- XRP is shifting from its original “bank rail” vision to new roles like retail remittances, SME payments, and IoT micropayments.

- Platforms like goLance and SBI Japan already use XRP for fast, low-cost cross-border transfers.

- The XRPL ecosystem and XRP’s supply burn position it as both a utility asset and a potential hedge in a CBDC-driven world.

When XRP launched, its pitch was bold—become the digital rail for banks, the SWIFT killer for cross-border settlements. More than a decade later though, the banking world hasn’t quite signed on. Instead, giants are tinkering with central bank digital currencies (CBDCs) and building their own internal rails. Some critics, especially folks from the Chainlink community, have even called this a loss for XRP. But that’s not the whole story. The token has carved out new paths—smaller maybe, but meaningful—that keep it relevant and growing.

XRP as the People’s Rail

One of XRP’s strongest lanes now is retail remittances. In countries like Mexico, the Philippines, Nigeria, and India, millions of workers rely on cross-border transfers to support families. Every second saved and every fee cut matters. Platforms like goLance, led by Michael Brooks, are already using XRP to pay freelancers instantly and cheaply. For workers earning around $50 a week, waiting days or losing 10% to bank fees isn’t an option. XRP fixes that. With the global remittance market near $860 billion, this “people’s rail” narrative could quietly become XRP’s new backbone.

Corporate Payments Without Bank Approval

Small and mid-sized businesses are another opportunity. They don’t need to overthrow banks—they just want faster, cheaper ways to pay suppliers, freelancers, or teams abroad. XRP offers that. Take SBI Japan in 2023: they launched an XRP-based service for remittances into the Philippines, Vietnam, and Indonesia. Using XRP as a bridge currency, funds move quickly and land in local currency with minimal cost. This shows adoption can grow steadily outside traditional finance, especially in high-volume corridors across Asia.

Fueling the Internet Economy

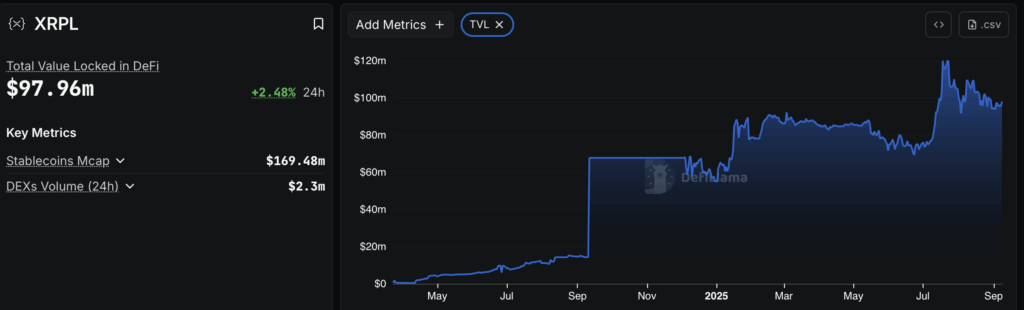

The future isn’t only about remittances or payrolls. XRP could play a role in the online economy too. Think micropayments for gaming, streaming, IoT devices, or even automated API calls. Bitcoin’s Lightning Network and stablecoins are popular here, but XRP’s speed and low fees make it a natural contender. On top of that, the XRP Ledger itself is expanding—decentralized exchanges, tokenized assets, automated market makers, even NFT projects are springing up. As stablecoin issuers join the XRPL, XRP’s value as a bridge and liquidity asset grows stronger.

XRP in a CBDC World

Looking further ahead, XRP might also find a niche as a reserve-like asset. With transaction fees gradually burning XRP supply, scarcity could make it attractive as a hedge in a CBDC-heavy world. It doesn’t need to replace the dollar or euro. Just being an alternative allocation in portfolios could support long-term value.

Final Word

The idea that XRP’s success depends entirely on banks is outdated. Instead, XRP has found new legs—from remittances and SME payments to IoT micropayments and tokenized assets. Each use case may be smaller than the original “bank rail” dream, but together they create a diverse foundation that keeps XRP alive and kicking. Banks may hesitate, but XRP still has plenty of ways to win.