- Bitcoin whales holding over 10,000 BTC have been steadily selling since 2017, reducing their stash by 40% as BTC hits new highs.

- Profit-taking surged after BTC nearly touched $112K, with over $500M/hour in realized profits recorded multiple times on June 3.

- Despite the sell-off, Bitcoin has held above $100K for 27 consecutive days—the longest stretch in its history.

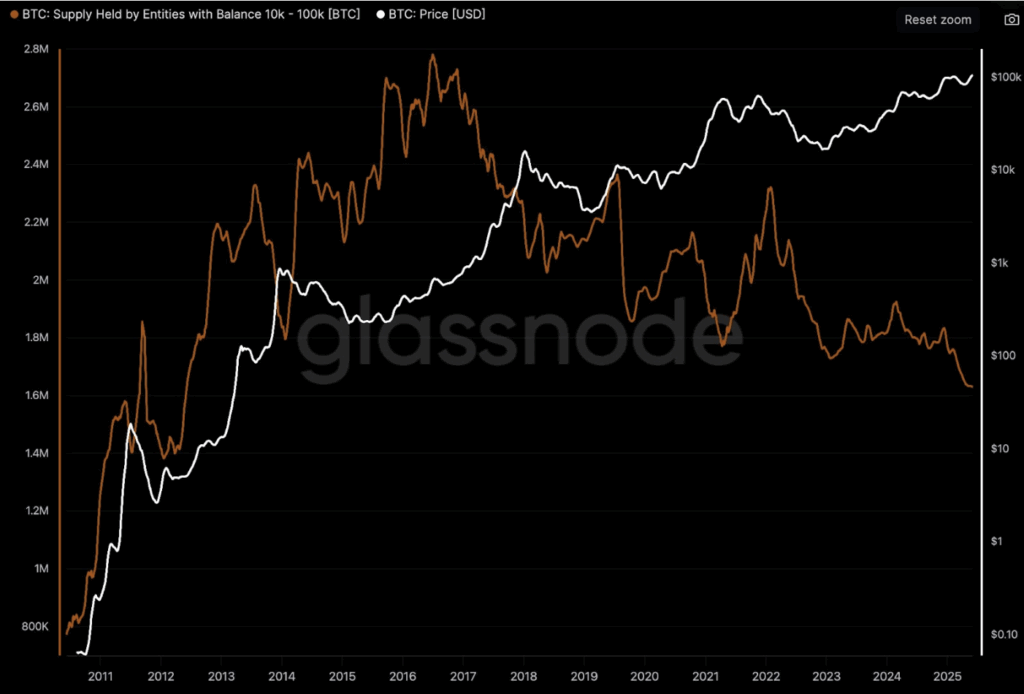

Bitcoin’s recent climb to a new all-time high came with a familiar pattern—large holders, aka “whales,” have started offloading their bags again. On June 3, analyst Willy Woo pointed out that whales holding more than 10,000 BTC have been quietly selling since way back in 2017. And they’re still doing it now, even as institutions and entire nations are scooping up billions in Bitcoin.

Most of these whales, Woo says, bought their coins dirt cheap—somewhere between $0 and $700. They’ve held for 8 to 16 years. Not bad, right? So it kinda makes sense they’re finally cashing in. According to Glassnode data, the total BTC held by these mega-wallets has dropped by 40% in eight years, falling from 2.7 million to around 1.6 million BTC. That’s not a small shift.

Profit-Taking Is Ramping Up Across the Market

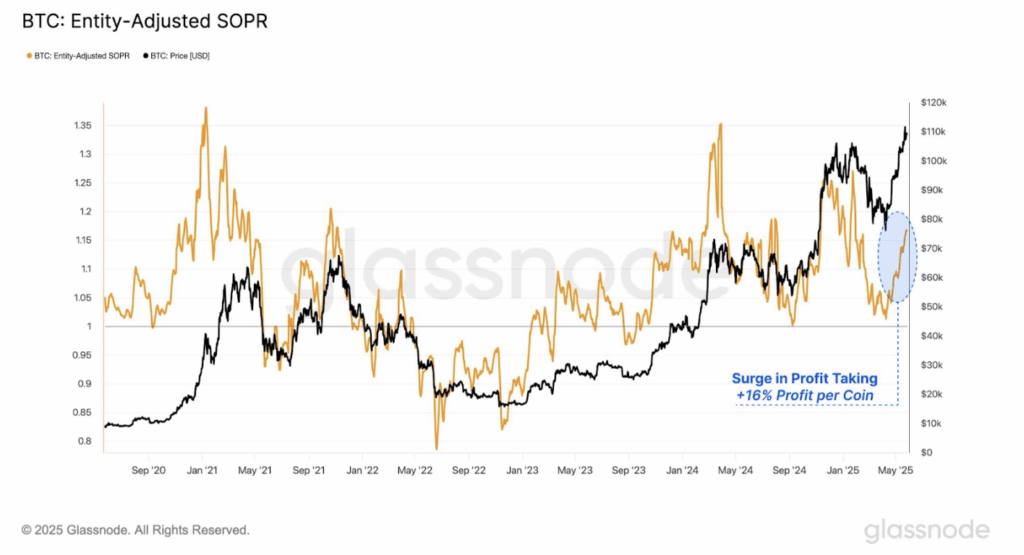

Glassnode also dropped some insights on June 3, saying the recent BTC rally (which peaked just under $112K on May 22) triggered a serious profit-taking spree. On average, coins sold during this breakout locked in gains of about 16%. And yeah, that’s a big enough payday to turn heads.

Apparently, fewer than 8% of trading days in Bitcoin’s history have been more profitable than now. Which means? A lot of investors are taking chips off the table. On June 3 alone, realized profit (adjusted for unique entities) hit over $500 million per hour… not once, not twice, but three different times. That’s some serious exit activity.

BTC Still Strong Above $100K… For Now

Even with all that selling, Bitcoin hasn’t exactly fallen apart. As of June 3, BTC dropped to $105K, a 5.5% pullback from its May highs. But it bounced back a bit—hitting $106,800 before settling around $105,750 during early June 4 trading.

Here’s the stat that matters: Bitcoin has now stayed above $100K for 27 straight days. That breaks the previous record of 18 days from January. So despite all the whale unloading and profit-taking, BTC is still holding firm in six-figure territory.

Long-Term View Still Bullish—Just Not Cheap Anymore

Woo wrapped it up by saying Bitcoin probably isn’t the best short-term buy right now at six-figure levels. Fair enough. But over the next decade? He called it probably one of the best investments you’ll see in your investment career. So yeah, short-term volatility or not, the big picture still looks pretty bright… if you’re patient.