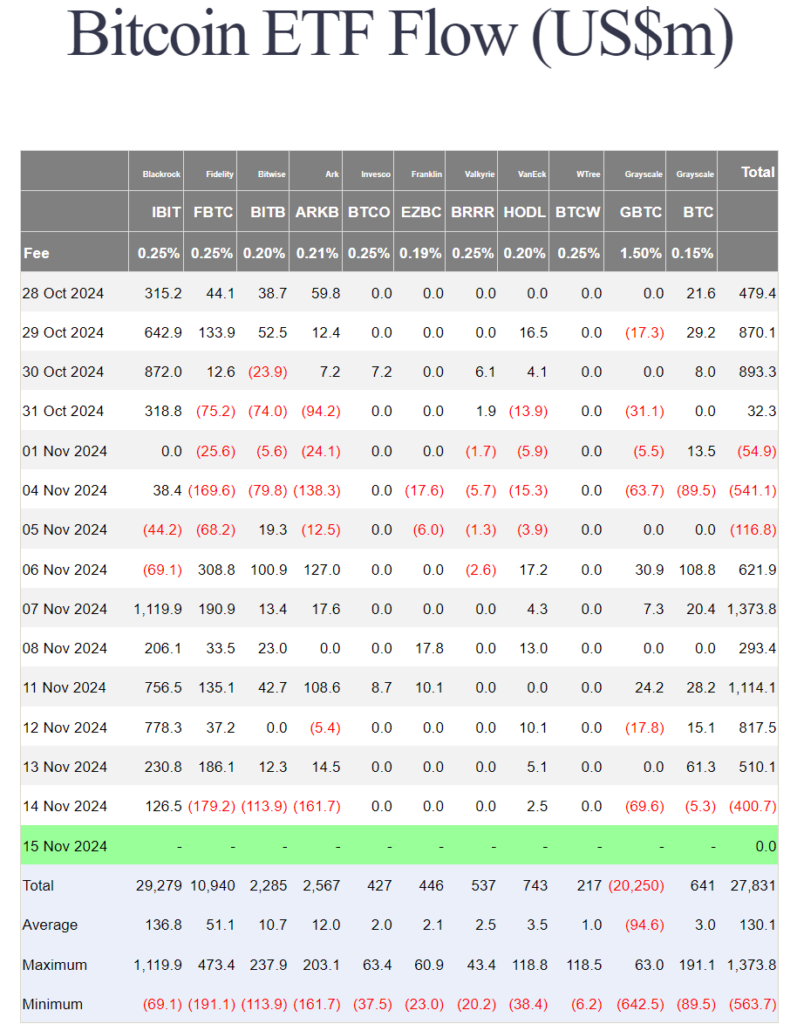

Data from Farside Investors revealed that Bitcoin ETFs experienced a combined outflow of $400.7 million as Bitcoin slipped by 2% to $88,200. Fidelity’s Bitcoin ETF led the outflows with $179.2 million, followed by ARK and 21Shares’ joint ETF at $161.7 million.

BlackRock’s iShares Bitcoin Trust ETF defied the trend, attracting $126.5 million in net inflows, while the VanEck Bitcoin ETF saw a modest $2.5 million gain.

Source: Farside

Ethereum ETFs Follow Bitcoin’s Trend

Ethereum ETFs also saw outflows for the first time since Trump’s election victory. A net $3.2 million exited ETH-focused funds, capping nearly $800 million in inflows since November 4.

Grayscale’s Ethereum ETF accounted for $21.9 million of the outflows, while BlackRock’s iShares Ethereum Trust ETF continued to attract investors, logging $18.9 million in new inflows.

A Rally Paused, Not Ended

Bitcoin’s rally began post-election, climbing from $68,000 to nearly $93,500 by November 13. The surge was driven by optimism surrounding President-elect Donald Trump’s pro-crypto stance and promises to stimulate the U.S. economy.

Though ETFs have seen their first outflows in over a week, BlackRock’s funds remained in positive territory, reflecting continued investor confidence in the long-term potential of digital assets.