- Binanace.US strikes a temporal deal to allow its users to process US dollar withdrawals within the next five days

- The exchange also encourages its users to convert their USD fiat balances to stablecoin to enhance crypto-to-crypto trading on the platform.

- Binance.US aims to provide a seamless trading process by encouraging users to utilize alternative options in withdrawing funds.

Binance.US, a well-known cryptocurrency, has finally resolved the issues surrounding the withdrawal of US dollars that was suspended weeks ago. This juicy news was communicated in a press release showing how the Exchange collaborated to rectify the issues surrounding their dealings with banking partners. However, the communication comes with the condition that it will be a temporary resolution.

The latest communication from Binance.US assured its customers that the system is operational and that the time required to process US dollar withdrawals will be expected to normalize in five business days or less.

The statement announced;

“……as our systems remain fully operational. Going forward, we expect most USD withdrawal requests to be successfully completed within the normal timeframe of 5 business days or less.”

What led to the suspension?

Binance.Us had suspended dollar deposits and informed customers of the suspension in fiat withdrawal channels. Below is the earlier communication that led to fiat suspension:

“Today, we are suspending USD deposits and notifying customers that our banking partners are preparing to pause fiat (USD) withdrawal channels as early as June 13, 2023. We encourage customers to take appropriate action with their USD.”

The decision was necessitated by the existing court battle with the Securities and Exchange Commission (SEC). This earlier communication warned their users of the plans by the banking partners to halt fiat withdrawals by June 13, which occurred with minimal disruptions. It is now a relief that the suspension has been temporarily lifted for users to access their funds.

Binance.US’ temporary solutions to withdrawal suspension

In processing transactions, Binance.US advises its users to resubmit their withdrawal requests if it fails on their first attempt and indicates that the system is now functioning without any disruptions. Alternatively, the Exchange has encouraged its users to take advantage of many other options like converting their USD, utilizing stablecoins, or withdrawing funds to facilitate their transactions in crypto–to–crypto processes. The communication read in part;

“We encourage users to use, withdraw, or convert their USD fiat balances to stablecoins to continue crypto-to-crypto trading on the platform.”

Additionally, the Exchange has made a further announcement that reports the expected new trading pairs as of June 26 and features ZIL, XNO, XTZ, WAVES, RVN, IOTA, ICX, DASH, HBAR, ANKR, and DAI. This information is coupled with an announcement that there is a potential to convert the remaining USD balances to Tether. The requests are strategically executed to align Binance.Us to a crypto-only platform.

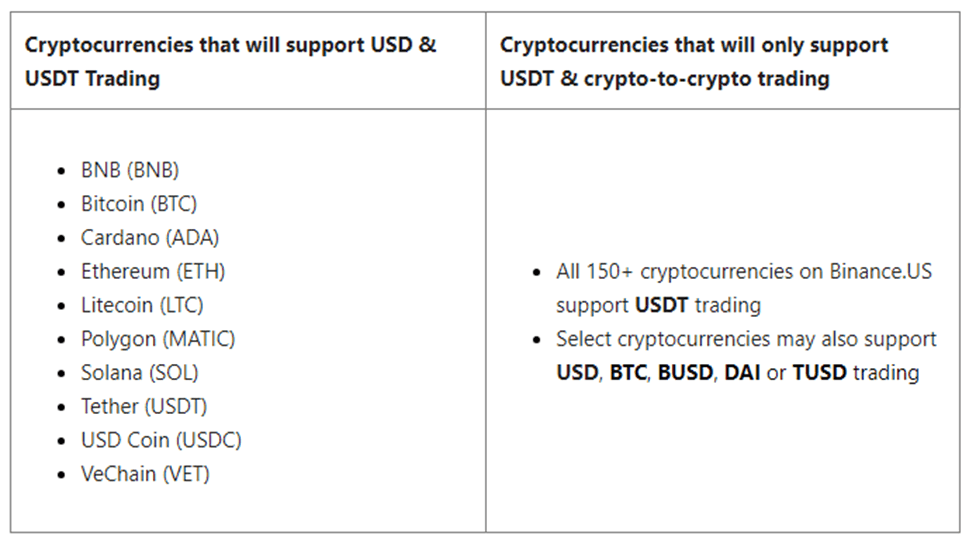

On another note, the company reported that they plan to remove most pairs traded in USD from the Exchange on June 26. Most traded pairs will be scrapped from the platform, with only 10 out of the top 150 supported cryptocurrencies remaining operational. The remaining pairs will include USDT, VET, LTC, BNB, ADA, ETH, BTC, SOL, and MATIC. They shared the following chart as a summary of the changes;

Future outlook and possible implications

The successful resolution to allow USD withdrawals ends an already rising confusion in its users, who can now access their withdraw or transfer their funds without hindrance. The major huddle remains on the future speculated disruptions making many users rush to exchange or withdraw their funds before the temporal relief expires.

Binance.US aims to provide a seamless trading process as it encourages its users to utilize alternative options in withdrawing funds and through the implementation of strategic changes to streamline their services. The communication regains customer confidence as they can explore the shifting financial landscape for their benefit.