- BSC’s Q1 boom: Binance Smart Chain posted 70% revenue growth in Q1, with network fees and DeFi activity surging—signaling strong user engagement.

- BNB stays resilient: While ETH and SOL struggled, BNB only dropped 14% in Q1 and has bounced 6% from its recent low, with signs of capital rotating in.

- Momentum shift brewing: Technicals suggest BNB could break out in Q2, especially as the RSI shows bullish divergence and BTC pairs gain strength.

Binance Smart Chain (BSC) is making noise again—and it’s not just hype this time. Q1 wrapped up with some eye-catching metrics, and all signs point to rising on-chain demand. Transaction fees surged. User activity spiked. And the DeFi crowd? They’re clearly paying attention.

In fact, BSC saw a 70% jump in revenue quarter-over-quarter, powered largely by DeFi growth and a fresh wave of liquidity. Its total value locked (TVL) hit $6.82 billion—right back where it was in early February.

Now, with Binance Coin (BNB) climbing off its recent dip, questions are swirling. Could this momentum carry BNB even higher in Q2?

BNB Holds Strong Amid Market Chop

While some coins have been sliding all over the place, BNB’s been holding its own. After dipping to around $524, it’s bounced back to about $558 at the time of writing. That’s not a moonshot, sure—but it’s a solid 6% rebound in a choppy market.

And that rise in BSC’s TVL? It’s not happening in a vacuum. Decentralized exchange (DEX) volume is ticking up, which usually means capital’s rotating back into the ecosystem. If that continues, BNB could find itself front and center as one of Q2’s altcoin heavyweights.

BSC Users Are Back—And They’re Paying Fees Again

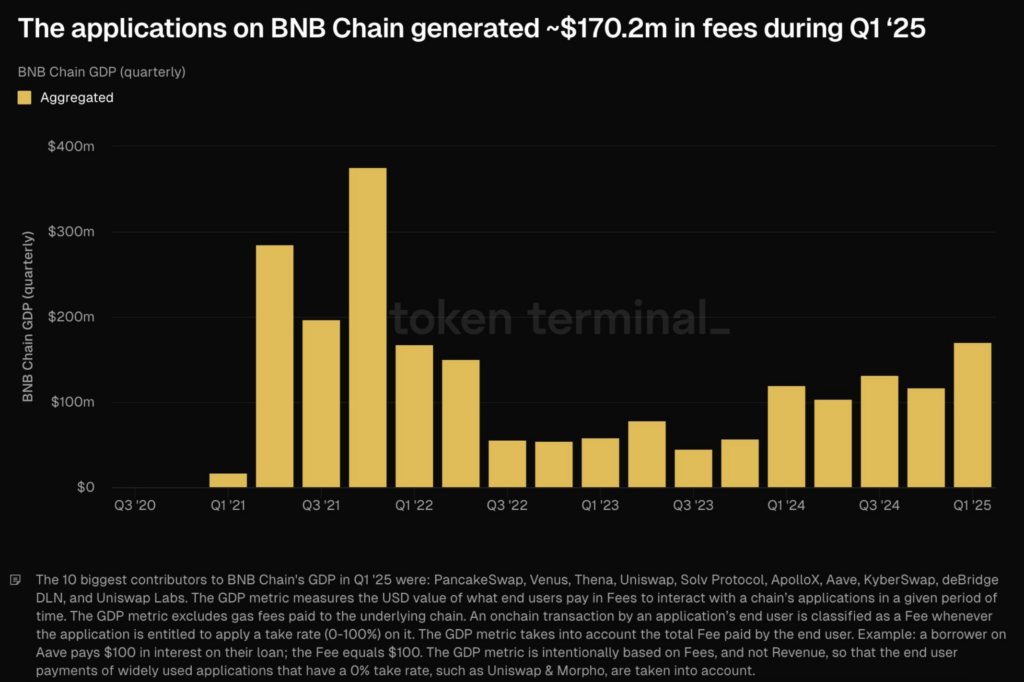

According to data from Token Terminal, apps on BSC raked in around $170.2 million in fees during Q1. That’s big. Fees are one of those raw metrics that cut through the noise—more fees usually mean more people are actually using the chain.

Compare that to Ethereum, where fees are at five-year lows, and the difference is stark. ETH’s network activity has slowed, and it shows in the charts. The asset ended Q1 with a brutal 46% drawdown. BNB? It only fell 14% over the same period. Still a loss, yeah, but not nearly as bad.

To be fair, both tokens gave up their post-election gains, but BNB’s showing far more resilience.

Capital Rotation: BTC Out, BNB In?

Look closer at the BNB/BTC chart, and something interesting pops up. Since February, that pair’s been climbing. In mid-March, BNB actually broke out against BTC, retesting highs from last December.

That breakout happened right when Bitcoin fell hard—from $100k to $78k. While BTC stumbled, money started rotating into BNB, giving it a boost while most of the market flailed.

The outcome? BTC dropped 11%. BNB rose 10%.

Not many coins can say that right now.

Can BNB Steal the Show in Q2?

Ethereum and Solana? They’ve been getting wrecked against Bitcoin. But BNB’s story is different. Rising network fees, growing DeFi activity, and a price that refuses to roll over—BNB’s looking like a real contender.

The RSI is hinting at a bullish reversal, too. After being beat down into oversold territory, momentum is quietly shifting back. If that picks up steam, we could see a full-on rally.

Bottom line? BNB might not be flashy, but it’s weathering the storm better than most. And if the broader market gives it an inch—don’t be surprised if BNB runs with it.