- Avalanche (AVAX) trades near $34.69, holding support at $32, with resistance at $37 as the next big test.

- Institutional confidence grows with Scaramucci advising a $550M AVAX treasury, boosting long-term sentiment.

- On-chain inflows and smart money positioning point to $47–$50 as the next liquidity zone if $37 breaks.

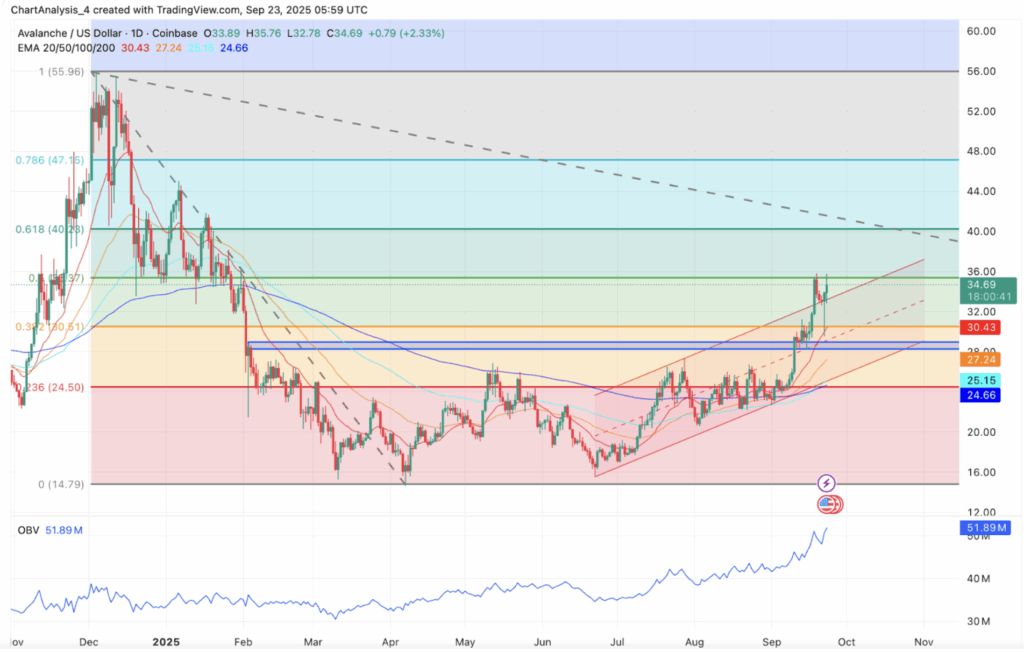

Avalanche (AVAX) is holding its ground and showing signs of strength, trading near $34.69 after climbing more than 2% in the last 24 hours. Buyers managed to protect the $32 zone and drive the price toward the upper side of its rising channel. The next big test is waiting at $37 — a level that lines up with the 0.5 Fibonacci retracement. If this hurdle breaks, AVAX might just have the legs to stretch toward $50 in the weeks ahead.

Avalanche Price Faces Fibonacci Resistance

Looking at the daily chart, Avalanche has been grinding upward inside a rising channel, with steady support from the 20-day EMA at $30.43. The price already cleared the 50-day and 100-day EMAs, while the 200-day EMA is way down at $24.66. That’s a strong technical alignment and gives bulls confidence in the mid-term trend.

For now, resistance sits right at $37. A clean breakout above this could open targets at $40 and then $47.15. On the flip side, support holds at $32 and $30, while a channel breakdown risks a slide toward $27. Indicators still lean bullish: RSI is elevated but not screaming overbought, and On-Balance Volume keeps climbing — showing steady accumulation.

Institutional Bets Boost Avalanche’s Story

AVAX’s bullish narrative got another lift after SkyBridge Capital founder Anthony Scaramucci signed on as a strategic advisor for AVAX One — a $550 million Avalanche-focused digital asset treasury. This came right after he revealed a $300 million tokenized hedge fund, sending a clear message that institutions are taking Avalanche seriously.

Analysts argue that AVAX One could improve liquidity and further solidify Avalanche’s position in the tokenization race. It’s not just retail traders fueling this rally; big names are stepping in with serious bets.

On-Chain Flows and Liquidity Trends

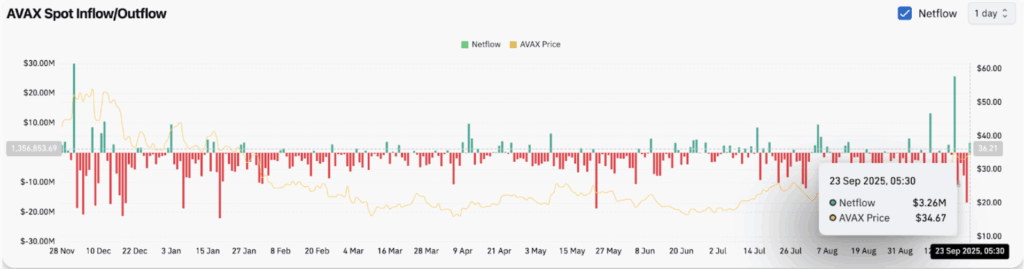

Exchange data shows AVAX recorded $3.26 million in net inflows on Sept. 23 — one of the stronger positive sessions in months. While flows have been pretty choppy lately, this uptick hints at traders gearing up for more upside. Futures open interest is also creeping higher, showing leveraged demand is picking up.

That said, analysts caution that to really push for a large-scale breakout, AVAX needs consistent inflows above $10 million daily. Anything less leaves it vulnerable to sudden liquidity swings.

Smart Money Targets Next Liquidity Zone

Smart Money analysis shows that AVAX completed a liquidity sweep and is now building higher off a base support zone. The next battleground sits between $37 and $40. If bulls win here, the path toward $47–$50 opens up quickly.

Liquidity maps show clear support zones at $32 and $30, with deeper support around $27. On the upside, sellers are expected to show up again in the $47–$50 range — the first major supply zone in play.

Technical Outlook: Can AVAX Hit $50?

The short-term picture really boils down to whether AVAX can clear $37 resistance.

- Upside targets: $37, $40, $47–$50

- Downside levels: $32, $30, and $27

- Trend support: $24.66 (200-day EMA)

As long as Avalanche holds above the $30–$32 band, the setup remains bullish. Strong EMA structure, on-chain inflows, and institutional bets are all working in its favor. A breakout over $37 would confirm momentum and raise the odds of hitting that $47–$50 liquidity zone.

If bulls stumble, though, price could fall back toward $30 before another push higher. For now, the trend leans bullish, with $50 still very much on the table if momentum holds through October.