- Bitcoin’s bull market may push BTC to $100,000 in the next 90 days.

- Economist Timothy Peterson dismisses “diminishing returns” theory in Bitcoin’s current price surge.

- Analysts see $60,000 as key support, with expectations of long-term gains into 2025.

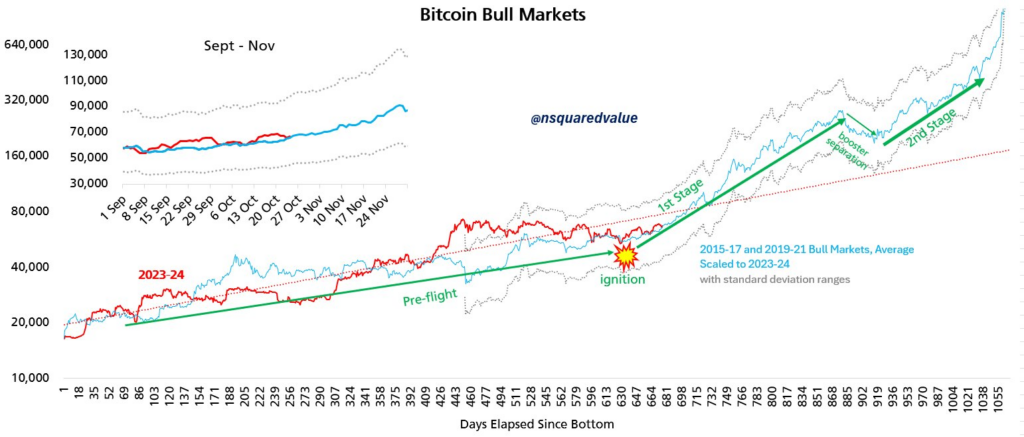

Bitcoin’s price could surge to $100,000 within the next three months, marking the first six-figure valuation for the cryptocurrency, according to network economist Timothy Peterson. In his latest market analysis on October 24, Peterson argued that Bitcoin’s current bull run is showing signs similar to past cycles, suggesting a robust upward trend.

Source: Timothy Peterson on X

Strong Momentum Drives BTC Toward Six Figures

Peterson’s analysis pointed to an “ignition” phase that has set off this new Bitcoin bull run. He noted that Bitcoin’s price performance since its 2022 macro low mirrors past cycles, challenging the “diminishing marginal returns” theory that some analysts believe applies to Bitcoin’s growth. He predicted that BTC could break through the $100,000 mark within the next 90 days, deeming such a move “completely within reason” based on current market conditions.

Peterson’s bullish forecast is not tied to the outcome of the upcoming U.S. presidential election, as he stated that political factors are unlikely to significantly affect Bitcoin’s trajectory in the short term.

Key Support Levels and Analyst Perspectives

While Bitcoin’s momentum builds, some traders remain cautious. Notably, analyst Credible Crypto foresees potential short-term corrections, predicting a possible dip toward the $60,000 range. However, Peterson suggested that such a decline is “becoming less and less likely” as Bitcoin maintains a strong alignment with its multi-cycle price trends. He emphasized that Bitcoin has closely followed a two-cycle average in recent weeks, reflecting price patterns anticipated several years ago.

Bitcoin’s growing momentum continues to spark projections for record highs, with many analysts predicting six-figure valuations in 2025 as the cryptocurrency maintains long-term upward pressure.