- Axie Infinity surged over 200% in a month, defying a weak crypto market.

- The rally followed changes to its reward system aimed at reducing bots.

- Despite momentum, a correction remains likely given broader bearish conditions.

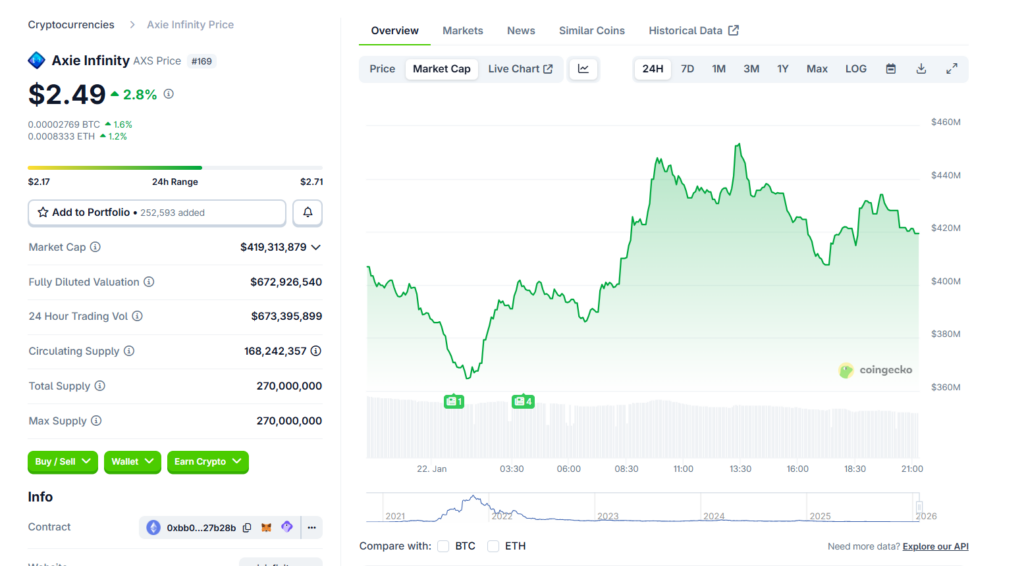

Axie Infinity has suddenly pushed its way back into the spotlight, posting one of the strongest rallies in the crypto market despite broader weakness. AXS is up nearly 8% in the last 24 hours, more than 130% on the week, and over 200% across the past month. In a market where most assets are struggling to hold support, that kind of move naturally raises the same question traders always ask next. Is this the start of something bigger, or just another short-lived spike?

A Reminder of How Far AXS Fell

The speed of the rebound is striking, especially given AXS’s history. During the 2021 bull run, Axie Infinity surged to an all-time high near $165, becoming one of the most recognizable names in crypto gaming. Since then, the token lost more than 98% of its value as NFT enthusiasm faded and capital rotated elsewhere. The collapse wasn’t unique to Axie, but it left deep scars, and many long-term holders never recovered.

What Sparked the Latest Rally

This recent surge followed Axie Infinity’s announcement of a revamped reward system. The update is designed to curb bot activity while shifting incentives away from tradable AXS toward non-transferable bonded AXS, known as bAXS. The change appears to have reignited speculative interest, with traders jumping in quickly as the news spread. In a thin, bearish market, that kind of catalyst can move prices fast.

Why a Pullback Still Looks Likely

As impressive as the rally looks, the broader backdrop hasn’t improved much. Crypto markets remain fragile, and risk appetite is still limited. AXS’s sudden move higher feels driven more by short-term positioning and FOMO than a deep structural shift. When momentum fades in this environment, corrections tend to come just as quickly as rallies.

NFTs and Gaming Still Face Headwinds

There’s also the larger context to consider. NFT and gaming-focused projects have taken a clear backseat over the past few years, and bear markets rarely revive dormant narratives. While Axie Infinity still has an active community, sustained upside would likely require a broader return of interest in NFTs and on-chain gaming, something that doesn’t usually happen while markets remain defensive.

For now, AXS stands out as a rare outperformer in a weak tape. Whether it can hold those gains is another matter. In the short term, volatility looks almost guaranteed.