- Binance completed its full $1B SAFU conversion from stablecoins into Bitcoin

- The fund bought 4,545 BTC for over $305M, reaching roughly 15,000 BTC total

- The conversion finished in under 13 days, far ahead of the 30-day target

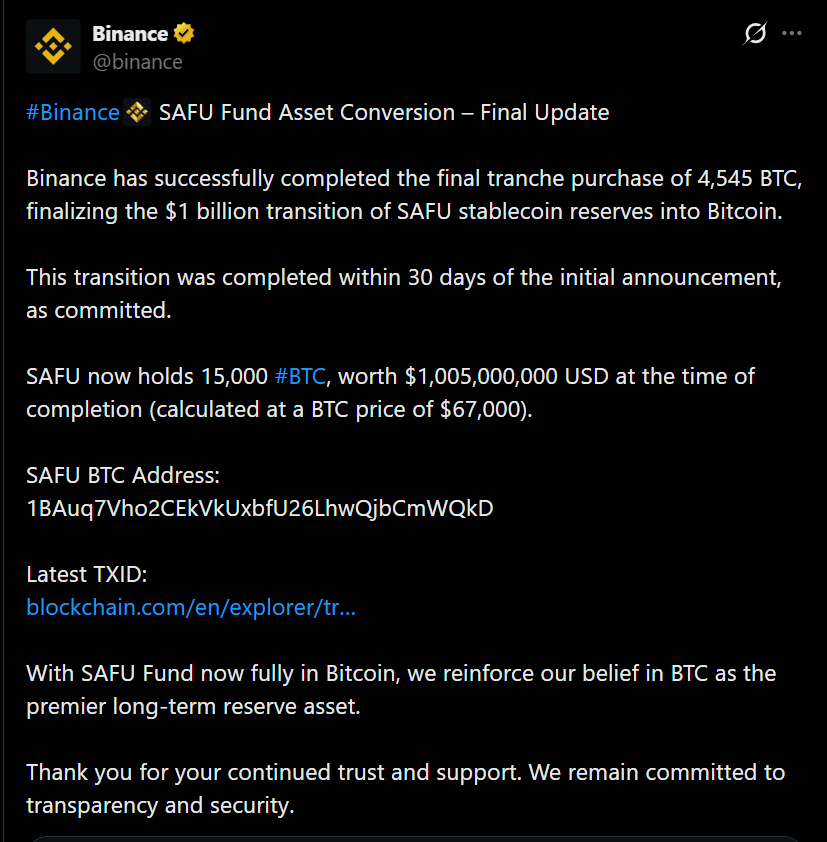

Binance has completed the conversion of its $1 billion Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin. The final push happened Thursday, when the fund spent more than $305 million to acquire 4,545 BTC, bringing total holdings to roughly 15,000 BTC worth over $1 billion, according to Arkham Intelligence data.

This wasn’t a slow roll. Binance originally said the conversion could take up to 30 days starting January 30, but it finished the process in under 13 days. That speed matters because it shows intent. When a firm this large moves that quickly, it’s usually because they want the market to see it.

Why Speed Matters More Than the Exact Number

A $1 billion reserve shifting into Bitcoin is already a strong signal. But doing it in under two weeks is what makes it stand out. Binance could have spread this out quietly, reduced attention, and avoided the “headline risk” of buying into weakness. Instead, it accelerated.

That tells you Binance isn’t treating this like a trade. It’s treating it like a structural allocation. And for an emergency reserve fund, that’s a meaningful shift. SAFU is supposed to be a confidence backstop, so the asset chosen for that role is never just a casual decision.

The $800M Floor Is the Hidden Mechanic

Binance has said it will monitor SAFU and rebalance the fund if its market value falls below $800 million. That clause is important because it adds a discipline mechanism. It implies SAFU isn’t meant to float freely as a pure Bitcoin exposure vehicle. It’s meant to remain a reliable reserve, even during drawdowns.

In practice, this creates a framework where Binance has committed to defending the fund’s minimum value, not just holding BTC passively. That makes SAFU feel less like a marketing line and more like a structured reserve policy.

This Comes as Corporate BTC Hype Cools

Institutional interest in Bitcoin is still growing under the current regulatory environment, but the frenzied accumulation from late 2024 through mid-2025 has clearly cooled. Recent market turbulence has shaken risk appetite, and many public-company treasury plays have slowed down or gone quiet.

That’s why Binance’s move lands differently. It’s happening in a more cautious tape, not a euphoric one. Bitcoin is hovering around $67,000 at press time, down roughly 5% over the past seven days, per CoinGecko. In other words, this wasn’t Binance buying into a breakout. It was Binance buying into stress.

Conclusion

Binance completing a full $1 billion SAFU conversion into Bitcoin is a major signal, especially because it happened so quickly. In a market where corporate and institutional accumulation has cooled, Binance just made a very loud statement: Bitcoin is still the reserve asset they trust most when volatility is high. And that’s exactly why this move matters.