- Billionaire investor Paul Tudor Jones backs both Bitcoin and gold as a response to increasing geopolitical risks, considering them as valuable hedges against uncertainty.

- Jones sees Bitcoin as a digital form of gold, offering similar qualities of protection and value preservation during times of geopolitical turmoil.

- Geopolitical risks, such as trade disputes and political tensions, have been on the rise, driving the need for investors to strategically navigate these uncertainties with assets like Bitcoin and gold.

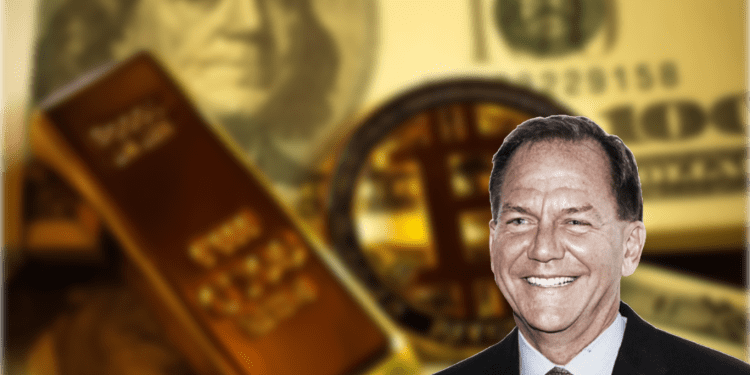

Renowned billionaire investor Paul Tudor Jones has recently expressed his support for both Bitcoin and gold, citing the increasing geopolitical risks as a driving factor. In a rapidly changing world, Jones believes in the value of these assets as a hedge against uncertainty.

Paul Tudor Jones on Bitcoin’s Role in Geopolitical Risks

Jones firmly believes in Bitcoin’s potential as a safe haven asset during times of geopolitical uncertainty. He sees it as a digital form of gold, offering similar qualities of protection and value preservation. The rising geopolitical risks have strengthened his conviction in Bitcoin’s long-term potential.

Alongside Bitcoin, Jones also supports gold as a hedge against geopolitical risks. Recognized for its historical role as a store of value, gold continues to be regarded as a safe investment in times of geopolitical turmoil. Jones views gold as a prudent asset to diversify one’s portfolio and protect against market fluctuations caused by geopolitical events.

Rising Geopolitical Risks and Investor Sentiment

Geopolitical risks, such as trade disputes, political tensions, and economic uncertainties, have been on the rise in recent times. These events can significantly impact financial markets and investor sentiment. Jones acknowledges the need for investors to navigate these risks strategically, and he sees Bitcoin and gold as essential components in a well-diversified portfolio.

Bitcoin’s Evolution as a Recognized Asset

Jones’ endorsement of Bitcoin marks a significant milestone in the evolution of cryptocurrencies. With a billionaire investor like Jones openly supporting Bitcoin, it adds legitimacy to the digital asset class and further enhances its acceptance in traditional financial markets. This development may potentially drive increased adoption of Bitcoin by institutional and retail investors.

The Future Outlook for Bitcoin and Gold

As geopolitical risks continue to shape the global landscape, Paul Tudor Jones stands firm in his belief that Bitcoin and gold will remain valuable assets. Both instruments offer investors protection against inflation, currency volatility, and geopolitical uncertainties. However, it is essential for investors to conduct thorough research and exercise caution when considering these investments.

Billionaire investor Paul Tudor Jones reiterates his support for Bitcoin and gold in the face of rising geopolitical risks. He sees these assets as an important hedge against uncertainty and believes that they will continue to play a vital role in investors’ portfolios. With ongoing geopolitical challenges, the appeal and relevance of Bitcoin and gold are expected to persist in the future.