- AVAX dipped 5%, but strong support at $25 and light resistance above could mean a rebound is near.

- Avalanche just welcomed a $250M RWA initiative with players like Janus Henderson, signaling big institutional interest.

- Technicals suggest bullish momentum’s still alive—if $21.79 holds, the path to $38 or even $45 stays open.

A 40% run-up? Hard to ignore. But a $250 million real-world asset play? That kind of thing makes you double-take. Over the past month, AVAX’s been on a heater—until now. Price cooled off a bit today, but the broader story’s still alive, and maybe even heating up again.

Let’s break it down.

Slipping… but Still Strong?

AVAX is sitting around $25.34 right now, down just over 5% in the last 24 hours. Not ideal, but hey—it’s crypto. Pullbacks are part of the game. What’s more important is the underlying structure, and that’s where things get interesting.

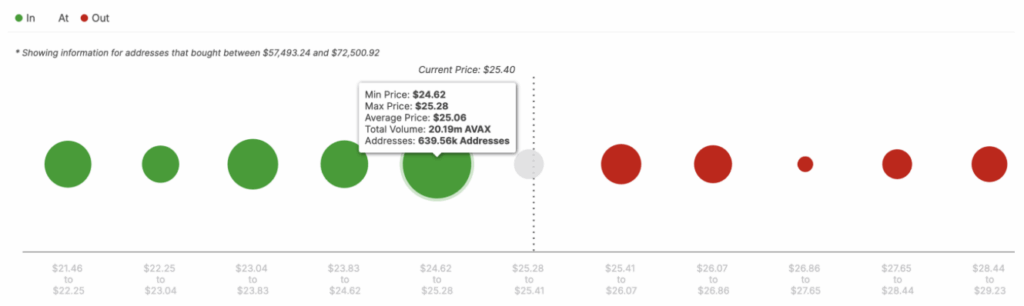

According to IntoTheBlock, there’s a fat chunk of support sitting near $25.06. Nearly 640K wallets picked up over 20 million AVAX in that range, and most of ’em are still in the green. That’s a whole lotta people probably not looking to sell unless the sky falls.

Between $25.40 and $29.20? Not a lot of resistance either. That means, if bulls step up, AVAX could pop right back over $29 without too much friction. The setup is leaning bullish—but yeah, only if buyers show up soon.

Avalanche’s Wall Street Moment

While the price action’s cooling, Avalanche just dropped some news that might heat things back up. A $250 million RWA initiative is kicking off, bringing some big-league TradFi players into Avalanche’s world.

We’re talking Janus Henderson (yeah, the $370B asset manager), Grove Finance, and Centrifuge. They’re dropping serious capital into tokenized real-world assets—and they picked Avalanche as the playground.

In their own words: “A new milestone unlocked.” And honestly, they might be right. If this thing sticks, it could give Avalanche a serious edge in the growing RWA race.

Price Setup: Pullback Before Liftoff?

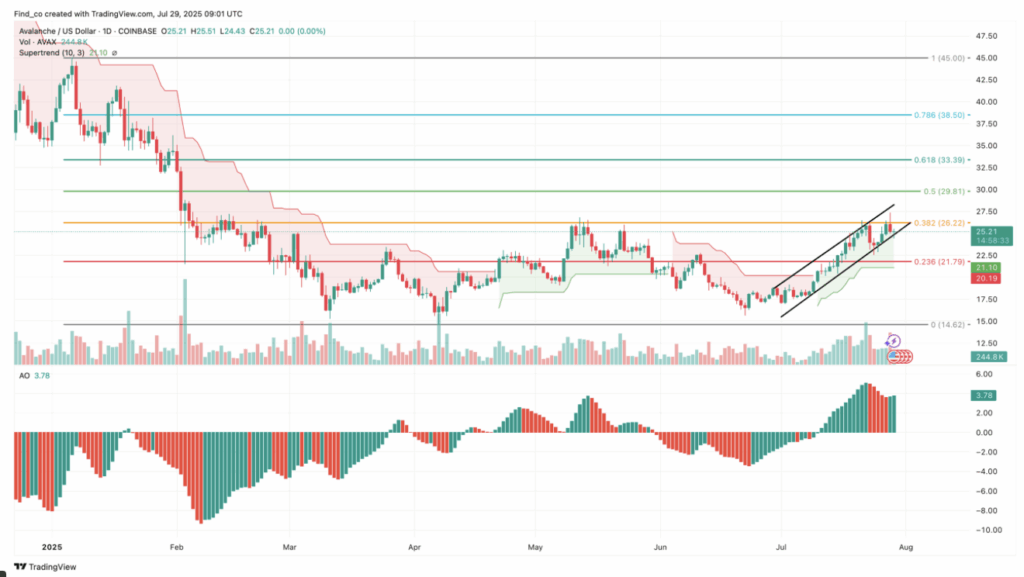

Even with the dip, AVAX is still hanging inside its ascending channel on the daily chart. That’s a good sign. And look at the indicators—the Awesome Oscillator just flipped green again. Momentum’s not dead, it’s just catching its breath.

If AVAX can hold the line here, it might take another swing at resistance zones up at $29.81 and $33.39. The Supertrend is also flashing green underneath the price, which usually acts like a kind of soft safety net.

If all the stars align (and let’s face it, that’s a big if), we could be looking at a run to $38.50, and maybe $45 if the broader market catches a bid.

…But Watch Your Back

This ain’t a guaranteed moon mission. If the bears drag it below $21.79, that whole channel setup gets invalidated. That’d likely open the door to deeper pain and a bigger correction.

So yeah, AVAX is at a crossroads. But with massive TradFi money sniffing around and strong support just beneath, the bulls might not be out of gas just yet.