- Avalanche’s TVL has surged 90% since March to $1.9B, signaling strong ecosystem growth and fundamental adoption.

- Technicals show price holding key Fibonacci zones, with $36–$43 as the main breakout range before potential targets at $72–$89 and $80+.

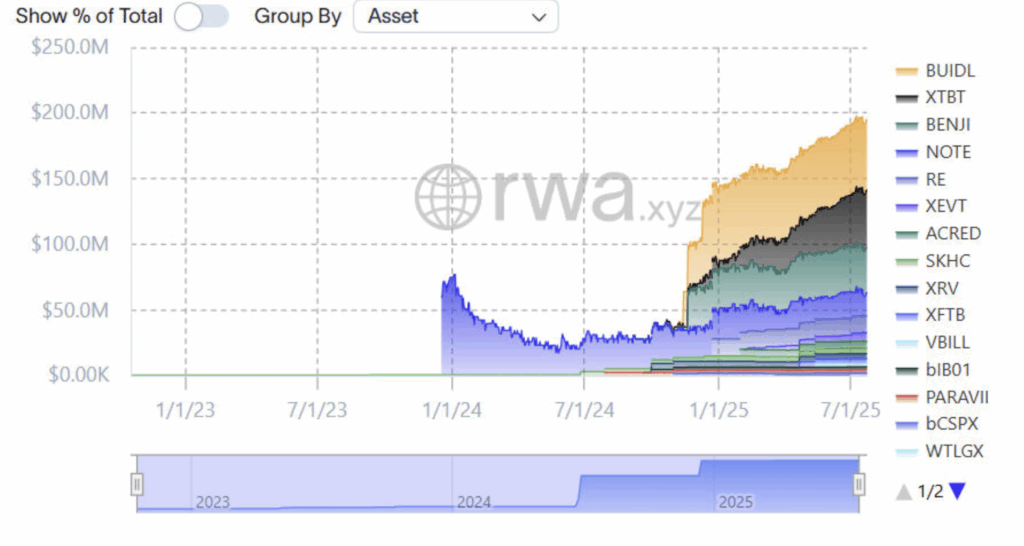

- $250M in new RWA inflows from tokenized Janus Henderson funds adds institutional confidence and long-term bullish momentum.

Avalanche has been doing more than just holding its ground—it’s been quietly laying the bricks for what could turn into a serious breakout. TVL is climbing fast, technicals are firming up, and the RWA narrative is giving it a whole new layer of momentum. If the current setup plays out, we might be looking at a run that stretches well beyond the mid-$30s and toward that elusive $80+ mark.

TVL Surge Signals Real Ecosystem Growth

It’s not hype this time—the numbers are actually backing AVAX’s move. The network’s total value locked has jumped 90% since March, now sitting at $1.9B and inching toward that $2B milestone. That kind of growth usually doesn’t happen without some real adoption driving it, and the curve is steep enough to grab even the casual observer’s attention.

Higher TVL typically points to more users, more protocols, and more capital staying in the ecosystem. In Avalanche’s case, it’s starting to look like one of the most fundamentally solid L1 plays in the space right now.

Fibonacci Levels and the $34.20 Target

Price action’s been playing nice with the key Fibonacci zones. After tagging the 0.618 retracement, AVAX has been consolidating—typical behavior before a push to the next extension level at $34.20. Analyst CW8900 thinks the recent pullback is more of a cooldown than a red flag, with volume holding steady and no signs of bulls throwing in the towel.

If AVAX can keep above the 0.5 or 0.382 retracement zones, that $34.20 target isn’t just wishful thinking—it’s the logical next step.

Multi-Timeframe Indicators Lining Up

The bounce from $17.20 wasn’t random. RSI and KDJ have reset and are curling upward, the VWAP’s holding, and those prior accumulation range highs (VAH) are now acting as a solid floor. Analyst Centurion pegs the $36–$43 zone as the next big roadblock—clear that on a weekly close, and the mid-term path toward $72–$89 opens right up.

RWA Inflows Add Serious Firepower

Then there’s the real-world asset angle. Avalanche just doubled its RWA exposure with a $250M injection of tokenized Janus Henderson funds via Grove. That’s not just noise—it’s the kind of capital that brings credibility. We’re talking a mix of BUIDL, BENJI, and XACRED allocations, the sort of thing that signals institutional confidence is starting to take root.

The Bigger Picture – $80+ Still on the Table

On the monthly chart, AVAX is showing rounded accumulation and higher lows—classic base-building behavior. TraderSteve points to this same zone as a historic launchpad, and if price can keep above the $20–$23 range, the case for a move toward $80+ stays strong.

Bottom line: AVAX has the TVL growth, the RWA inflows, and the technical structure all pointing in the same direction. The short-term chop might still shake out weak hands, but if it can push through $36–$43, the door swings wide open for a much bigger rally.