- Paul Tudor Jones’ hedge fund has disclosed holding $230 million worth of BlackRock’s Spot Bitcoin ETF

- Tudor Jones expressed concerns about inflation and believes in the potential of Bitcoin as “digital gold”

- BlackRock’s Bitcoin ETF received regulatory approval in January and has proven to be the most successful crypto-based ETF

Billionaire hedge fund manager Paul Tudor Jones has recently disclosed that his fund holds $230 million worth of shares in BlackRock’s Bitcoin exchange-traded fund (ETF). This comes as no surprise, as Jones has previously expressed his conviction in Bitcoin‘s potential amid high inflation.

Paul Tudor Jones’ Background

Paul Tudor Jones II is an American billionaire hedge fund manager who founded and still runs Tudor Investment Corporation. His net worth is estimated to be around $7.5 billion. Jones has a long track record of successful macro trading and prescient market calls.

The Inflation Issue

In an October 2022 interview with CNBC, Jones expressed concerns about mounting inflation in the US. He believes that all roads lead to inflation due to the ballooning US federal debt, which recently hit $30 trillion.

Jones reiterated his stance, stating “That’s historically the way every civilization has gotten out – they’ve inflated away their debts.” To hedge against this, he is long on gold, bitcoin, and commodities.

Betting on Bitcoin

Jones has been vocal about his bitcoin endorsement amid rising inflation. His hedge fund recently disclosed through an SEC filing that it holds around $230 million worth of BlackRock’s Bitcoin ETF shares.

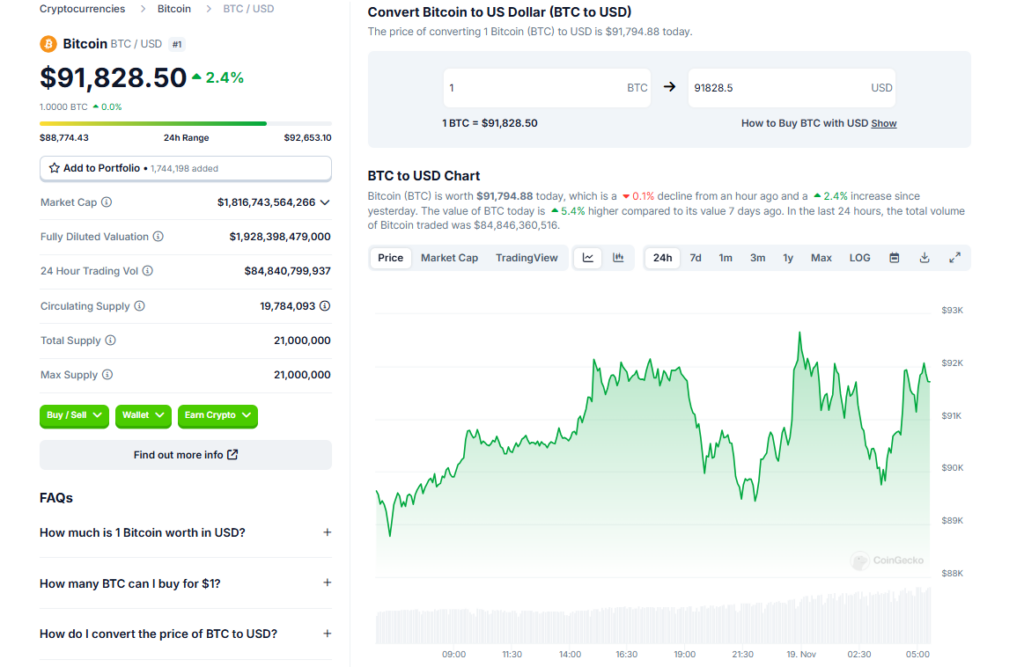

BlackRock’s spot bitcoin ETF was approved in January 2023 and has been the most successful so far. With bitcoin reaching new all-time highs in November 2023, Jones’ early bet seems to be paying off.

Jones’ conviction in bitcoin’s inflation-hedging properties and long-term potential is proving warranted. His fund’s sizable investment in BlackRock’s Bitcoin ETF shows he is backing up his opinions with action. The SEC disclosure cements Jones as one of the early institutional proponents of bitcoin.