- Moonrock Capital’s CEO accused Binance of demanding 15% of a project’s token supply for a listing.

- Binance co-founder Yi He refuted these claims, citing transparent and charitable fee policies since 2018.

- Centralized exchanges face criticism and declining trading volumes as decentralized platforms gain traction.

The CEO of Moonrock Capital recently claimed that Binance, a major centralized cryptocurrency exchange, requested 15% of a project’s total token supply in exchange for listing. This statement led to widespread discussion on social media regarding the fee structures of centralized exchanges. In response, Binance co-founder Yi He rejected the accusations and explained the company’s policies.

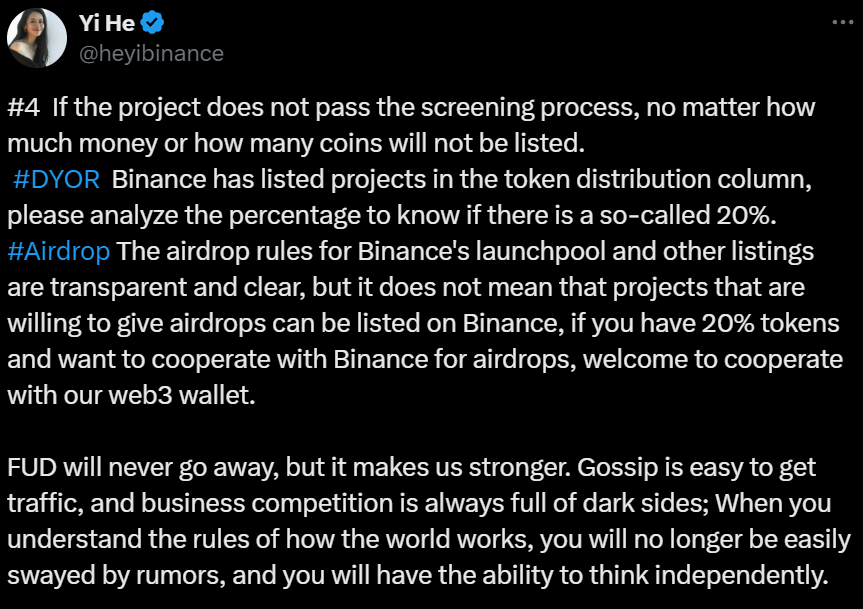

Source: Yi He on X

Binance’s Listing Policy Explained

Yi He noted that Binance has maintained a transparent listing policy since 2018. The company does not ask for a percentage of a project’s tokens or a set fee for listing. Instead, project teams are encouraged to suggest a “donation” amount, which is entirely directed to charitable initiatives. The policy explicitly states that there is no minimum requirement for these donations, reinforcing Binance’s commitment to transparency in its operations.

These recent allegations have fueled wider debate over the listing fees that centralized exchanges may demand. Andre Cronje, co-founder of Sonic, added to the conversation by pointing out similar concerns regarding Coinbase’s practices.

Shifts in the Exchange Landscape

The discussion comes at a time when centralized exchanges are facing challenges. Data from CCData showed a decrease in trading volume in September 2024, with Binance experiencing a 23% drop. Other significant platforms like OKX, Coinbase, and Kraken reported declines ranging between 20% to 30%. Analysts attributed these drops to geopolitical uncertainties, investor caution ahead of the U.S. elections, and increasing activity on decentralized exchanges.

Binance’s recent decision to list Scroll, an Ethereum layer-2 scaling solution, also stirred reactions. Critics argued that the move countered the decentralized principles that projects like Scroll are built on. A community member, Zeng Jiajun, pointed to the potential implications of high listing fees, drawing an analogy with Ethereum’s creator, Vitalik Buterin, being hypothetically required to pay significant percentages for listing on exchanges.